What is 2 disadvantages of filing bankruptcy?

What is the main disadvantage of declaring bankruptcy

bank and building society accounts will be frozen and controlled by the trustee. during the bankruptcy period, accessing any form of credit is extremely difficult (and there are other restrictions) credit ratings can be affected for up to six years following a bankruptcy order.

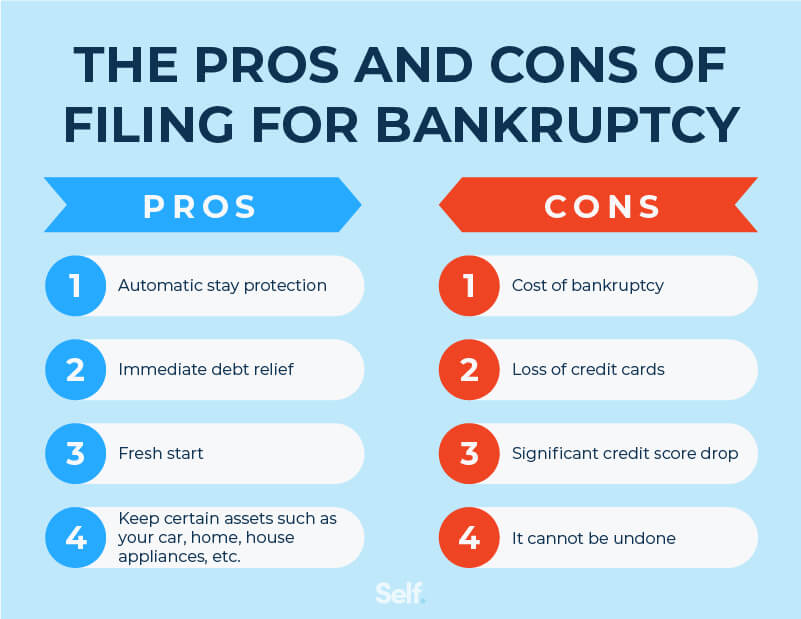

What is the advantage and disadvantage of filing bankruptcy

Bankruptcy: Advantages and Disadvantages

| DISADVANTAGES | ADVANTAGES |

|---|---|

| Bankruptcy will lower your credit until you work to rebuild it | Missed debt payments, defaults, repossessions, and lawsuits will hurt your credit – bankruptcy can often be the easier option |

Cached

What is one of the advantages of filing bankruptcy

You Get Permanent Debt Relief in the Form of a Bankruptcy Discharge. Filing Chapter 7 bankruptcy wipes out most types of debt, including credit card debt, medical bills, and personal loans. Your obligation to pay these types of unsecured debt is eliminated when the bankruptcy court grants you a bankruptcy discharge.

Cached

Why should you not file for bankruptcies

Filing for bankruptcy can negatively impact your immediate financial future. Obtaining credit after filing for bankruptcy could mean increased interest rates. Obtaining credit after filing for bankruptcy might require security deposits.

What are five common mistakes consumers make when filing for bankruptcy

6 Common Mistakes People Make When Filing for BankruptcyMistake #1: Choosing the Wrong Kind of Bankruptcy.Mistake #2: Adding to Your Credit Card Debt Before You File.Mistake #3: Transferring Property to Another Person.Mistake #4: Repaying Debts to Friends and Family.Mistake #5: Filing Too Close to A Major Life Event.

What does bankruptcies do to your credit

The exact effects will vary, depending on your credit score and other factors. But according to top scoring model FICO, filing for bankruptcy can send a good credit score of 700 or above plummeting by at least 200 points. If your score is a bit lower—around 680—you can lose between 130 and 150 points.

Why do people choose bankruptcy

Common reasons that people file for bankruptcy include loss of income, high medical expenses, an unaffordable mortgage, spending beyond their means, or lending money to loved ones. Often, a bankruptcy is a result of several of these factors combined.

Do you lose everything after a bankruptcies

Don't worry—you won't lose everything in bankruptcy. Most people can keep household furnishings, a retirement account, and some equity in a house and car in bankruptcy. But you might lose unnecessary luxury items, like your fishing boat or a flashy car, or have to pay to keep them.

Is it smart to claim bankruptcies

Filing for bankruptcy can cause significant harm to your credit history, however it can be the best solution for managing debt that you can't afford to pay. Consider consulting with a reputable credit counselor to explain all your options for repayment before you file for bankruptcy.

What is the catch in filing bankruptcy

If you declare bankruptcy, creditors have to stop any effort to collect money from you, at least temporarily. Most creditors can't write, call or sue you after you've filed. But even if you declare bankruptcy, the courts can require you to pay back certain debts.

Can you lose your bank account in bankruptcies

After your bankruptcy filing, the creditor bank you owe money to will likely close your accounts, which can be problematic because many banks won't open a new bank account shortly after a bankruptcy filing. Your bank probably won't close it if your bank account isn't overdrawn and you don't owe any other debts.

Is it better to file bankruptcy or just not pay

Bankruptcy frees you from debt collection, but the headaches can linger for years. Debt settlement without bankruptcy can take more time but — if negotiated properly — can do less damage to your credit. Debt settlement stays on your credit report for seven years, but has less negative impact on your credit score.

Can you live a normal life after bankruptcies

There will be hardships you'll have to endure — from cash flow management to establishing good credit and rebuilding your financial profile — but it's possible to financially recover from bankruptcy and give yourself a fresh start.

What all goes away when you file bankruptcies

Chapter 7 bankruptcy erases or "discharges" credit card balances, medical bills, past-due rent payments, payday loans, overdue cellphone and utility bills, car loan balances, and even home mortgages in as little as four months. But not all obligations go away in Chapter 7.

How long does bankruptcy count against you

Key takeaways. Filing for bankruptcy can hurt an individual's credit, and the impact can last for years. A Chapter 7 bankruptcy may stay on credit reports for 10 years from the filing date, while a Chapter 13 bankruptcy generally remains for seven years from the filing date.

What doesn’t go away in bankruptcies

No matter which form of bankruptcy is sought, not all debt can be wiped out through a bankruptcy case. Taxes, spousal support, child support, alimony, and government-funded or backed student loans are some types of debt you will not be able to discharge in bankruptcy.

What happens to your bills when you file bankruptcies

A Chapter 7 bankruptcy will sell off many of your assets to pay your creditors. In a Chapter 13 bankruptcy, you keep the assets but must repay your debts over a specified period. Bankruptcy can do severe damage to your credit score and should be considered a last resort.

What do you lose when you file for bankruptcy

You could lose assets of value

Depending on which type of bankruptcy you qualify for, your income, the equity in your assets and other factors, you may lose your home, your car and other valuable items. Your trustee may be required to sell these items to repay your creditors.

Can I get an 800 credit score after bankruptcy

Keep your balances low or at zero and pay on time. Though it will take a few years to achieve an 800 credit score after bankruptcy, you can begin to rebuild your credit successfully.

Are you debt free after bankruptcies

Once your case is finalized, you will get a discharge of most of your debts. Your creditors are also legally prohibited from trying to collect any outstanding debts from you.