What happens when we swipe a credit card?

What happens after you swipe a credit card

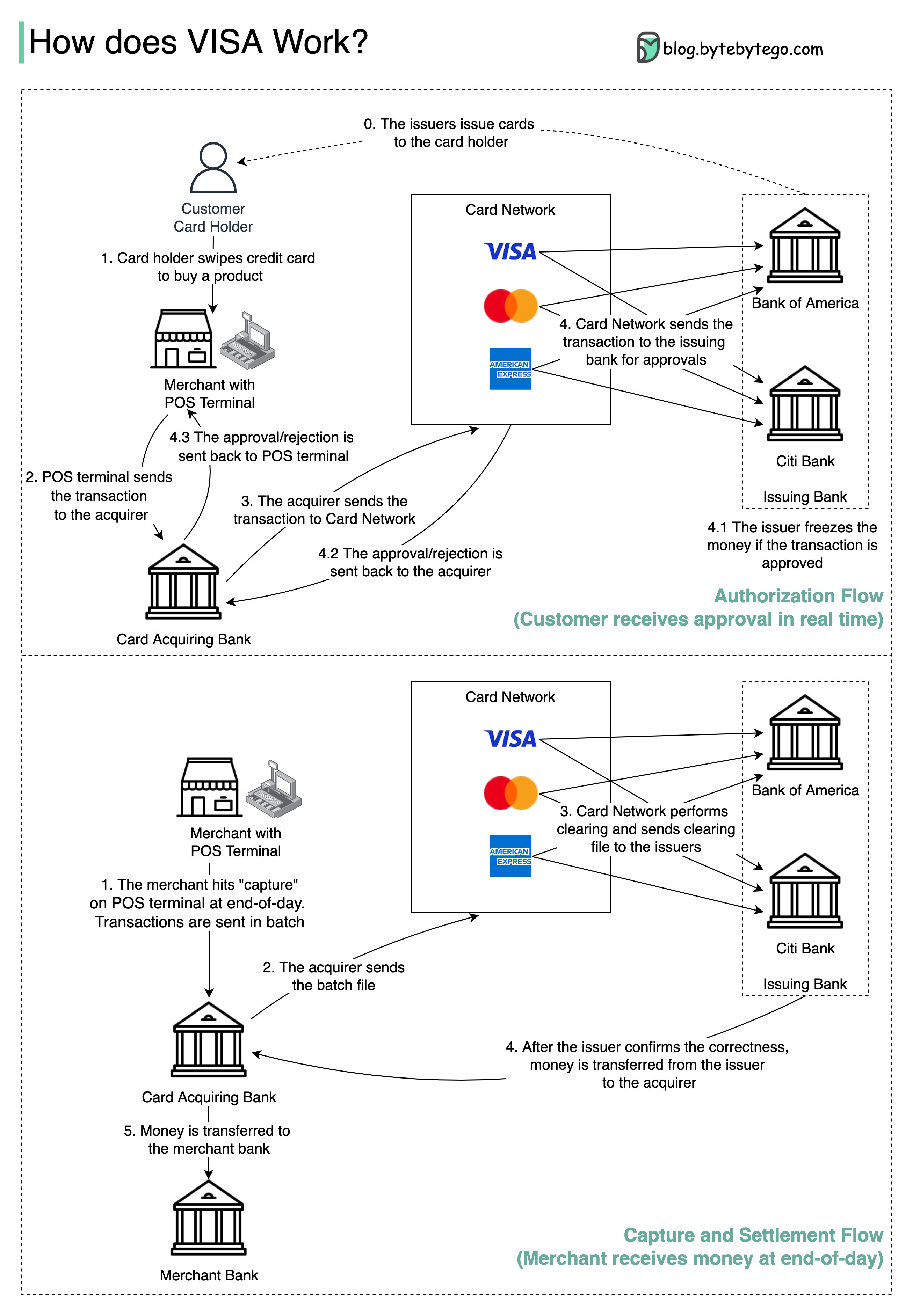

The terminal used to pay with a card is known as a point of sale or POS terminal. That terminal sends the details of the card you swiped to the bank or processor through a phone line or internet connection. Typically, the bank or processor forwards the card details to the network of credit cards within a few seconds.

Cached

How does credit card swiping work

When you swipe the strip through a credit card reader at a point of sale, the reader pulls the information stored in the strip. Once the information is read and accepted, the system communicates the transaction through the credit card network, so the transaction amount can be debited from the account.

How risky is credit card swiping

While swipe credit card transactions are known to be the more secure payment method, they're not immune to fraud. Swipe transactions can still be associated with credit card theft and fraudulent charges, thanks to hackers using malicious card machines, RFID scanners, and mobile devices to fish for this information.

Do you get charged for swiping your card

When consumers use a credit or debit card to make a purchase, banks and card networks like Visa and Mastercard charge retailers a hidden “swipe fee” to process the transaction. For credit cards, the fees average about 2% of the transaction but can be as much as 4% for some premium rewards cards.

Cached

Do you need a PIN when swiping credit card

A credit card personal identification number (PIN) is basically a four-digit code which is used to verify the identity of the credit card holder. It is mandatory to enter the credit card PIN in order to complete a transaction.

Is it safer to swipe or tap credit card

Tapping to pay isn't all about making your life simpler, but it also creates a more secure way to shop. By using a mix of chip technology, Near Field Communication (NFC), and Radio Frequency Identification (RFID), tapping to pay is safer than your classic swipe or insertion of a credit or debit card.

How long is jail time for swiping

a misdemeanor credit card fraud conviction is punishable by up to one year in county jail and a fine up $1,000 fine; a felony credit card conviction is punishable by 16 months, 2 or 3 years in jail and a fine up to $10,000.

What is the process of swiping

To swipe your credit card correctly:Position the magnetic strip that is on the back of the card into the card reader's slot. Face the magnetic strip toward the card reader.From top to bottom, move the magnetic strip through the card reader slot.

What happens if you get caught swiping

If caught, the thief may face fines up to $1,000 and up to one year in the county jail. Often, thieves are ordered to pay restitution to cover the losses suffered by their victims. In some cases, thieves are charged with multiple crimes, including both misdemeanors and felonies.

What is the penalty for swiping

Misdemeanor Credit Card Fraud

valued at less than $100 in any six-month period, is a first-degree misdemeanor punishable by up to a one-year prison sentence and $1,000 fine.

Can you just swipe a credit card

You can swipe a credit card just by sliding it through the slot in the machine with the stripe on the back of your card at the bottom, facing left. Or on a machine that requires you to swipe your card horizontally rather than vertically, just make it so the front of your card is facing up.

Is it safe to tap or swipe credit card

Contactless credit cards are currently among the safest forms of payment. It's incredibly difficult for a hacker to recreate the one-time code that contactless credit cards create for each transaction. Compared to magnetic strips that are more easily duplicated, contactless credit cards are much more secure.

What are the risks of swiping

Dangers of SwipingSkimming. Skimming is a type of credit card fraud that involves illegally copying information from the magnetic stripe on a credit or debit card.Data Breaches.Card Not Present Fraud.ID Theft.Counterfeit Cards.Gas Stations.ATM.Non-Bank ATMs.

How much trouble can you get in for credit card swiping

In most states, if the thief uses a stolen credit card to buy goods or to get cash over the amount defined as a misdemeanor, the crime becomes a felony. Depending on the situation, thieves may face up to 15 years in prison and up to $25,000 in fines. Again, thieves may also have to pay restitution.

What happens if I get caught swiping

If caught, the thief may face fines up to $1,000 and up to one year in the county jail. Often, thieves are ordered to pay restitution to cover the losses suffered by their victims. In some cases, thieves are charged with multiple crimes, including both misdemeanors and felonies.

Do credit card companies actually investigate

Credit card companies dedicate millions of dollars annually to catching and preventing fraudulent transactions in their customers' accounts. Credit card companies investigate fraudulent activity and may forward the results of their investigation to the closest law enforcement agency.

What is credit card swiping illegal

Swiping cards scamming is a type of fraud that involves the use of stolen credit card information to make purchases or withdraw money from a victim's bank account. The scammer may also use the stolen information to open new accounts in the victim's name, allowing them access to funds for their own benefit.

How long do you go to jail for credit card swiping

a misdemeanor credit card fraud conviction is punishable by up to one year in county jail and a fine up $1,000 fine; a felony credit card conviction is punishable by 16 months, 2 or 3 years in jail and a fine up to $10,000.

How many years is it if you get caught swiping

The penalties for credit card fraud in California can vary depending on the circumstances and severity of the case. On the low end, it is a year in county jail and a $1,000 fine. On the high end, it is punishable by up to three years in county jail and a $10,000 fine.

What happens if you swipe a chip card

As a consumer, you still receive the full fraud protection of your credit card whether you use the magnetic strip or the EMV chip. The only difference between swiped and inserted transactions is who covers the cost of fraud.