What happens if you don’t have good credit?

Can you survive with bad credit

Living well without credit is certainly possible. We'll be straightforward here: Many things in life are much easier when you have a good credit score. But lacking a credit score doesn't mean you'll be forced to go live in the woods. You can theoretically live your life without having any credit to your name.

Cached

Is it worse to have bad credit or no credit

So which scenario is worse — not having any credit or having bad credit “Neither is good,” says Greg Reeder, CFP, a financial advisor with McClarren Financial Advisors in State College, Pennsylvania. However, “A poor credit score is worse,” he says. “If you have no credit, you can start from the ground up.

Cached

How fast can you go from no credit to good credit

Whatever your reason for wondering how long it takes to get a credit score, you can generally expect it to take about six months – and usually longer to get into the good-to-exceptional credit score range.

Can I live without a credit score

Living without a credit score (or with a bad one) is possible, but it will present challenges from time to time even if you never borrow money.

How long does a bad credit last

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

What is the poorest credit score

The VantageScore model breaks down its credit score ranges as follows:Very Poor: 300-499.Poor: 500-600.Fair: 601-660.Good: 661-780.Excellent: 781-850.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What are 2 disadvantages of a poor credit score

These are the biggest disadvantages of having a bad credit scoreYou're too big of a risk for mainstream lenders.You pay more for your loan.Your insurance premiums may go up.You may miss out on career opportunities.You'll have a harder time renting an apartment.

How to rebuild credit from $500

Ways to start rebuilding from a credit score of 500Pay your bills on time. Payment history is an important factor in calculating your credit scores.Maintain a low credit utilization ration.Consider a secured credit card.Look into credit counseling.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How many Americans have no credit

Approximately 16% of Americans have bad credit, according to Experian data. What the Experian data indicates is that more people have very good credit scores than have bad or subprime credit scores. This may come as a surprise to some, but most people in the U.S have pretty good credit.

What does bad credit say about you

A person is considered to have bad credit if they have a history of not paying their bills on time or owe too much money. Bad credit is often reflected as a low credit score, typically under 580 on a scale of 300 to 850. People with bad credit will find it harder to get a loan or obtain a credit card.

How do I fix my bad credit

The Bottom Line: Take Control Of Repairing Your Credit ScoreCheck your credit report often and look for errors.Focus on small, regular payments and control your spending.Reduce your high-balance accounts and use credit cards sparingly.Consider a debt consolidation loan.Work with a credit counseling agency.

How do I build my bad credit back

You can build credit by using your credit card and paying on time, every time. Pay off your balances in full each month to avoid paying finance charges. Paying off your balance each month can also build better credit than carrying a balance, because it helps keep you from getting too close to your credit limit.

How long does bad credit last

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

How do you fix a bad credit score

How To Fix Your Credit In 7 Easy StepsCheck Your Credit Score & Report.Fix or Dispute Any Errors.Always Pay Your Bills On Time.Keep Your Credit Utilization Ratio Below 30%Pay Down Other Debts.Keep Old Credit Cards Open.Don't Take Out Credit Unless You Need It.

How bad is a 500 credit score

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 500 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

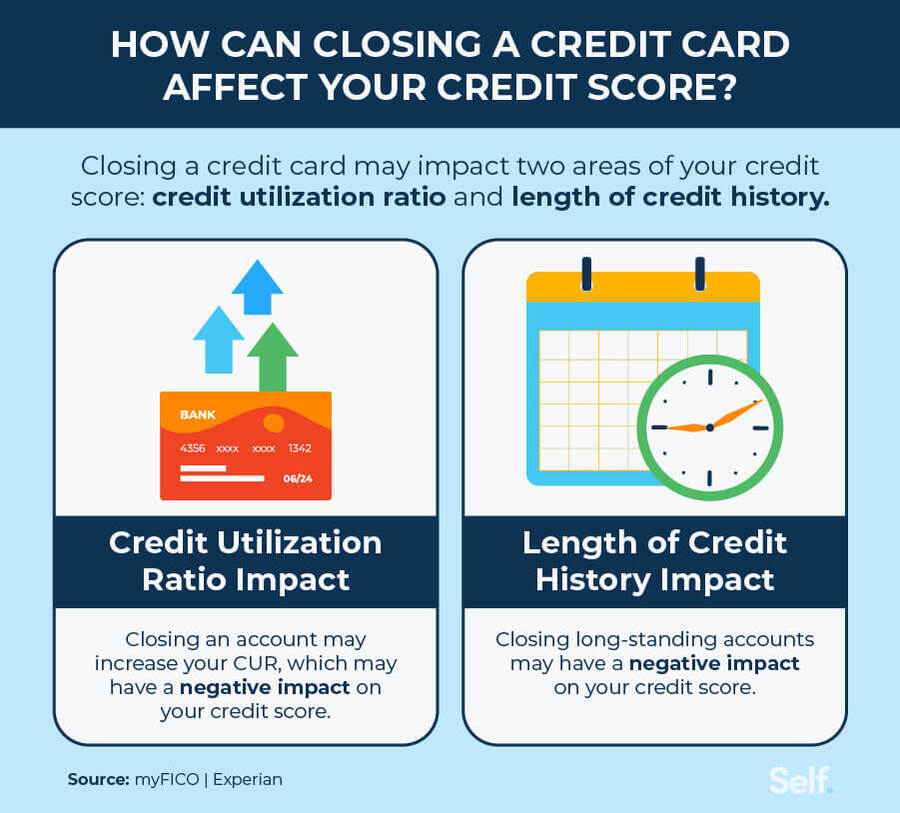

What will destroy your credit score

Highlights: Even one late payment can cause credit scores to drop. Carrying high balances may also impact credit scores. Closing a credit card account may impact your debt to credit utilization ratio.

How bad credit can hurt you

A poor credit history can have wider-ranging consequences than you might think. Not only will a spotty credit report lead to higher interest rates and fewer loan options; it can also make it harder to find housing and acquire certain services. In some cases it can count against you in a job hunt.

How long does bad credit affect you

seven years

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.