What increases equity?

What makes equity increase

Stockholders' equity increases due to additional stock investments or additional net income. It decreases due to a net loss or dividend payouts. Retained earnings increases when revenue accounts are closed out into it and decreases when expense accounts and cash dividends are closed out into it.

Cached

What are 2 ways to increase equity

How To Build Equity In A HomeMake A Big Down Payment.Refinance To A Shorter Loan Term.Pay Your Mortgage Down Faster.Make Biweekly Payments.Get Rid Of Mortgage Insurance.Throw Extra Money At Your Mortgage.Make Home Improvements.Wait For Your Home's Value To Increase.

Cached

What action will increase equity

Equity capital is generated through the sale of shares of company stock rather than through borrowing. If taking on more debt is not financially viable, a company can raise capital by selling additional shares. These can be either common shares or preferred shares.

What 4 things affect equity

Owner's equity accounts

Some income statement accounts impact your owner's equity. The main accounts that influence owner's equity include revenues, gains, expenses, and losses.

What builds equity in a home

You build equity in two ways: by paying down your mortgage over time and through your home's appreciation.

How do you increase owner’s equity

If you want to increase your owner's equity, you'll need to:Lower your liabilities.Pay off debts.Reduce operating costs.Increase profit margins.

What increases or decreases equity

The transactions involving income and gains, such as revenue, service revenue, and sales, increase the equity balance. The equity balance increases with the issue of shares. The transactions that involve expenses and losses, such as rent, salaries, depreciation, and losses on sales, lower the equity balance.

What affects equity value

Equity value is concerned with what is available to equity shareholders. Debt and debt equivalents, non-controlling interest, and preferred stock are subtracted as these items represent the share of other shareholders.

What causes low equity

A low equity ratio means that the company primarily used debt to acquire assets, which is widely viewed as an indication of greater financial risk. Equity ratios with higher value generally indicate that a company's effectively funded its asset requirements with a minimal amount of debt.

How long before you get equity in your home

Mortgage lenders prefer that you have at least 15% to 20% of equity built up in your home before they'll let you borrow against it. For the average homeowner, it can take about five to 10 years to build that amount of equity.

What is a good amount of equity in a house

In order for a borrower to avoid private mortgage insurance, they must often have at least 20% equity in their home. However, this is not a requirement at acquisition as some lenders may approve loans with down payments with 5% down or less.

What are the four items that affect equity

Four components that are included in the shareholders' equity calculation are outstanding shares, additional paid-in capital, retained earnings, and treasury stock.

What transactions increase owner’s equity

Owner's equity may increase from selling shares of stock, raising the company's revenues and decreasing its operating expenses.

What causes cost of equity to increase

If the financial risk to shareholders increases, they will require a greater return to compensate them for this increased risk, thus the cost of equity will increase and this will lead to an increase in the WACC. more debt also increases the WACC as: gearing. financial risk.

What are the factors affecting equity

The factors that determine the cost of equity include:Dividend per share. Dividend per share indicates the distribution of profit of the firm as compensation for an equity share held by an investor.The current market value of the share.Dividend growth rate.The risk-free rate of return.Beta.Expected market return.

Can you pull equity out of your home without refinancing

Home equity loans and HELOCs are two of the most common ways homeowners tap into their equity without refinancing. Both allow you to borrow against your home equity, just in slightly different ways. With a home equity loan, you get a lump-sum payment and then repay the loan monthly over time.

How much equity does a house gain in a year

“U.S. Homeowners Gained Average $57,000 in Equity in One Year.” Fannie Mae. “Housing Forecast: April 2023.”

Do you have equity if your home is paid off

A paid-for house means you have 100% equity in your home. However, having enough equity is just one requirement you'll need to meet when you take out a home equity loan on a paid-off house.

What are the 7 elements of equity

Brand Equity is made up of seven key elements: awareness, reputation, differentiation, energy, relevance, loyalty and flexibility.

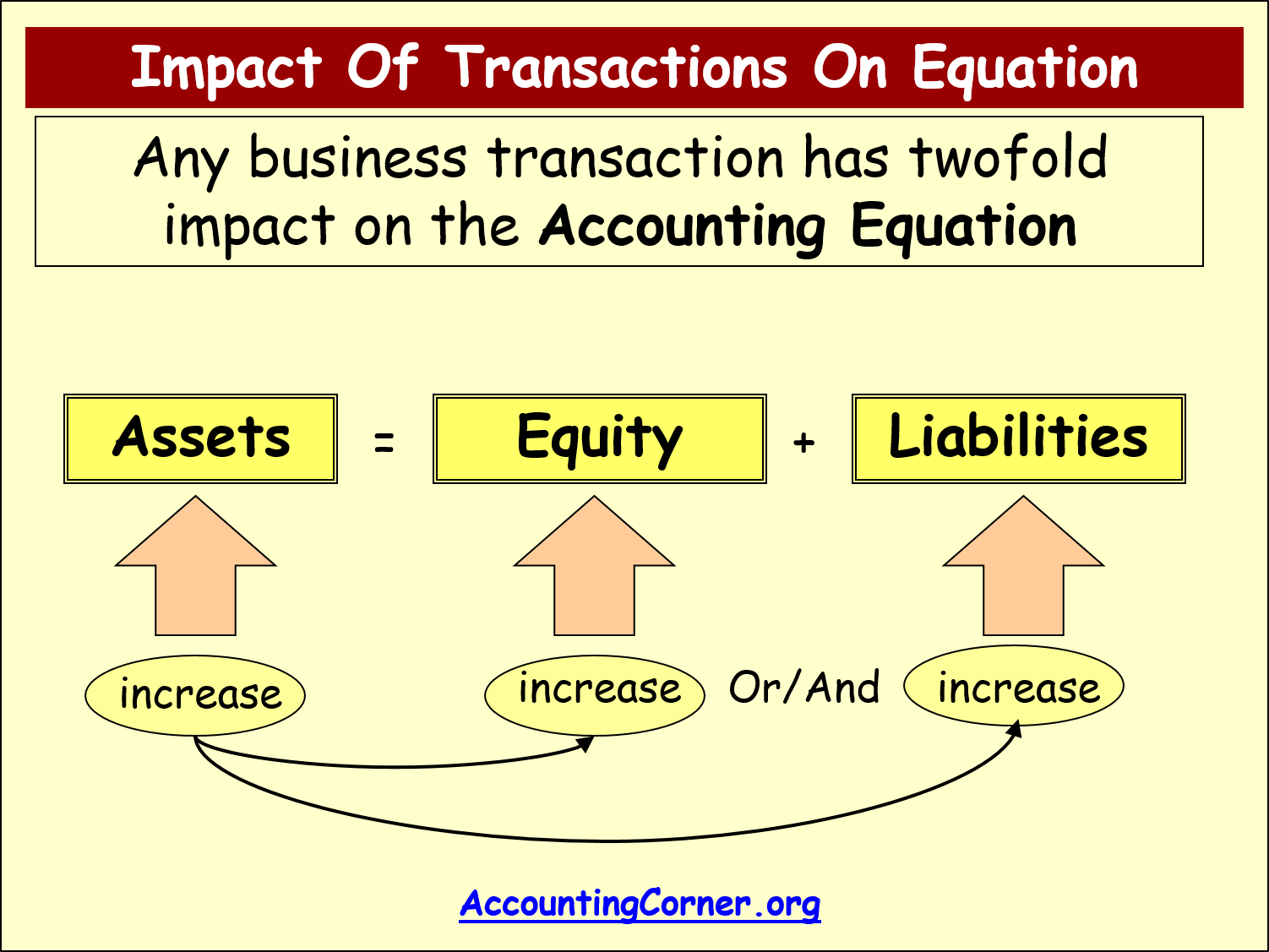

Do assets increase equity

The accounting equation captures the relationship between the three components of a balance sheet: assets, liabilities, and equity. All else being equal, a company's equity will increase when its assets increase, and vice-versa.