What happens if you don’t report Coinbase taxes?

What happens if I don’t report Coinbase

The IRS has made it clear that they expect people to report their cryptocurrency holdings on their taxes along with all capital assets. Failing to do so could result in a number of penalties, including fines and even jail time.

Cached

Will I get in trouble for not reporting crypto on taxes

Taxpayers are required to report all cryptocurrency transactions, including buying, selling, and trading, on their tax returns. Failure to report these transactions can result in penalties and interest.

Do you have to report Coinbase on taxes

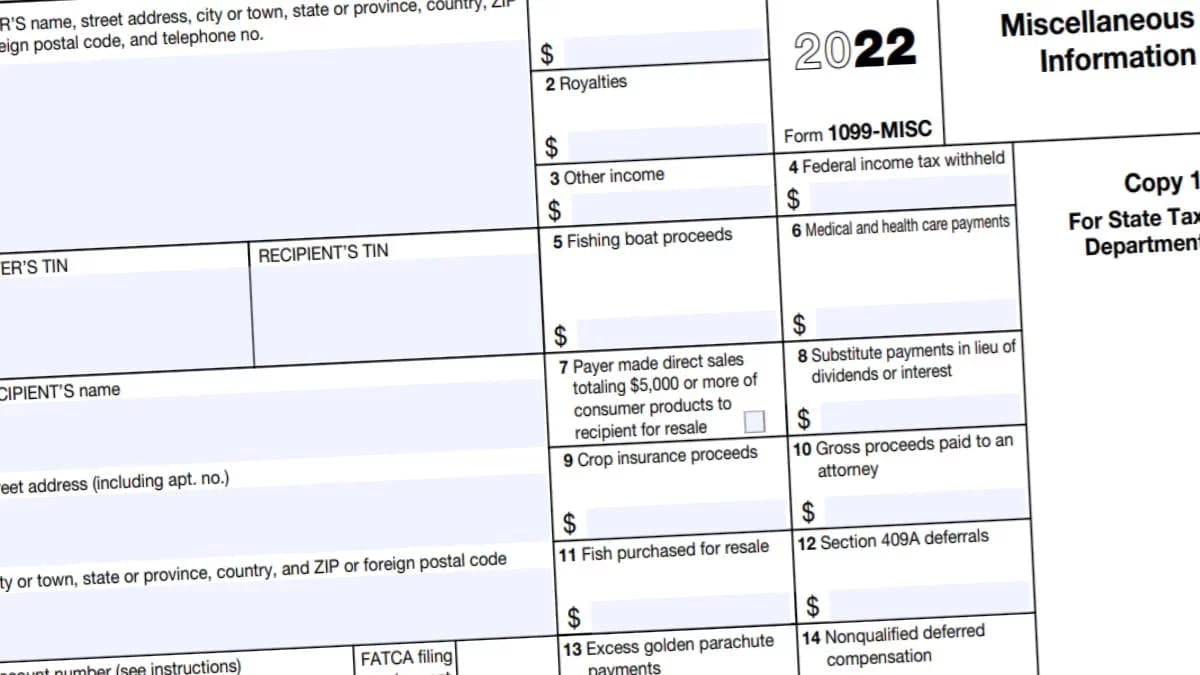

If you earn $600 or more in a year paid by an exchange, including Coinbase, the exchange is required to report these payments to the IRS as “other income” via IRS Form 1099-MISC (you'll also receive a copy for your tax return).

Cached

What is the penalty for not reporting crypto losses

After an initial failure to file, the IRS will notify any taxpayer who hasn't completed their annual return or reports. If, after 90 days, you still haven't included your crypto gains on Form 8938, you could face a fine of up to $50,000.

Cached

Does Coinbase report to IRS if you don’t sell

Gain/loss report

A Coinbase 1099 signals to the IRS that a user is actively trading crypto and may have transactions other than rewards or staking to report. Coinbase does have a gain/loss report but does not report your gains or losses to the IRS.

Do you have to report crypto under $600

However, you still need to report your earnings to the IRS even if you earned less than $600, the company says. The IRS can also see your cryptocurrency activity when it subpoenas virtual trading platforms, Chandrasekera says.

Will I get audited if I don’t report crypto

What happens if you don't report taxable activity. If you don't report taxable crypto activity and face an IRS audit, you may incur interest, penalties, or even criminal charges.

Do I need to report crypto if I didn’t make a profit

No, you do not need to report crypto if you don't sell. Because cryptocurrency and other digital assets are treated as property, taxable events only occur when you realize capital gains or losses through events such as swapping, trading, selling for fiat, or other methods of disposal.

Do I have to report crypto less than $600

Even if you earned staking or rewards income below the $600 threshold, you'll still have to report the amount on your tax return. If you've earned less than $600 in crypto income, you won't be receiving any IRS 1099 forms from us. Visit Qualifications for Coinbase tax form 1099-MISC to learn more.

Can the IRS see my Coinbase account

Yes, Coinbase reports to the IRS. It sends Forms 1099-MISC to the IRS for U.S. traders who made more than $600 in crypto rewards or staking. $600 is the Coinbase IRS reporting threshold for tax year 2023.

Does Coinbase report to IRS if under 600

Coinbase will issue Form 1099-MISC to you and the IRS only if you've met the minimum threshold of $600 of income during the year.

What triggers IRS audit crypto

2. What triggers a crypto audit Unreported income is one of the most common reasons for the IRS to conduct a crypto audit. Most crypto exchanges send 1099-B or 1099-K forms to clients that exceed certain transaction thresholds, the copies of which are then sent to the IRS.

How likely is it that the IRS will audit me for crypto

Most crypto tax filers will not be audited, but some will. The best way to prepare for possibility of a crypto tax audit is to keep thorough records of all crypto transactions and any related communications.

Do I have to report 20 dollars in crypto

You owe taxes on any amount of profit or income, even $1. Crypto exchanges are required to report income of more than $600 for activities like staking, but you still are required to pay taxes on smaller amounts.

At what point does Coinbase report to IRS

Does Coinbase report small-time crypto traders Coinbase will issue Form 1099-MISC to you and the IRS only if you've met the minimum threshold of $600 of income during the year.

Do I have to report crypto less than $100

How much do you have to earn in crypto before you owe taxes You owe taxes on any amount of profit or income, even $1. Crypto exchanges are required to report income of more than $600 for activities like staking, but you still are required to pay taxes on smaller amounts.

What if I forgot to report my 1099 crypto

The best idea is to amend your tax return from whichever year(s) you didn't include your crypto trades. You have three years from the date that you filed your return to file an amended return. Some investors fear that submitting an amended return may increase their risk of a future audit.

Do I need to report $100 crypto gain

The $100 difference would be considered a capital gain and subject to capital gains tax, which is typically taxed at a lower rate than ordinary income. If you sold your crypto for less than what you paid for it, that would be considered a capital loss.

Can the IRS see your Coinbase

Yes, Coinbase reports to the IRS. It sends Forms 1099-MISC to the IRS for U.S. traders who made more than $600 in crypto rewards or staking. $600 is the Coinbase IRS reporting threshold for tax year 2023.

Will the IRS know if I don’t report my crypto

Investors must report crypto gains, losses and income in their annual tax return on Form 8940 & Schedule D. Evading crypto taxes is a federal offence. Penalties for tax evasion are up to 75% of the tax due (maximum $100,000) and 5 years in jail. The IRS knows about your crypto already.