What is a 51 ARM?

What does 5 1 ARM mean in mortgages

adjustable rate mortgage loan

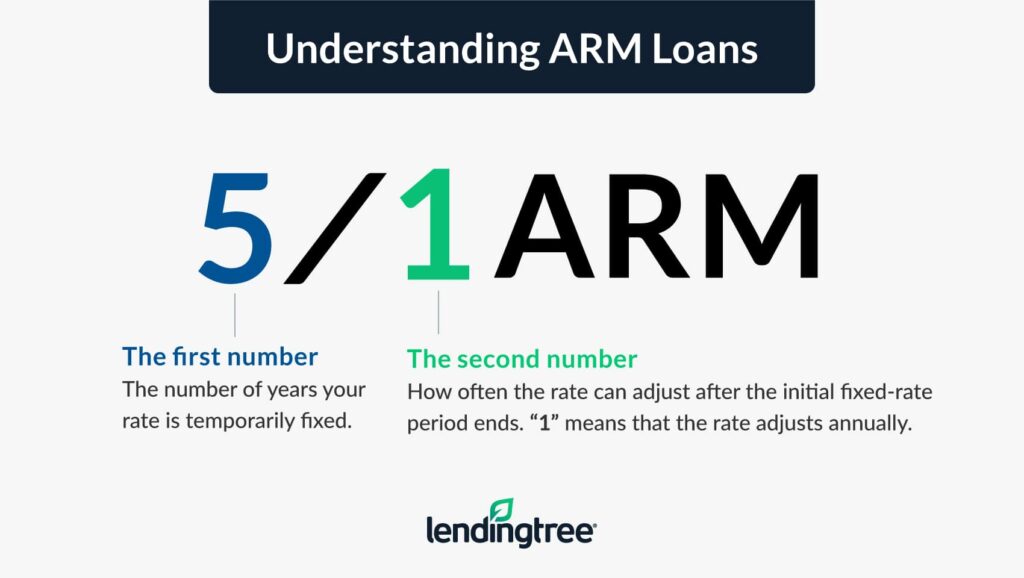

What Is A 5/1 ARM Loan A 5/1 ARM is a type of adjustable rate mortgage loan (ARM) with a fixed interest rate for the first 5 years. Afterward, the 5/1 ARM switches to an adjustable interest rate for the remainder of its term. The words “variable” and “adjustable” are often used interchangeably.

Cached

Is it a good idea to have a 5 1 ARM

A 5/1 adjustable-rate mortgage (ARM) loan may be worth considering if you're looking for a low monthly payment and don't plan to stay in your home long. Rates on 5/1 ARMs are typically lower than 30-year fixed-rate mortgages for those first five years.

Cached

What are the risks of a 5 1 ARM

The biggest disadvantage of an ARM is the risk of interest rate hikes. For example, it's possible a 5/1 ARM with a 4.5% start rate could (worst case) increase as follows: Beginning of year six: 6.5% Starting year seven: 8.5%

Can you pay off a 5 1 ARM early

Can you pay off a 5/1 ARM early Yes, you can pay off the loan early, either by selling the property or refinancing the original loan. Many 5/1 ARMs come with prepayment penalties.

Cached

How long does it take to pay off a 5 1 ARM

5/1 ARMs typically come with an overall term of 15 years or 30 years. The interest rate remains fixed for the first five years and then adjusts every year after that for the remainder of the loan. To see what your monthly payment would be at a certain interest rate, use the calculator below.

Are ARM loans a good idea

Adjustable-rate mortgages may be the better option over fixed-rate mortgages for borrowers who expect to move out before the fixed-rate period of their ARM ends. ARMs are also often good in housing markets where interest rates are high, as your interest rate can adjust if rates drop.

What is the average 5 1 ARM rate

Current ARM loan interest rate trends

The national average 5/1 ARM refinance interest rate is 6.01%, up compared to last week's of 6.00%.

Why would someone choose an ARM over a fixed rate loan

ARMs are easier to qualify for than fixed-rate loans, but you can get 30-year loan terms for both. An ARM might be better for you if you plan on staying in your home for a short period of time, interest rates are high or you want to use the savings in interest rate to pay down the principal on your loan.

What is the downside to getting an ARM

The big disadvantage of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your repayments will increase. Often, there's a cap on the annual/total rate increase, but it can still sting.

Is it a good idea to have a 5 5 ARM

5/5 ARMs are great for those who don't plan to stay in their home for more than a decade, but perhaps more than 5 years. This gives them only one rate adjustment period in that time and plenty of opportunity to refinance or sell.

How hard is it to get an ARM loan

Qualifying for an ARM

To be eligible for an adjustable-rate mortgage, you typically must have: At least a 5% down payment (note: FHA ARMs require only 3.5% down payments) A credit score of at least 620. A debt-to-income ratio (DTI) of no more than 50%

What are the disadvantages of ARM

The big disadvantage of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your repayments will increase. Often, there's a cap on the annual/total rate increase, but it can still sting.

Why would someone do an ARM loan

Many homeowners choose an ARM to take advantage of the lower mortgage rates during the initial period. You may consider an adjustable-rate mortgage if: You plan on moving or selling your home within five years, or before the adjustment period of the loan. Interest rates are high when you buy your home.

What are bad things about ARM loans

Cons of an adjustable-rate mortgageRates and monthly payments may rise. The big disadvantage of an ARM is the likelihood of your rate going up.You could buy too much house. The lower initial payments could make it easier to qualify for a more expensive home.Difficulty with refinancing.

Is an ARM loan ever a good idea

Adjustable-rate mortgages may be the better option over fixed-rate mortgages for borrowers who expect to move out before the fixed-rate period of their ARM ends. ARMs are also often good in housing markets where interest rates are high, as your interest rate can adjust if rates drop.

Can you live a normal life with one ARM

If you only have the use of one hand or arm, doing your day-to-day activities can be hard. If you have lost your dominant hand you will need to use your other hand for most tasks like feeding or writing, at least in the beginning.

Why would someone choose an ARM

ARMs allow you to build equity and take advantage of a lower interest rate while saving and searching for your dream home. A high interest rate market: When interest rates are high, it makes sense to choose an ARM.

What are the dangers of an ARM vs fixed

ARMs require borrowers to plan for when the interest rate starts changing and monthly payments grow. Even with careful planning, though, you might be unable to sell or refinance when you want to. If you can't make the payments after the fixed-rate phase of the loan, you could lose the home.

Do you need 20% down for an ARM

ARM down payment: A conventional ARM requires at least 5 percent of the home's purchase price for a down payment. An FHA ARM requires at least 3.5 percent. There's no down payment requirement for a VA ARM.

Why would someone want an ARM mortgage

Many homeowners choose an ARM to take advantage of the lower mortgage rates during the initial period. You may consider an adjustable-rate mortgage if: You plan on moving or selling your home within five years, or before the adjustment period of the loan. Interest rates are high when you buy your home.