What happens if you have 2 primary beneficiaries?

What happens if you have multiple primary beneficiaries

If you have named more than one primary beneficiary, or if the primary beneficiary is deceased and you have more than one contingent beneficiary and one of them has died, then the death benefit proceeds from your policy will typically be redistributed among the remaining beneficiaries.

Cached

Can you have 2 primary beneficiaries

Key Takeaways. A primary beneficiary is a person or entity named to receive the benefit of a will, trust, insurance policy, or investment account. More than one primary beneficiary can be named, with the grantor able to direct particular percentages to each.

Cached

How will the policy money be paid if there are two beneficiaries

Who Gets the Life Insurance Payout The life insurance payout will be sent to the beneficiary listed on the policy. If there's more than one, each beneficiary has to submit their own claim. Then, the insurance company will pay each person or organization the amount the policyholder left them.

What happens if you have two beneficiaries

If you have multiple beneficiaries listed and one of them passes before you, the standard rule is that the death benefits that would have been given to said person would be redistributed to the rest of the beneficiaries. If you have co-beneficiaries, they will each get 50% of the benefits after you pass away.

Cached

What overrides beneficiaries

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty.

Who comes after the primary beneficiary

In the event your primary beneficiary dies before or at the same time as you, most policies also allow you to name at least one backup beneficiary, called a “secondary” or “contingent” beneficiary. If the primary beneficiaries are all deceased, the secondary beneficiaries receive the death benefit.

What are the rights of a primary beneficiary

The primary beneficiary has the right to inherit and claim your assets upon your death before anyone else. However, there can be multiple primary beneficiaries if you wish to have your assets distributed amongst more than one of your heirs.

What disqualifies life insurance payout

Life insurance covers death due to natural causes, illness, and accidents. However, the insurance company can deny paying out your death benefit in certain circumstances, such as if you lie on your application, engage in risky behaviors, or fail to pay your premiums. Here's what you need to know.

Can the beneficiary keep all the money

This means that executors cannot ignore the asset distribution in the will and take everything for themselves. However, if the executor of the will is also the only beneficiary named in the will, they can take the estate assets after debts and taxes are paid.

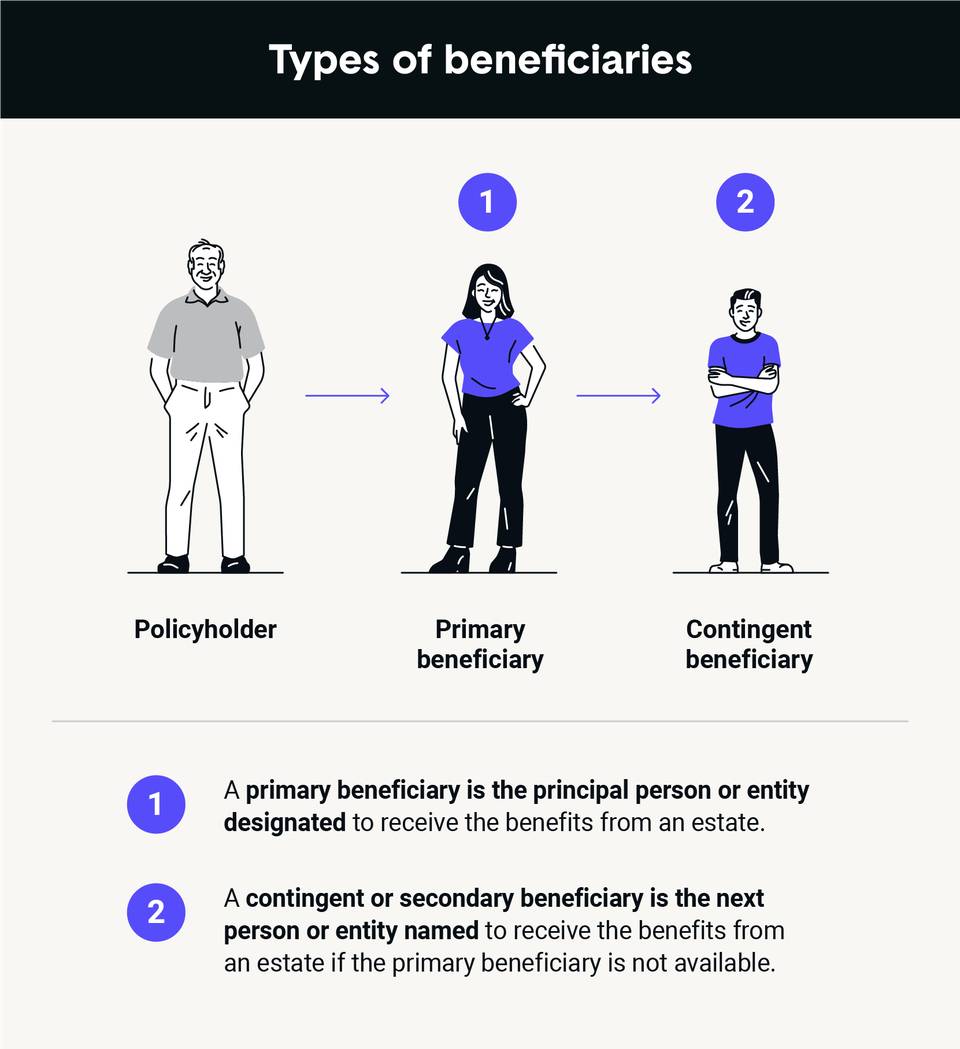

What is the 2nd beneficiary called

A contingent beneficiary, or secondary beneficiary, serves as a backup to the primary beneficiaries named on your life insurance policy. When you pass away, if all of your primary beneficiaries have also passed away, your contingent beneficiaries will receive the payout.

Can a beneficiary lose their inheritance

A beneficiary of a will can refuse their inheritance. Earlier, we explained that this action is formally called a “disclaimer of inheritance.” If the named beneficiary takes this action, then the probate court will treat the beneficiary as if they had predeceased the decedent.

Who has the power to exclude beneficiaries

In exercise of the power given to them by the Declaration the Trustees hereby irrevocably declare that from the date of this Deed the Excluded Beneficiaries shall be Excluded Persons. This is an irrevocable exclusion and takes effect on completion of the Deed.

Who is the first beneficiary of inheritance

The primary beneficiary is the person or entity who has the first claim to inherit your assets after your death. Despite the term “primary," you may name more than one such beneficiary and designate how the assets will be divided among them.

How much does a primary beneficiary get

The primary beneficiary has the first claim to the insurance proceeds and will receive the entire proceeds if they are alive and willing to accept them.

Can life insurance companies refuse to pay out

Quickly put, a life insurance claim can be paid, denied, or delayed. So, yes, life insurance companies can deny claims and refuse to pay out and if you're here, chances are you're in the same situation.

What are 3 reasons you may be denied from having life insurance

A serious medical condition or poor results from your life insurance medical exam tend to be the most common reasons why people are rejected. Or it might even be non-medical related, with factors like bankruptcy, a criminal record, a positive drug test, or a dangerous hobby all having an impact.

What can override a beneficiary

The Will will also name beneficiaries who are to receive assets. An executor can override the wishes of these beneficiaries due to their legal duty.

What is the difference between 1st beneficiary and 2nd beneficiary

Your primary beneficiary is first in line to receive your death benefit. If the primary beneficiary dies before you, a secondary or contingent beneficiary is the next in line. Some people also designate a final beneficiary in the event the primary and secondary beneficiaries die before they do.

How many primary beneficiaries can you have

Can I have more than one primary beneficiary You can have more than one primary beneficiary; you simply need to designate what percentage of your life insurance proceeds you want to allocate to each of your primary beneficiaries.

What is inheritance hijacking

Inheritance hijacking can be simply defined as inheritance theft — when a person steals what was intended to be left to another party. This phenomenon can manifest in a variety of ways, including the following: Someone exerts undue influence over a person and convinces them to name them an heir.