What happens to my credit score if I pay off a collection?

Will paying off collections improve credit score

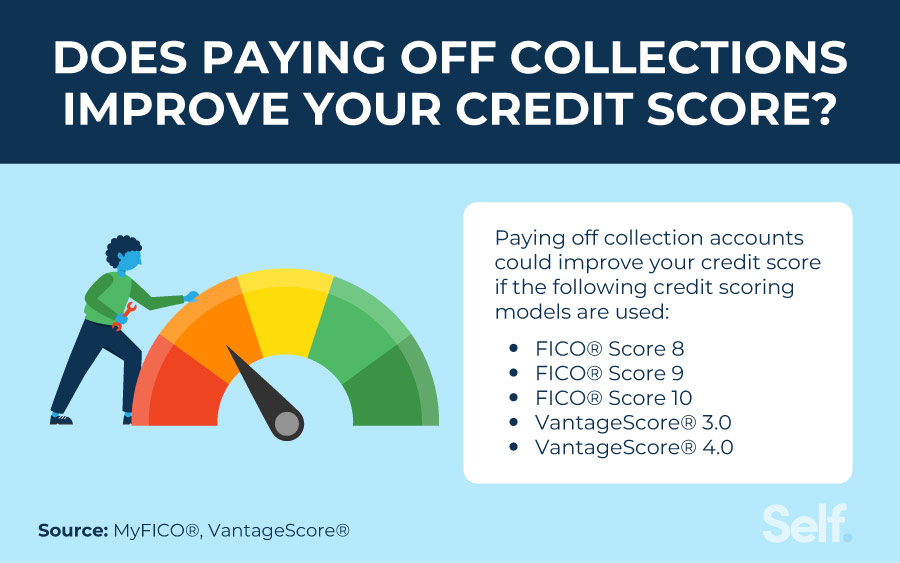

Newer credit-scoring models from FICO® and VantageScore (like FICO Score 9 and VantageScore 3.0) ignore zero-balance collection accounts. So paying off a collections account could raise your scores with lenders that use these models.

Cached

What happens to credit score when a collection is paid off

In general, collections accounts stay on your credit report for up to seven years, even when they're paid off in full. That means that paid collections can continue to hurt your creditworthiness for that length of time. However, the impact of collection accounts on your score lessens with time.

Cached

Does a collection go away after you pay it off

How long will collections stay on your credit report Like other adverse information, collections will remain on your credit report for 7 years. A paid collection account will remain on your credit report for 7 years as well.

Cached

Will my credit score go up after a collection is removed

Will deleting collections improve credit score In most cases, deleting a collections account from your credit report can improve your credit score. In other cases, it may have little-to-no effect on your credit score.

Should I pay off a 2 year old collection

Any action on your credit report can negatively impact your credit score, even paying back loans. If you have an outstanding loan that's a year or two old, it's better for your credit report to avoid paying it.

Is it better to pay off collections or let them go

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.

How do I rebuild my credit after collections

Taking Steps to Rebuild Your CreditPay Bills on Time. Pay all your bills on time, every month.Think About Your Credit Utilization Ratio.Consider a Secured Account.Ask for Help from Family and Friends.Be Careful with New Credit.Get Help with Debt.

How do I get a collection removed

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How do I get a paid collection removed

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

Can you delete a collection

You can delete a collection at any time, but you can't undo a deletion. When you delete a collection, all the posts you created in that collection are deleted. Posts reshared to the collection remain after the collection is deleted. At the bottom, tap Collections.

Is it better to pay off a collection or have it removed

It's better to pay off a debt in full (if you can) than settle. Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

How do I remove a collection from my credit report

It's possible to remove a collection account from your credit report by disputing an inaccurate account or requesting deletion for an account that is being or has been paid in full. In any case, a collection account should leave your credit report after seven years.

Can I ask pay to delete collections

In some cases, you can negotiate what is called a pay-for-delete arrangement. With pay-for-delete, you pay all or a portion of the debt in exchange for the collection agency removing the account from your credit report.

Why does credit score go down when collections are removed

This is because your total available credit is lowered when you close a line of credit, which could result in a higher credit utilization ratio. Additionally, if the account you closed was your oldest line of credit, it could negatively impact the length of your credit history and cause a drop in your scores.

How do I get paid collections removed

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

How long after a collection is paid will credit score increase

With most collection accounts, if you pay them in full, their impact on your credit doesn't go away immediately. You'll usually have to wait until they reach the end of their seven-year reporting window. The good news is that the older the information is, the less impact it should have on your credit.

Is a paid collection better than an unpaid

A fully paid collection is better than one you settled for less than you owe. Over time, the collections account will make less difference to your credit score and will drop off entirely after seven years. Finally, paying off a debt can be a tremendous relief to your mental health.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Why is it bad to pay accounts in collections

' Once you pay the collection agency, the debt will remain on your credit report for six more years, two years longer than not making a payment. Even if the collection agency agrees to accept less than the full amount owing, it's still on your credit report for six more years.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.