What happens when you debit a revenue?

Can you debit sales revenue

The bottom line is, sales revenue is not recorded as a debit but as a credit because it represents a company's income during an accounting period. This income has an impact on the company's equity, thus, as a company generates revenue, its equity increases.

Cached

Does a debit to revenue increase

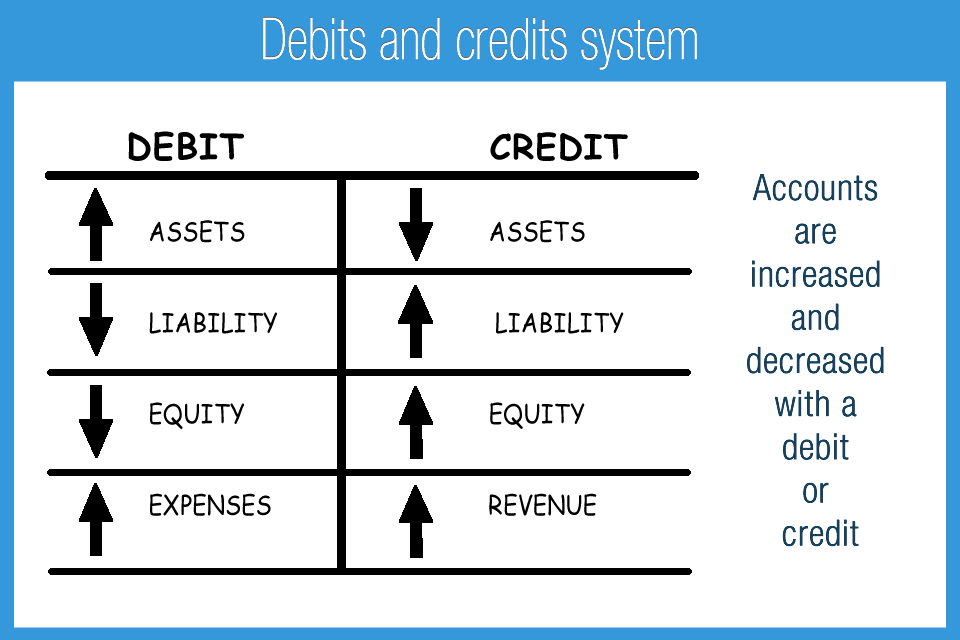

Debits and credits are used in a company's bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Credits do the reverse.

Cached

Is a debit to revenue positive or negative

A debit also decreases a liability or equity account. Thus, a debit indicates money coming into an account. In terms of recordkeeping, debits are always recorded on the left side, as a positive number to reflect incoming money.

Cached

Is revenue returns debit or credit

debit

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance.

Do you debit cash and revenue

Debits and Credits in Common Accounting Transactions

Sale for cash: Debit the cash account | Credit the revenue account. Sale on credit: Debit the accounts receivable account | Credit the revenue account. Receive cash in payment of an account receivable: Debit the cash account | Credit the accounts receivable account.

Why is revenue not a debit

In business, revenue is responsible for the business owner's equity increasing. Since the normal balance for the business owner's equity is a credit balance, revenue has to be recorded not as a debit but as a credit.

Is a debit to revenue a decrease

To record revenue from the sale from goods or services, you would credit the revenue account. A credit to revenue increases the account, while a debit would decrease the account.

Does a debit entry increase or decrease revenues

A debit increases the balance of an asset, expense or loss account and decreases the balance of a liability, equity, revenue or gain account. Debits are recorded on the left side of an accounting journal entry.

What happens if revenue is negative

A negative net income means a company has a loss, and not a profit, over a given accounting period. While a company may have positive sales, its expenses and other costs will have exceeded the amount of money taken in as revenue.

What is the debit and credit rule of a revenue account

Revenues are increased by credits and decreased by debits. Expenses are increased by debits and decreased by credits. Debits must always equal credits after recording a transaction.

Why is revenue recorded as a credit

Revenues cause owner's equity to increase. Since the normal balance for owner's equity is a credit balance, revenues must be recorded as a credit.

Why would you debit revenue

Revenue. In a revenue account, an increase in debits will decrease the balance. This is because when revenue is earned, it is recorded as a debit in the bank account (or accounts receivable) and as a credit to the revenue account.

Is revenue a credit or debt

In bookkeeping, revenues are credits because revenues cause owner's equity or stockholders' equity to increase. Recall that the accounting equation, Assets = Liabilities + Owner's Equity, must always be in balance.

Does a debit decrease unearned revenue

After the goods or services have been provided, the unearned revenue account is reduced with a debit. At the same time, the revenue account increases with a credit. The credit and debit will be the same amount, following standard double-entry bookkeeping practices.

Why does revenue go down with debit

Revenue. In a revenue account, an increase in debits will decrease the balance. This is because when revenue is earned, it is recorded as a debit in the bank account (or accounts receivable) and as a credit to the revenue account.

Can I have a negative revenue

Profit & Loss Statement

A negative revenue figure may mean that you had to credit a customer or customers for more than you sold in a given period.

What is negative revenue called

What is net profit Net profit is the amount of money your business earns after deducting all operating, interest, and tax expenses over a given period of time. To arrive at this value, you need to know a company's gross profit. If the value of net profit is negative, then it is called net loss.

Why is revenue a credit and not a debit

In bookkeeping, revenues are credits because revenues cause owner's equity or stockholders' equity to increase. Recall that the accounting equation, Assets = Liabilities + Owner's Equity, must always be in balance.

What does it mean to credit a revenue account

The reason why revenues are credited is that they increase the shareholders' equity of a business, and shareholders' equity has a natural credit balance. Thus, an increase in equity can only be caused by transactions that are credited.

Why is revenue credit and expense debit

Revenues have a normal balance of credit because this account is presented as part of the equity. On the other hand, expenses are recorded as debits because these are contra-revenue accounts.