What insurance do most doctors accept?

What percentage of doctors don t accept Medicare assignment

Only 1 percent of non-pediatric physicians have formally opted-out of the Medicare program. As of September 2023, 9,541 non-pediatric physicians have opted out of Medicare, representing a very small share (1.0 percent) of the total number active physicians, similar to the share reported in 2013.

Cached

What type of insurance is Medi Cal HMO or PPO

Almost all Medi-Cal plans are “managed care plans” which means they function similar to an HMO. Medi-Cal Plans can be found in the Medi-Cal Managed Care Health Plan Directory. A managed care plan means you'll have a primary care physician, and they're the one person you'll see if you need medical care.

What does a doctor who accepts Medicare assignment agree to

as full payment for a covered service. This is called “accepting assignment.” If a provider accepts assignment, it's for all Medicare-covered Part A and Part B services.

Cached

What is the difference between a participating and non participating Medicare provider

Non-participating providers accept Medicare but do not agree to take assignment in all cases (they may on a case-by-case basis). This means that while non-participating providers have signed up to accept Medicare insurance, they do not accept Medicare's approved amount for health care services as full payment.

How do doctors feel about Medicare for All

In 2023, the American College of Physicians and the Society of General Internal Medicine went a step further, endorsing both public option and single-payer reforms. Yet, physician opinion on Medicare for All remains split, with most doctors concerned that such reform might decrease their income.

Is Medicare cutting payments to doctors

Physicians are facing a 2% cut in Medicare payment in 2023, and 2024 will bring at least a 1.25% cut.

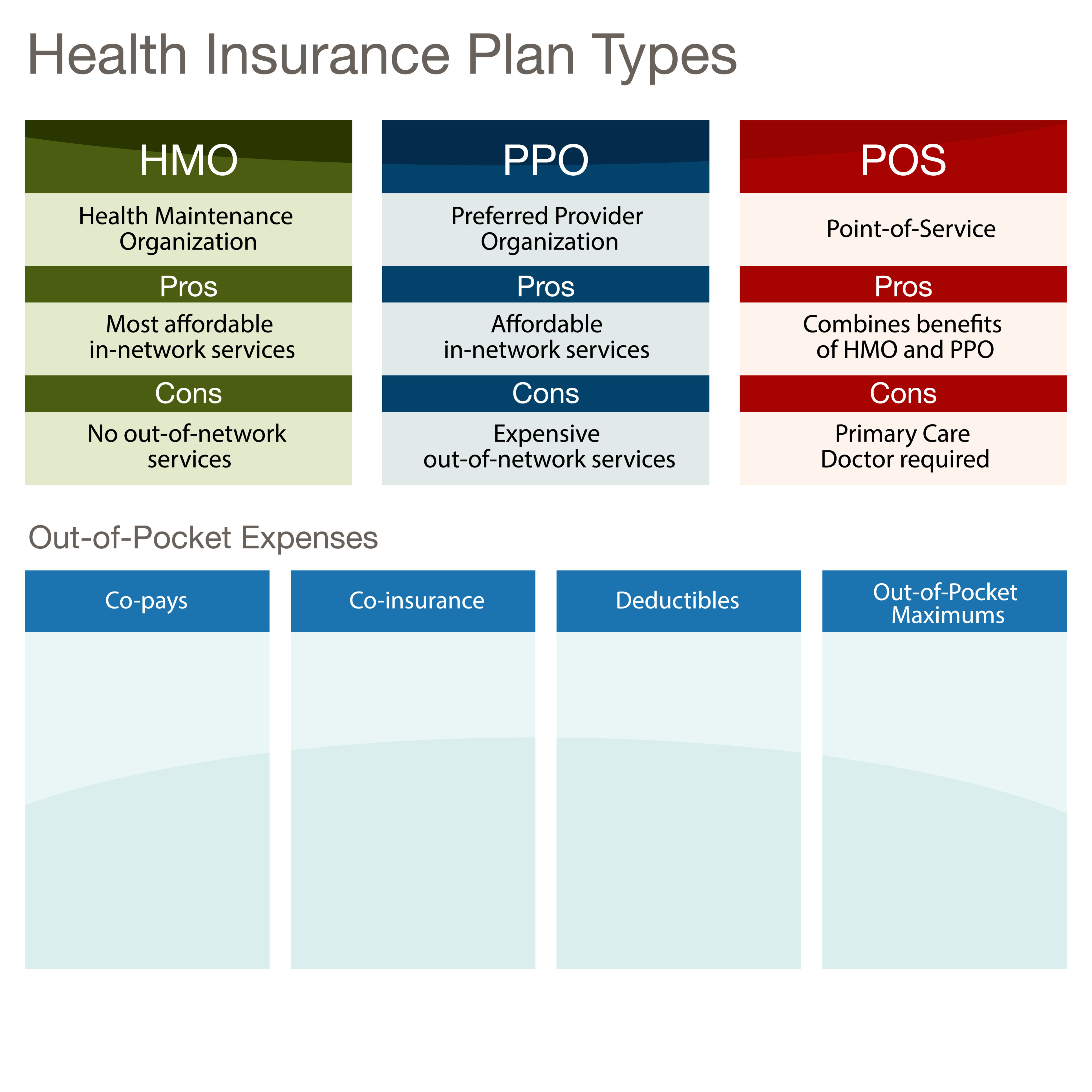

Why do doctors prefer PPO

To summarise, the PPO plan offers too much flexibility and the patient does not need any referral inside or outside the network. One of the biggest benefits of the PPO plan is patients do not need any referral to see any other out of network specialist.

Does Blue Shield have a Medi-Cal plan

Blue Shield of California Promise Health Plan currently serves Medi-Cal members in Los Angeles and San Diego counties. In Los Angeles County, we are contracted with L.A. Care Health Plan.

Do I have to pay more than the Medicare-approved amount

Doctors and other providers who do not accept assignment can charge you more than the Medicare-approved amount, but they cannot charge you more than 115% of Medicare's approved amount. This additional 15% is called an excess charge or limiting charge.

Do insured members have the freedom to choose any doctor who accepts Medicare patients

The Social Security Act mandates this patient right in sections 1802 and 1902 (a)(23). In short, patients with Medicare or Medicaid may receive health services from any provider qualified to participate.

Which is better participating or non-participating insurance

In case of a non-participating policy, there is no bonus or dividend paid to the policyholder. However, there are guaranteed death benefits and maturity benefits. The most important benefit of participating policies is that it not only provides protection, but also provides returns in the form of a bonus.

Why are many providers choosing not to take Medicare patients

One of the most common reasons is that they do not feel that the reimbursements provided by Medicare cover the costs associated with providing care for these patients. Additionally, some doctors may have concerns about the paperwork or bureaucracy that comes along with treating Medicare patients.

What are the disadvantages of Medicare for All

Cons of Medicare for All:

Providers can choose only private pay options unless mandated differently. Doesn't solve the shortage of doctors. Health insurance costs may not disappear. Requires a tax increase.

Who is in favor of Medicare for All

The Medicare for All of 2023 has also been endorsed by more than 60 major organizations, including National Nurses United, American Medical Student Association, Nation Union of Health Care Workers, Service Employees International Union (SEIU), Association of Flight Attendants-CWA (AFA-CWA), Indivisible, Public Citizen, …

What will Medicare not pay for

Medicare and most health insurance plans don't pay for long-term care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What procedures will Medicare not pay for

Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures. Most cosmetic surgery. Massage therapy.

What are 3 disadvantages of a PPO

Disadvantages of PPO plansTypically higher monthly premiums and out-of-pocket costs than for HMO plans.More responsibility for managing and coordinating your own care without a primary care doctor.

Is PPO or HMO more common

In terms of popularity, the Kaiser Family Foundation's 2023 Employer Health Benefits Survey shows that in employer health insurance, PPOs dominate. 49% of covered workers had PPO plans in the survey, while HMOs covered 16%.

Can I go to any hospital with Medi-Cal insurance

Emergency Rooms: As stated above, if you have an emergency and you cannot find a doctor right away, you can go to the emergency room at any hospital. If you show your BIC to staff at the emergency room, Medi-Cal will pay for the services you receive.

Does Medi-Cal cover everything

Medi-Cal covers most medically necessary care. This includes doctor and dentist appointments, prescription drugs, vision care, family planning, mental health care, and drug or alcohol treatment. Medi-Cal also covers transportation to these services.