What happens when you dispute something on Credit Karma?

What happens when you dispute an account on Credit Karma

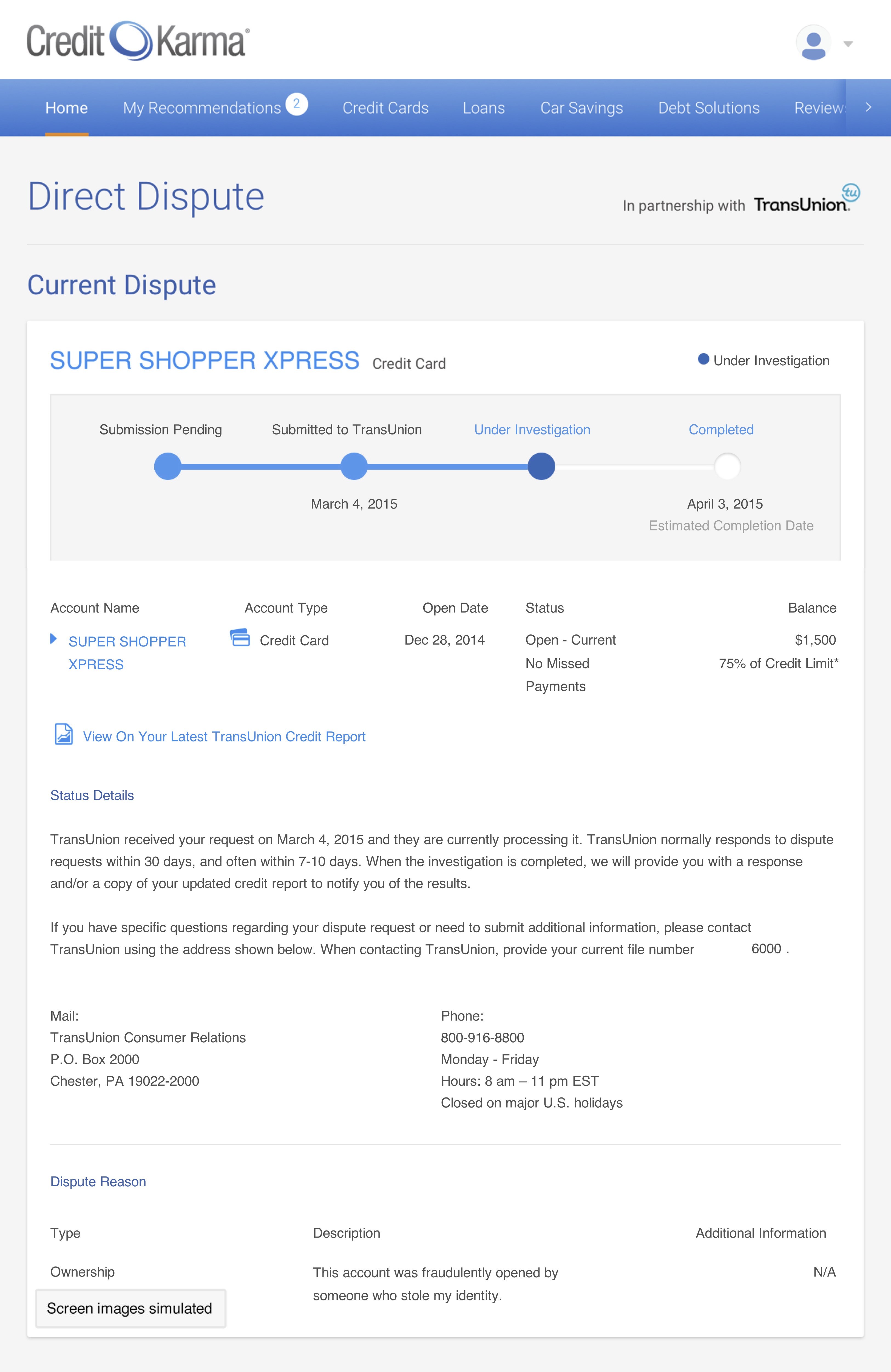

Generally speaking, TransUnion will review your dispute within 30 days. After TransUnion's investigation, you'll be notified about whether any changes will be made to your credit report.

Cached

Will I get my money back if I dispute a charge

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

How do you know if your dispute is approved on Credit Karma

You can check the status of your dispute by checking the transaction details of your disputed item on the Credit Karma website or mobile app.

Cached

What happens after you dispute something on your credit report

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

Cached

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What is the best reason to dispute a collection on Credit Karma

Incorrect dates of payments or delinquencies. Accounts with an incorrect balance. Accounts with an incorrect credit limit. Reinsertion of disputed information that has previously been corrected and removed.

What happens if you falsely dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

Does disputing on Credit Karma hurt your score

No. The act of disputing items on your credit report does not hurt your score. However, the outcome of the dispute could cause your score to adjust.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

How long does it take for your credit score to go up after a dispute

If you file a dispute regarding information on your Equifax credit report, you can generally expect to receive the results of the investigation within 30 days. If the information on your credit report is found to be inaccurate or incomplete, your credit report will be updated, generally within about 30 days.

What happens if I falsely dispute a charge

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

What happens if you accidentally dispute a charge

The bottom line. If you dispute a credit card charge by mistake, contact your card issuer and explain the situation. You could also follow up with the merchant if required.

Is it worth it to dispute a collection

You can get ready by understanding your rights as a consumer. You have the right to stop harassment by a debt collector and you have the right to dispute the debt they claim you owe. In fact, I recommend that you exercise your right to dispute in almost every situation. It can't hurt—and it may save you time and money!

What is a good excuse to dispute a charge

We can divide all valid disputes into one of five basic categories: criminal fraud, authorization errors, processing errors, fulfillment errors, or merchant abuse.

Is it a good idea to dispute credit report

If you find mistakes on your credit reports, you should dispute them. Here's how you can dispute errors you find. Errors can appear on one or more of your credit reports due to an error in the information provided about you or as the result of fraud or identity theft.

Can you get in trouble for falsely disputing credit

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

What is the success rate of a credit dispute

You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Is it OK to dispute a charge

The law allows consumers to dispute charges when the merchant has made a legitimate error or has failed to uphold their end of a transaction. This does not include items you simply don't like or which you've decided you don't need.

Is it better to dispute a debt or pay it

It is always better to pay off your debt in full if possible. While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative.

What happens after you dispute a collection

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.