What is 30 days credit term?

How to calculate 30 days credit term

2/10 net 30 Explained

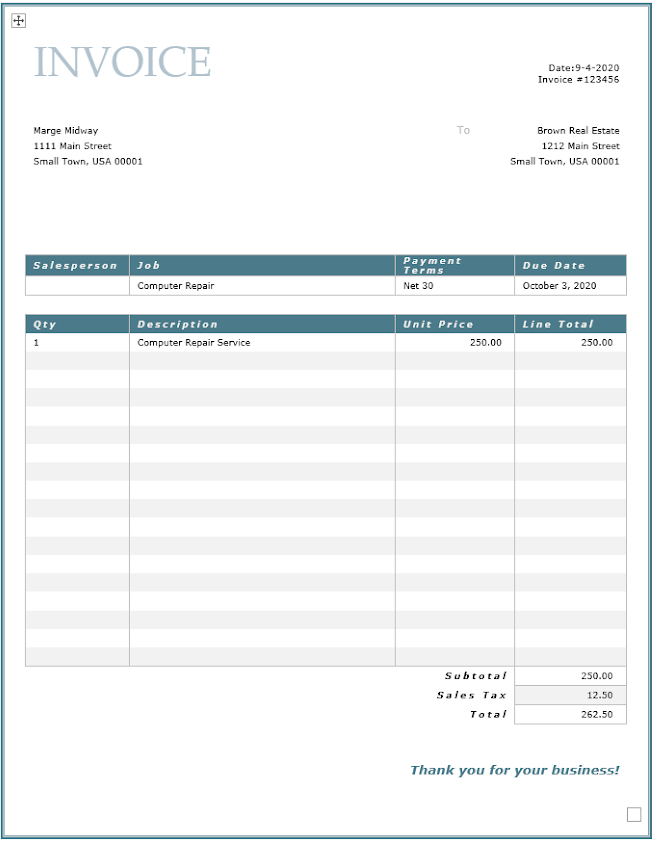

A typical net 30 credit term means the balance is due within 30 days from the invoice date. A 2/10 net 30 (also known as 2 10 net 30) means the balance will be discounted by 2% if the buyer makes a payment within the first ten days.

What does payment terms 30 days end of month mean

30 days End of Month. Payment is due at the end of the month following the month of the invoice. 60 days End of Month. Payment is due at the end of the second month following the month of the invoice.

What is credit term

What are Credit Terms Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash.

Cached

What does 15 day credit term mean

On an invoice, net 15 means that full payment is due 15 days after the invoice date, at the very latest. Net 15 is part of a company's payment terms.

Cached

What is 30 day payment terms example

30 days payment terms are often referred to as net 30 on invoices. This means that customers are granted a payment period of 30 calendar days (not working days). Instead of 30 days, you can also give your customers a shorter or longer payment term, for example net 14 or net 60.

What is an example of a credit term

Credit terms are terms that indicate when payment is due for sales that are made on credit, possible discounts, and any applicable interest or late payment fees. For example, the credit terms for credit sales may be 2/10, net 30. This means that the amount is due in 30 days (net 30).

What does credit terms days mean

The credit period is the number of days that a customer is allowed to wait before paying an invoice. The concept is important because it indicates the amount of working capital that a business is willing to invest in its accounts receivable in order to generate sales.

How do credit terms work

Credit terms are terms that indicate when payment is due for sales that are made on credit, possible discounts, and any applicable interest or late payment fees. For example, the credit terms for credit sales may be 2/10, net 30. This means that the amount is due in 30 days (net 30).

What is credit term 60 days

Net 60 is a payment term that sellers offer credit customers to pay invoices within 60 calendar days from the invoice date.

What is an example of credit term

Credit terms are terms that indicate when payment is due for sales that are made on credit, possible discounts, and any applicable interest or late payment fees. For example, the credit terms for credit sales may be 2/10, net 30. This means that the amount is due in 30 days (net 30).

What is a good credit term

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What does 30 terms mean

If an invoice to a customer is dated March 15th and the payment due date is April 15th, then a business has offered that customer net 30 payment terms. Net 30 terms can be calculated in a variety of ways: 30 business days or 30 calendar days; 30 days from the product's purchase date vs.

How long is credit term

The credit terms of most businesses are either 30, 60, or 90 days. However, some businesses may have credit terms as short as 7 or 10 days.

What does term credits and payments mean

Payments and credits both reduce the amount a student owes your school. Payments are unique transactions in which money changes hands. Usually, they're made by someone (a student, parent, organization, etc.) to pay down what a student owes your school.

What is 7 days credit terms

Term Definition

This means you expect payment immediately when the client receives your invoice. Payment is due seven days from the invoice date. Payment is due 21 days from the invoice date.

What is 30 or 60 day payment terms

What are net terms Net terms dictate how long a customer has to remit payment upon receipt of an invoice. For instance, net 30 means the customer has 30 days to settle their account, net 60 allows for 60 days, etc.

What is the normal credit term

The credit terms of most businesses are either 30, 60, or 90 days. However, some businesses may have credit terms as short as 7 or 10 days.

What are examples of credit terms

Types of Credit TermsCash on Delivery (CoD): Here the payment is due at the same time as a product or service is delivered.Payment in Advance: Seller demands the buyer to pay the consideration, either partial or full before the delivery of goods.Pre-paid: This is exactly opposite of cash on delivery(COD).

What does terms 1 30 mean

The 1%/10 net 30 calculation is a way of providing cash discounts on purchases. It means that if the bill is paid within 10 days, there is a 1% discount. Otherwise, the total amount is due within 30 days.

What does 15 terms mean

Businesses typically offer one of four net payment terms: Net 15 payment terms: This means an invoice is due in 15 days Net 30 payment terms: This means an invoice is due in 30 days Net 60 payment terms: This means an invoice is due in 60 days Net 90 payment terms: This means an invoice is due in 90 days.