What is a credit score disclosure?

What is the meaning of credit score disclosure

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Cached

When must you provide the credit score disclosure

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

Cached

What is a credit score disclosure exception notice

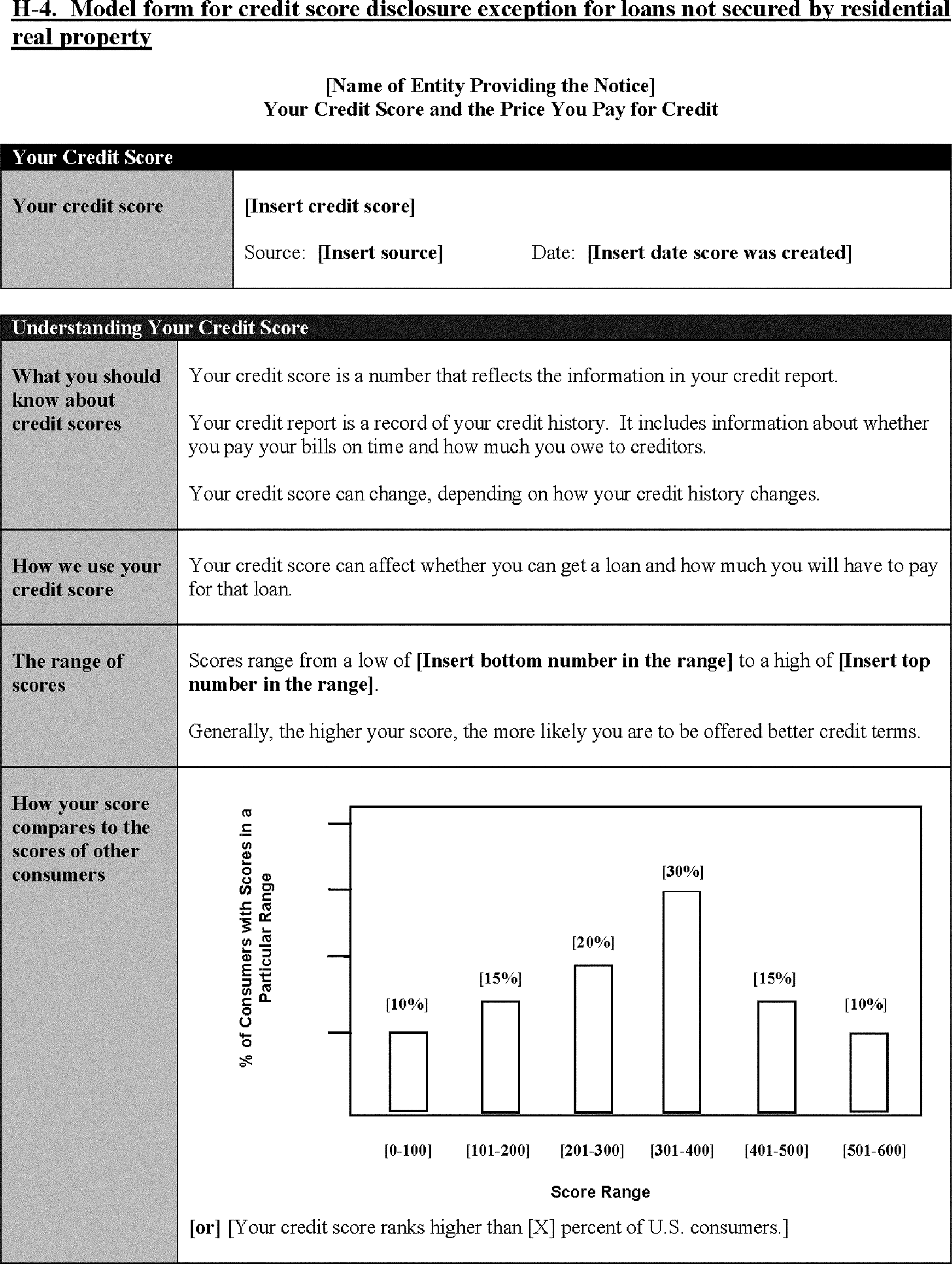

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

What is a credit score disclosure and notice to home loan applicant

Notice to Home Loan Applicant

In short, this is a disclosures that includes things like the credit score of the applicant, the range of possible scores, key factors that adversely affected the credit score, the date of the score, and the name of the person or entity that provided the score.

Cached

Why did I receive a credit score disclosure

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus.

Is it okay to disclose credit score

It gives the bad guys a good idea who to target," says Liz Weston, author of "Your Credit Score." Along with other pieces of information shared over social media, a fraudster could piece together enough details to hack into accounts or send you a fake email from a financial services provider requesting more information …

What does disclosure of use of information obtained from an outside source mean

Disclosure of Use of Information Obtained From an Outside Source. Letter Description: This letter should be completed if the credit decision was based in whole or in part on information. that has been obtained from an outside source. Examples Credit Bureau, Criminal File, Evictions.

Does a loan disclosure mean loan is approved

Does a closing disclosure mean your loan is approved No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

Do they pull credit after closing disclosure

Credit is pulled at least once at the beginning of the approval process, and then again just prior to closing. Sometimes it's pulled in the middle if necessary, so it's important that you be conscious of your credit and the things that may impact your scores and approvability throughout the entire process.

Is it legal for a company to ask for your credit score

What are your legal rights as a job applicant Thanks to the Fair Credit Reporting Act (FCRA), employers can't go checking your credit history behind your back. They must have written consent before pulling an applicant's credit history.

What can someone do with my credit score

Current or potential creditors — like credit card issuers, auto lenders and mortgage lenders — can pull your credit score and report to determine creditworthiness as well. Credit history is a major factor in determining (a) whether to give you a loan or credit card, and (b) the terms of that loan or credit card.

What does disclosure of information mean

Generally, it means releasing or making the information available to another person or organization.

What is an example of disclosure information

Some basic examples of information disclosure are as follows: Revealing the names of hidden directories, their structure, and their contents via a robots. txt file or directory listing. Providing access to source code files via temporary backups.

What are signs that your loan will be approved

Common Approval ConditionsIncome and bank statements verifying your monthly income.Additional paperwork to meet specific loan requirements.Verification of homeowners insurance.Gift letters for home buyers using gift funds for their down payment.A letter of explanation for a recent large withdrawal.

What comes after loan disclosures

After all the paperwork is signed, your lender will fund the loan. You'll receive a final settlement statement after the transaction is complete. If the closing disclosure overestimated any costs, you'll receive a refund for the difference.

Does closing disclosure mean clear to close

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

What comes after closing disclosure

What Happens After Getting the Closing Disclosure. Three business days after receiving the closing disclosure, you'll use a cashier's check or wire transfer to send the settlement company any money you're required to bring to the closing table, such as your down payment and closing costs.

Can bad credit disqualify you from a job

Most job seekers don't' even know this, and it raises a really important question is: can you be denied a job because of bad credit The short answer is yes, you can. Also, keep in mind that bad credit is different than no credit — but in this case, bad credit can be the culprit.

Is it okay to ask someone their credit score

Ethically, it's the right thing to do — especially if you're getting serious about someone and you (or they) have large student loans. However you approach debt, don't do it through a lens of shame.

Can someone steal your identity with a credit report

Can Someone Steal Your Identity with Your Credit Report Your credit report contains a lot of personal information, so it's a goldmine for identity thieves. With a copy of your report in hand, a potential fraudster might be able to see: Full name.