What is a credit score disclosure exception?

Why did I receive a credit score disclosure

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus.

Cached

What is a credit score disclosure and notice to home loan applicant

Notice to Home Loan Applicant

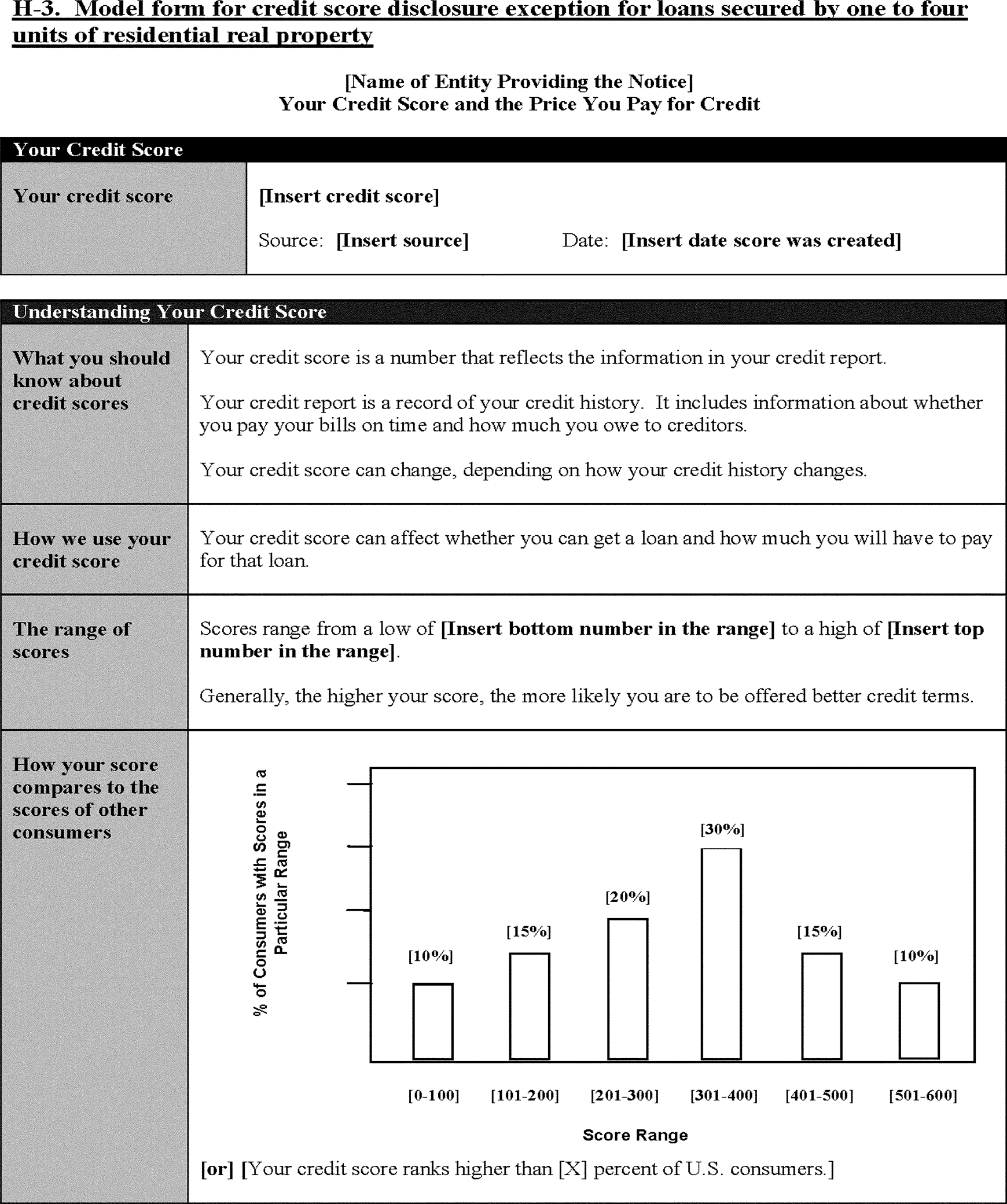

In short, this is a disclosures that includes things like the credit score of the applicant, the range of possible scores, key factors that adversely affected the credit score, the date of the score, and the name of the person or entity that provided the score.

Do lenders have to disclose credit scores

The Dodd-Frank Act also amended FCRA to require disclosure of a credit score and related information when a credit score is used in taking an adverse action or in risk-based pricing.

Cached

What is a credit disclosure

A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card.

Under what conditions must you send an applicant a credit score disclosure

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

What is required in a credit disclosure

APR (the cost of the credit as a yearly rate) Finance charge (the dollar amount the credit will cost you) Amount financed. Total amount you will have paid by the end of the loan term (assuming all payments are made on time) Total cost of your purchase (including down payment and finance charges)

Does a loan disclosure mean loan is approved

Does a closing disclosure mean your loan is approved No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

Is it legal for a company to ask for your credit score

What are your legal rights as a job applicant Thanks to the Fair Credit Reporting Act (FCRA), employers can't go checking your credit history behind your back. They must have written consent before pulling an applicant's credit history.

What is the purpose of a disclosure

Disclosure is the process of making facts or information known to the public. Proper disclosure by corporations is the act of making its customers, investors, and analysts aware of pertinent information.

What are the disclosure requirements

Disclosure requirements allow media and public to examine campaign funding. These requirements allow interested parties, such as the media and the public, to examine records otherwise hidden from them. The result is closer scrutiny of facts and figures and of the relationships between political actors.

When must lenders provide borrowers with a disclosure statement

Borrowers should always receive and review the TILA disclosure page in detail before signing any loan contact that obligates repayment.

What is the purpose of the disclosure requirements

The rationale of the Guidance is that such disclosure requirements, when applied by an entity, provide users of financial statements with useful information at a cost that does not exceed the benefits of its provision.

What is a fair credit disclosure

Section 612(f)(1)(A) of the Fair Credit Reporting Act (FCRA) provides that a consumer reporting agency may charge a consumer a reasonable amount for making a disclosure to the consumer pursuant to section 609 of the FCRA.

What are signs that your loan will be approved

Common Approval ConditionsIncome and bank statements verifying your monthly income.Additional paperwork to meet specific loan requirements.Verification of homeowners insurance.Gift letters for home buyers using gift funds for their down payment.A letter of explanation for a recent large withdrawal.

What comes after loan disclosures

After all the paperwork is signed, your lender will fund the loan. You'll receive a final settlement statement after the transaction is complete. If the closing disclosure overestimated any costs, you'll receive a refund for the difference.

Can a company pull your credit report without permission

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

Can a company fire you for your credit score

Most people know that employers can check your credit score while hiring you, but they can also do it while you work there—and let you go if the results are bad.

What are the three types of disclosure

Related contentApply for basic disclosure.Standard disclosure.Enhanced disclosure.Protecting Vulnerable Groups (PVG) scheme.

What is an example of a disclosure

Examples of Disclosure Statement

For example, it includes the name of the organization, the party of the loans, approval, date, and place at which the document was signed, key terms such as tenure of the loan, interest charged, annual percentage rate, total processing fees, loan statement,prepayment.

What are the 4 types of disclosure

There are 4 types of PVG disclosure:Scheme Record.Existing Scheme Record.Scheme Record Update (also known as a Short Scheme Record)Scheme Membership Statement.