What is a corporate line of credit?

What are the requirements for a business line of credit

To be eligible for a business line of credit, applicants must have a minimum personal credit score of 660, have been in business for at least one year, have a valid business checking account and have an average monthly revenue of at least $3,000.

Cached

What is an example of a business line of credit

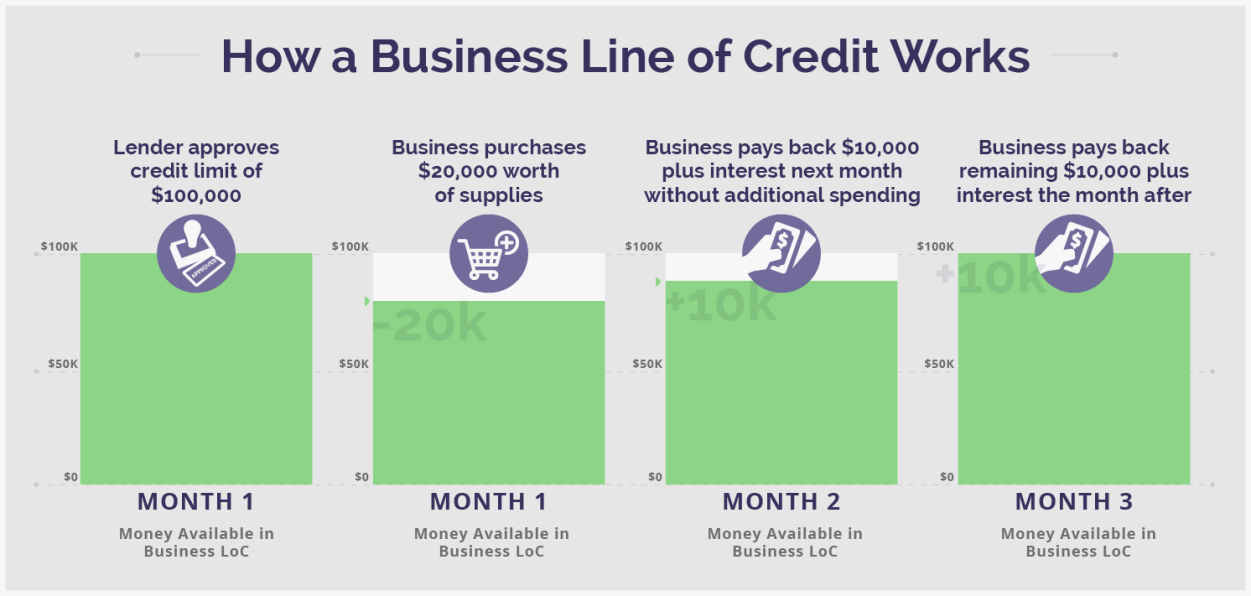

Example of a line of credit

A bank gives you a line of credit with a limit of $50,000. You withdraw $10,000 to buy inventory. You'll only pay interest on the $10,000 and can still use the remaining $40,000 if you want. You then need $5,000 for new shop fittings.

Is there such thing as a business line of credit

A business line of credit is a flexible financial tool that lets you deal with unexpected expenses and bridge the gap when waiting for customer payments. You can get them from traditional and online lenders.

Cached

What is the difference between a business line of credit and a business credit card

Business lines of credit tend to offer higher credit limits than business credit cards. Business credit cards come with interest-free days, whereas business lines of credit don't. While several business credit cards offer rewards, lines of credit do not.

Cached

What is the minimum credit score for a business line of credit

600

You may be able to qualify for a business line of credit from some online lenders with a minimum credit score of 600. You'll typically need a stronger credit score — often 700 or higher — to qualify for a credit line from a bank or credit union, however.

What type of collateral is needed for a business line of credit

What can I use as collateral for a business loan Cash is the most liquid form of collateral, while securities like treasury bonds, stocks, certificates of deposit (CDs) and corporate bonds can also be used. Tangible assets, such as real estate, equipment, inventory and vehicles, are another popular form of collateral.

Can you use a business line of credit for cash

It's similar to a credit card, but a business line of credit tends to come with much higher credit limits. As with a credit card, you can use it to make cash withdrawals or transfer funds to your business checking account.

Does a business line of credit affect personal credit score

Business credit is often linked closely with your personal credit. Your track record with business borrowing and repayment can therefore affect your personal credit history significantly, especially if you run into issues paying off business debt.

What is the minimum credit score for business line of credit

600

You may be able to qualify for a business line of credit from some online lenders with a minimum credit score of 600. You'll typically need a stronger credit score — often 700 or higher — to qualify for a credit line from a bank or credit union, however.

Can you withdraw money from a business line of credit

While a term loan offers a lump sum upfront with a fixed repayment schedule, a business line of credit allows you to withdraw funds as needed. You can withdraw up to the credit limit, and once you repay the borrowed amount, you can withdraw funds again.

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

How long does it take to get approved for a business line of credit

It can take anywhere from a day or two to several months to be approved for a line of credit. As a general rule, online lenders are faster than banks, and banks are faster than the SBA. For credit cards, you're looking at seven to 10 days in most cases.

Which kind of business loan is most likely to require collateral

Collateral by type of business loan

| Loan Type | Types of Collateral |

|---|---|

| Equipment financing | The equipment serves as its own collateral. |

| Inventory | The inventory serves as its own collateral. |

| Accounts receivable and invoice financing | Future earnings serve as collateral. |

| Peer-to-peer | Doesn't usually require collateral. |

Can I withdraw cash from my line of credit

A line of credit provides a ready source of funds for your various business needs. You can withdraw cash from the line of credit up to your credit limit, as many times as you want.

Can you use a business loan to pay off personal debt

Can you use a business loan for personal use Short answer: no. Business loans can only be used to provide funding for your business. This means you cannot use the capital generated from a business loan to pay off personal debt or make personal purchases.

Does opening an LLC hurt your credit

Does starting an LLC affect your credit score Starting an LLC will not directly affect your personal credit score unless you decide to personally guarantee or cosign a loan for your company.

How much of a business loan can I get with a 700 credit score

You can borrow $50,000 – $100,000+ with a 700 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

How do I build credit under my LLC

How to Build Business Credit Quickly: 5 Simple StepsStep 1 – Choose the Right Business Structure.Step 2 – Obtain a Federal Tax ID Number (EIN)Step 3 – Open a Business Bank Account.Step 4 – Establish Credit with Vendors/Suppliers Who Report.Step 5 – Monitor Your Business Credit Reports.

Is it easier to get credit with an LLC or a corporation

According to the Internal Revenue Service, to obtain a credit card, a company must be registered in the U.S. and shareholders must be U.S. citizens. Corporations, therefore, may find it easier to obtain a credit card than an LLC since under a corporation, shareholders must be U.S. citizens.

Can I withdraw cash from business line of credit

While a term loan offers a lump sum upfront with a fixed repayment schedule, a business line of credit allows you to withdraw funds as needed. You can withdraw up to the credit limit, and once you repay the borrowed amount, you can withdraw funds again.