What happens to my student loan after 10 years?

Are student loans being forgiven after 10 years

PSLF Process

Because you have to make 120 qualifying monthly payments, it will take at least 10 years before you can qualify for PSLF. Important: You must be working for a qualifying employer at the time you submit the form for forgiveness and at the time the remaining balance on your loan is forgiven.

Can student loans be collected after 10 years

The statute of limitations on debt determines how long creditors have to sue you to collect unpaid debts. Federal student loans administered by the Department of Education have no statute of limitations or time frame that limits the time the loan servicer has to sue you.

What happens if you don t pay off your student loans after 10 years

If you default on your student loan, that status will be reported to national credit reporting agencies. This reporting may damage your credit rating and future borrowing ability. Also, the government can collect on your loans by taking funds from your wages, tax refunds, and other government payments.

At what age do student loans get written off

At what age do student loans get written off There is no specific age when students get their loans written off in the United States, but federal undergraduate loans are forgiven after 20 years, and federal graduate school loans are forgiven after 25 years.

How do I know if my student loans will be forgiven

Who qualifies for student loan forgiveness To be eligible for forgiveness, you must have federal student loans and earn less than $125,000 annually (or $250,000 per household). Borrowers who meet that criteria can get up to $10,000 in debt cancellation.

Why haven t my student loans been forgiven

In the past two months, student loan forgiveness has been the target of two high-profile lawsuits. As a result of these lawsuits, the Department of Education is no longer accepting applications for forgiveness, and the program has been paused until the courts make a decision.

Do unpaid student loans ever go away

There is no legal limit or statute of limitations regarding the collection of defaulted student loans. Unless you qualify for a discharge, you are permanently liable for payment of your student loan until the account is paid in full.

Do my student loans ever expire

Federal student loans do not have a statute of limitations, so lenders and collections agencies have no time limit when it comes to forcing you to pay (aka suing you).

What if I will never pay my student loans

The longer you go without paying your student loans, the more your credit score may tank. Potential lawsuits. Your original lender could sell your loan to a debt collection agency, which can call and send you letters in an attempt to collect a debt. To garnish wages, lenders will need to go through court.

Do old student loans qualify for forgiveness

The answer: Yes! However, there are very specific eligibility requirements you must meet to qualify for loan forgiveness or receive help with repayment. Loan forgiveness means you don't have to pay back some or all of your loan.

What student loans are not eligible for forgiveness

What student loans are not eligible for forgiveness Private student loans, by definition, are private and are not eligible to be forgiven. These are loans the borrower owes to student loan providers and not the federal government. Mr.

Why did my student loans disappear

If your student loan balance is suddenly showing zero, some of the many reasons could be: Your federal student aid or private student loans were forgiven. You've completed one of the student loan forgiveness programs. You qualify for Public Service Loan Forgiveness (PSLF), or.

How will I know if my student loan has been forgiven

Log in to StudentAid.gov to track your PSLF progress. For updates on your application status, visit MOHELA's website or contact them at 1-855-265-4038.

Will my student loans automatically be forgiven

Will my student loans be forgiven All federally owned student loans are eligible for forgiveness. If you have Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, Direct Consolidation Loans or FFEL Loans owned by the U.S. Department of Education, they're all included in the forgiveness plan.

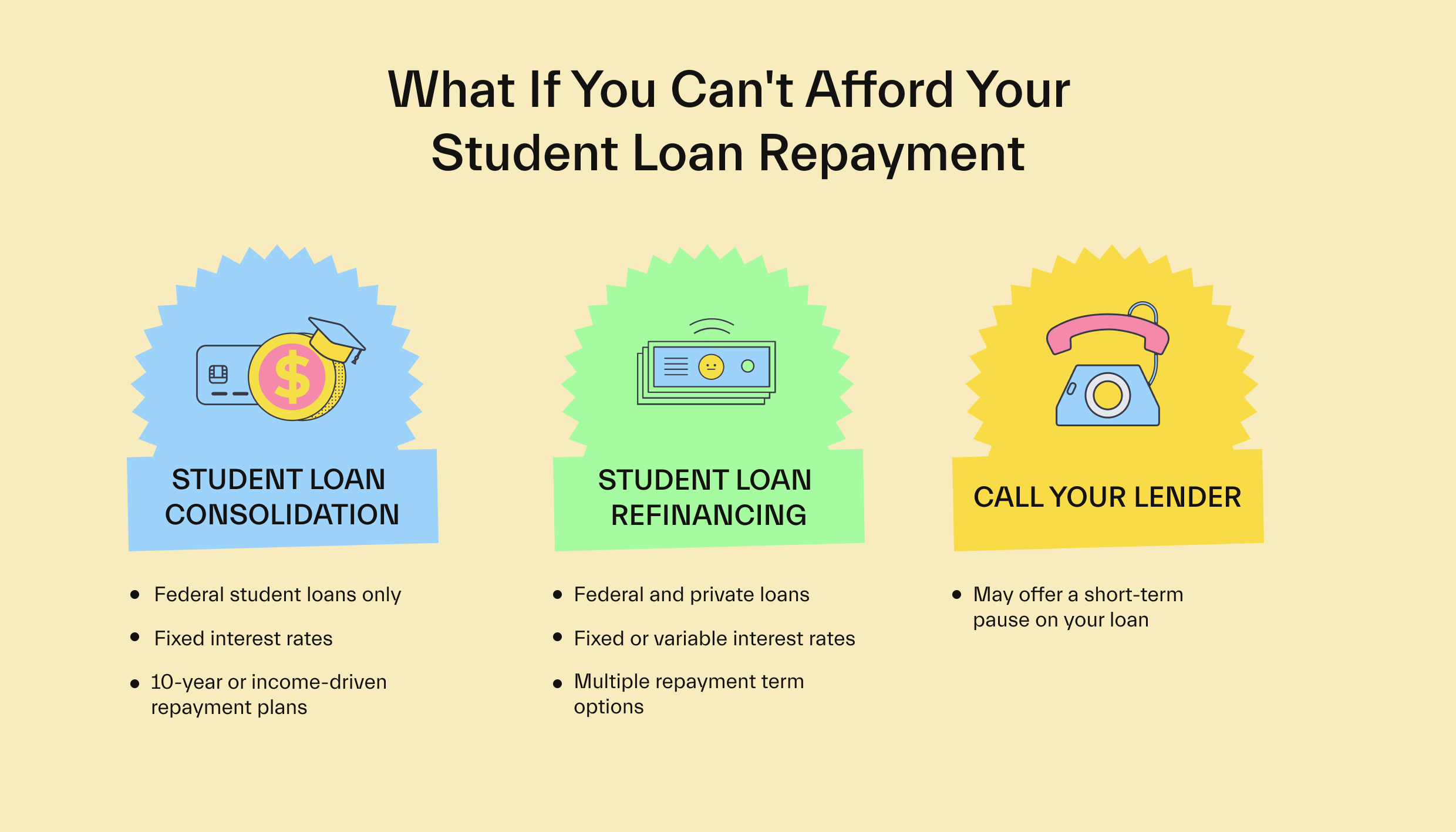

What do I do if I can’t pay my student loans

When bills are piling up, student loan repayment might be the last thing on your mind.Contact your loan servicer to discuss your options.Change your repayment plan.Look into consolidation.Consider deferment or forbearance.Look into loan forgiveness.Hear from an expert.

Why did my student loan debt disappear

If your student loan balance is suddenly showing zero, some of the many reasons could be: Your federal student aid or private student loans were forgiven. You've completed one of the student loan forgiveness programs. You qualify for Public Service Loan Forgiveness (PSLF), or.

What happens if you don’t pay student loans for 20 years

Are federal student loans forgiven after 20 years The U.S. Department of Education forgives student loan debt after 20 years of qualifying payments under an eligible income-driven repayment plan. In most cases, federal student loans go away only when you make payments.

What student loans are no longer eligible for forgiveness

What student loans are not eligible for forgiveness Private student loans, by definition, are private and are not eligible to be forgiven. These are loans the borrower owes to student loan providers and not the federal government.

How do I know if my student loans are forgiven

How do I know if my student loans are forgiven The Department of Education will notify you when your application is approved, and your loan servicer will update you once your loans are forgiven. Keep an eye out for any correspondence from your servicer via email or mail, and regularly check your loan balance online.

Which student loans qualify for forgiveness

Only federal Direct Loans can be forgiven through PSLF. If you have other federal student loans such as Federal Family Education Loans (FFEL) or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.