What happens to credit card debt when interest rates go up?

Does raising interest rates affect credit cards

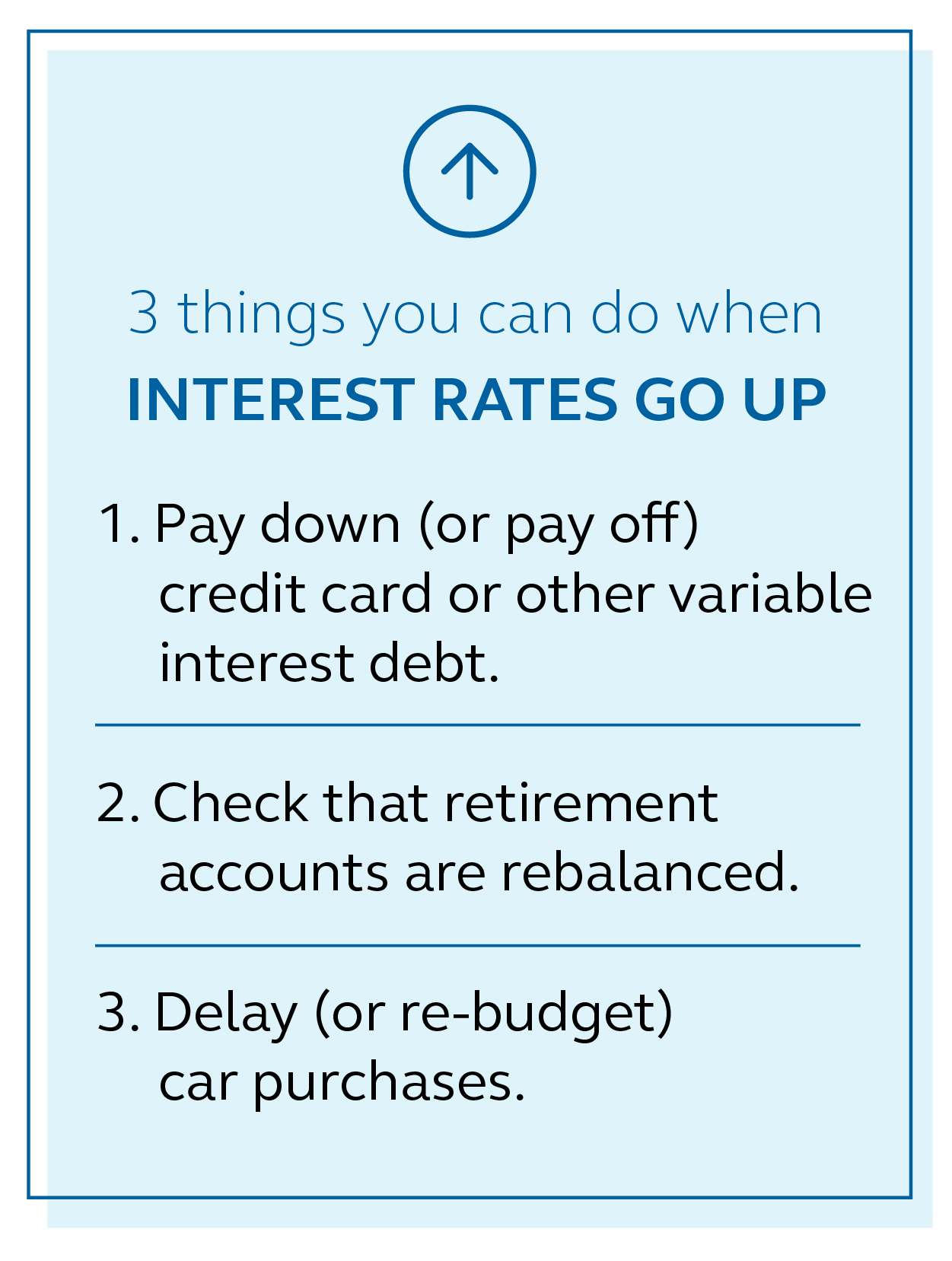

When the Federal Reserve raises interest rates, your credit card's APR usually also increases. You can take steps to limit or even alleviate the financial impact of rising interest rates.

Cached

What happens to debt when interest rates increase

Higher interest rates mean you'll be paying more in interest accrual which can lead to growing debt if you're unable to pay down the principal and interest in full each month. When interest rates rise, it can mean that your payments get bigger and your budget gets tighter.

Does raising interest rates lower debt

Higher Interest Rates Will Raise Interest Costs on the National Debt.

Are Americans piling up credit card debt

With inflation remaining stubbornly high, Americans are piling up a mountain of credit card debt as they use plastic to offset their shrinking purchasing power. Consumers now owe a record $986 billion on their charge cards, up 17% from a year earlier, according to the Federal Reserve Bank of New York.

Why did my credit card interest rate go up 2023

It's certainly possible your credit card interest rate will go up in 2023. Most credit cards have variable interest rates, meaning your account's interest rate is tied to a benchmark such as the Prime Rate. When the Prime Rate increases, your credit card APR also goes up.

How does rate hike affect credit cards

Your APR will rise: Most credit cards are variable APRs, meaning that they fluctuate and are susceptible to changes in the market and the federal funds rate. For those who have a hefty balance, carrying that balance over from month to month will begin to cost them.

Who benefits from higher interest rates

There are some upsides to rising rates: More interest for savers. Banks typically increase the amount of interest they pay on deposits over time when the Federal Reserve raises interest rates. Fixed income securities tend to offer higher rates of interest as well.

What does higher interest rate mean for debt

With a higher interest rate, you may wind up paying more in interest payments over the life of the loan. An example: You borrow $15,000 for a vehicle loan at 5 percent fixed interest for 48 months. That means you'll pay a total in $1,581 in interest over the life of the loan.

How high will interest rates go in 2023

Since the start of 2023, the Fed has hiked rates 10 times to combat rising inflation. As of May 2023, the federal funds rate ranges from 5.00% to 5.25%. If this prediction is correct, it won't be surprising to see some of the best high-yield savings accounts offering rates exceeding 4%.

How much credit card debt does the average person have in the US

How much credit card debt does the average person owe On average, each U.S. household has $7,951 in credit card debt, as of this analysis. With an average of 2.6 people per household, according to the U.S. Census Bureau, that's about $3,058 in credit card debt per person.

How much does the average American owe in credit card debt

Credit card debt is afflicting different generations in myriad ways. Older Americans tend to owe more card debt. A New York Life survey found that the average Generation X consumer with a balance owes just over $7,000, compared to an overall average debt of $6,321 per cardholder.

How will rate hike affect credit cards

The latest increase will likely raise the APR on your credit card 0.25%. So, if you have a 20.9% rate, which is the average according to the Fed's data, it might increase to 21.15%. If you don't carry a balance from month to month, the APR is less important.

What is the average credit card debt in the US

How much credit card debt does the average person owe On average, each U.S. household has $7,951 in credit card debt, as of this analysis. With an average of 2.6 people per household, according to the U.S. Census Bureau, that's about $3,058 in credit card debt per person.

Why does my credit card balance keep going up

If you're carrying a balance on your credit card, the card issuer typically calculates your minimum payment each month as a percentage of what you owe — and that figure will rise if you're charging more to the card each month and growing the balance.

Will credit card interest rates go down in 2023

And when the prime rate goes up, variable interest rates soon follow. In fact, interest rates on credit cards continue moving up, with the national average APR higher than 20 percent as of May 3, 2023, up from 16.34 percent in March 2023.

Who benefits the most from inflation

Here are the seven winners who can actually benefit from inflation.Collectors.Borrowers With Existing Fixed-Rate Loans.The Energy Sector.The Food and Agriculture Industry.Commodities Investors.Banks and Mortgage Lenders.Landowners and Real Estate Investors.

Who benefits and who is hurt when interest rates rise

Who benefits and who is hurt when interest rates rise Corporations with immediate capital construction needs are worse off. Households with little debt, saving a significant fraction of annual income for retirement, are better off. The federal government running persistent budget deficit is worse off.

Who benefits from increased interest rates

The financial sector has historically been among the most sensitive to changes in interest rates. With profit margins that actually expand as rates climb, entities like banks, insurance companies, brokerage firms, and money managers generally benefit from higher interest rates.

Who is affected by rising interest rates

One sector that tends to benefit the most is the financial industry. Banks, brokerages, mortgage companies, and insurance companies' earnings often increase—as interest rates move higher—because they can charge more for lending.

Will interest rates go down in 2023 or 2024

These organizations predict that mortgage rates will decline through the first quarter of 2024. Fannie Mae, Mortgage Bankers Association and National Association of Realtors expect mortgage rates to drop through the first quarter of 2024, by half a percentage point to about nine-tenths of a percentage point.