What if I didn’t get the Recovery Rebate credit?

What if I never received my recovery rebate credit

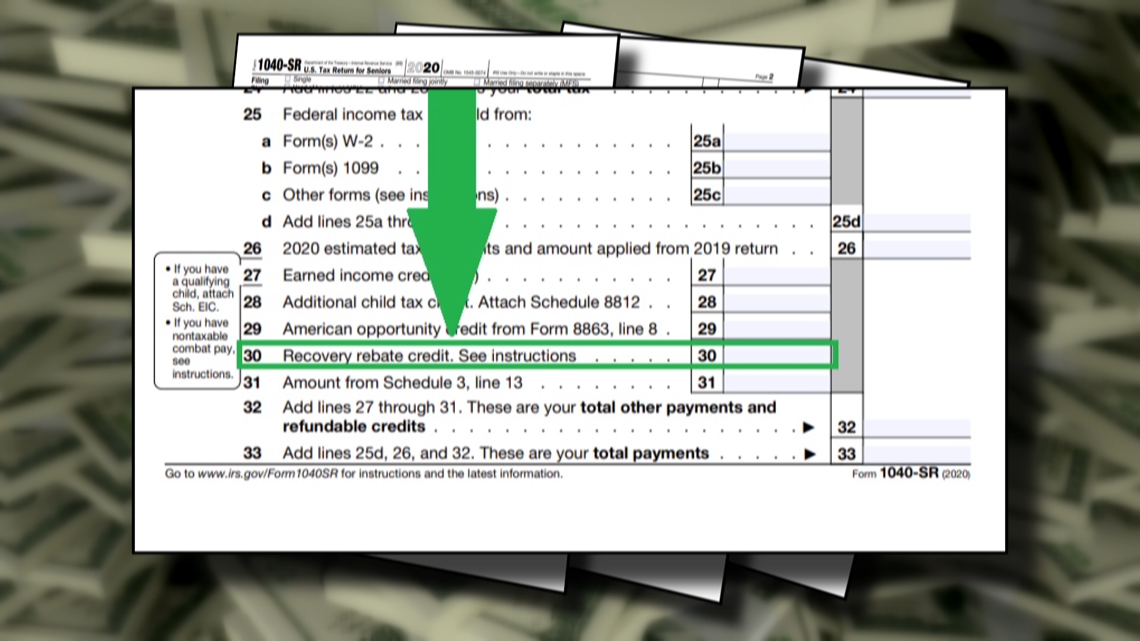

If you never got your payments or did not get all of the money you thought you should, you must file a 2023 tax return. On your return, provide your current bank account information (if you have one) and current address, and claim the Recovery Rebate Credit.

Cached

How do I find my recovery rebate credit

The only way to get a Recovery Rebate Credit is to file a 2023 tax return, even if you are otherwise not required to file a tax return. The fastest and most accurate way for you is to file is electronically where the tax preparation software will help you figure your 2023 Recovery Rebate Credit.

Is the IRS sending out letters about recovery rebate credit

The IRS began issuing Letter 6475, Economic Impact Payment (EIP) 3 End of Year, in January 2023. This letter helps EIP recipients determine if they're eligible to claim the Recovery Rebate Credit on their 2023 tax year returns.

Is it too late to claim stimulus money

It's not too late to claim any stimulus checks you might have missed! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third one.

Does everyone get recovery rebate credit

Generally, you are eligible to claim the Recovery Rebate Credit if: You were a U.S. citizen or U.S. resident alien in 2023. You are not a dependent of another taxpayer for tax year 2023.

How much was the 3rd stimulus check

$1,400

Third round of stimulus checks: March 2023

The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800.

How do I know if I received a recovery rebate

Your Online Account: Securely access your IRS online account to view the total amount of your first, second and third Economic Impact Payment amounts under the Tax Records page. IRS Notices : We mailed these notices to the address we have on file.

What if I didn’t receive letter 6475

What if I didn't receive my Letter 6475 or 6419 If you are ready to file your 2023 tax return, but haven't received your letter, you can always check your online IRS account. If you don't have an IRS account, create an ID.me account on the IRS website.

What if I still haven’t received my $1400 stimulus

Individuals who didn't receive a third-round payment should contact the IRS as soon as possible to see if a payment trace is needed. It may be needed if their IRS Online Account shows a payment they didn't receive or they received a notice or letter indicating they were issued a payment.

Is it too late if I never got my stimulus check

What do I do if I didn't get my stimulus checks It's not too late to get any missed stimulus checks! You will need to file a 2023 tax return to get the first and second stimulus checks and a 2023 tax return to get the third stimulus check.

Who qualifies for the $1400 recovery rebate credit

Individuals qualified for the full stimulus payment if their AGI was $75,000 or lower ($150,000 for married couples). The full payment was $1,400 for single individuals, $2,800 for married couples, and an additional $1,400 for each dependent.

Is the recovery rebate credit the same as a stimulus check

The big difference is that eligibility for the stimulus check was typically based on information found on your 2023 or 2023 tax return, while eligibility for the recovery rebate credit is based on information from your 2023 return. So, you could qualify for a stimulus check but not for the credit – and vice versa.

How do I know if I got my 3rd stimulus check

Find Out Which Payments You Received

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

Did everyone get a third stimulus check

Some people may have gotten the impression that everyone is entitled to a third stimulus check. Unfortunately, that's just not the case. There are a few reasons why you could be left without a third stimulus check. It could be because of your income, age, immigration status, or some other disqualifying factor.

When should I expect my recovery rebate credit

You will receive your 2023 Recovery Rebate Credit included in your refund after your 2023 tax return is processed.

What if I did not receive letter 6419

The IRS sent Letter 6419 out from December 2023 through January 2023, so you should have received yours by now. But don't worry if you weren't sent a letter, didn't receive it or threw it out. You can also use the IRS' CTC Update Portal or create and check your IRS account for a record of your advance CTC payments.

Did i get third stimulus payment

Find Out Which Payments You Received

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the “Economic Impact Payment Information” section on the Tax Records page.

How come I haven’t gotten my stimulus

Did Not File in 2023 or 2023. Another reason why you haven't received your stimulus check is because you did not file your taxes in 2023 or 2023. If you did file in 2023 and are not planning on filing in 2023, then the IRS needs updated information.

What if I didn t receive my $1,400 stimulus check

If a trace is initiated and the IRS determines that the check wasn't cashed, the IRS will credit your account for that payment. However, the IRS can't reissue your payment. Instead, you will need to claim the 2023 Recovery Rebate Credit on your 2023 tax return if eligible.

Who gets the $1400 relief check

Those with an adjusted gross income — which is gross income minus certain adjustments — of $75,000 or less are eligible to get the full $1,400. Those filing as head of household and earning at least $112,500 were not eligible for the stimulus payments.