What is a disadvantage of money order?

What are the advantages and disadvantages of money order

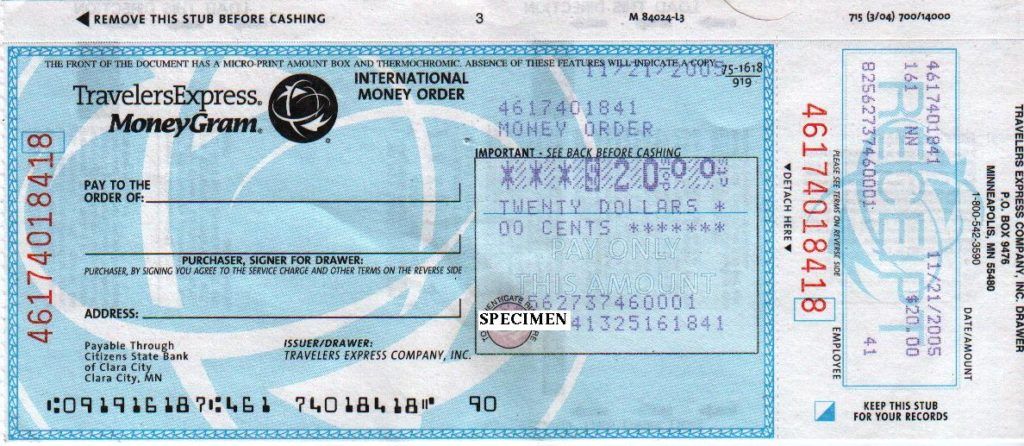

The recipient of a money order can cash it at a financial institution or post office or spend it like cash. Money orders are safe because they are backed by the issuing institution. However, if a money order is lost or stolen, it can be difficult to cancel and replace it.

Why would someone pay with a money order

Money orders let you send and receive large amounts of money safely without stupid bank fees. And most importantly, they help guard your personal information. Sure, money orders will include your name and address, but unlike a personal or certified check, they won't include your bank account or routing numbers.

Are money orders risky

Money orders are typically a safe payment method, but they can also be used fraudulently. To protect yourself: Try not to exchange money orders with strangers. This isn't always possible, but if you can, ask to be paid electronically or via another means.

Is a money order safer than a check

Like a personal check, a money order is a paper certificate. However, instead of being backed by your bank account, it's guaranteed by the company or organization that issues it. This makes it a more secure way of payment than a personal check. You can get a money order at a variety of places.

What is the advantage of using a money order rather than a personal check

If you're making a one-time purchase but want tangible proof that of the exact amount, money orders are a secure option. Plus, money orders do not contain your personal information, such as your account number. Our MaxMoney® account comes with free money orders.

Do money orders clear immediately

Receive payment. If the order is deposited into a bank account, it may take a couple days for the funds to become available.

When should I use a money order

Money orders are typically used for smaller amounts than cashier's checks and that is reflected in the fee to purchase one. Depending upon where you purchase a money order, the fee ranges from $0.35 to $2.00. Money orders are typically capped at $1,000. Some places may limit them to smaller amounts.

Are money orders hard to cash

How To Cash a Money Order. Converting any money order to cash is a relatively easy process: Take the payment to a location that cashes checks or money orders: Common options include banks, credit unions, grocery stores, and check-cashing stores. Endorse the money order as you would a check: Sign your name on the back.

Which is better a bank check or money order

Cashier's checks are generally considered more secure than money orders. Although there are check scams involving fake cashier's checks and money orders, a cashier's check has more security features than a typical money order.

What is the maximum amount for a money order

$1,000

Decide on the money order amount. You can send up to $1,000 in a single order anywhere in the United States. Go to any Post Office location. Take cash, a debit card, or a traveler's check.

Is a money order safer than cash

Like a check, money orders are written directly to individuals or companies by name, requiring endorsement and identification to cash them. This makes money orders much more secure than cash, protecting the funds in case of loss or theft.

What is better money order or check

Just like checks, they offer a paper trail to prove any payments. If you're making a one-time purchase but want tangible proof that of the exact amount, money orders are a secure option. Plus, money orders do not contain your personal information, such as your account number.

Can a money order ever bounce

Unlike a check, money orders can't bounce. You purchase a money order with cash or another guaranteed form of payment, such as a traveler's check or debit card. When purchasing a money order, you must provide the payee's name (the recipient), and the issuing financial institution's name must be on the order.

Is a money order safer than a cashier’s check

Cashier's checks are generally considered more secure than money orders. Although there are check scams involving fake cashier's checks and money orders, a cashier's check has more security features than a typical money order.

Is it better to deposit cash or money order

It's probably a better idea to deposit the money order into your bank account rather than cash it if you don't need 100% of the money in cash right away. You can get cash later if necessary and your funds will be safe in the bank in the meantime.

Is money order better than cash

When you fill out a money order, you'll sign it and select a recipient, creating an official record and making it a more secure option than cash. Money orders can also be advantageous for people without a bank account.

Do money orders cash instantly

Many recipients prefer money orders because, unlike a personal check, a money order can't “bounce” and clears almost immediately; therefore, they provide a fast, risk-free form of payment.

Do money orders cash immediately

A money order allows the recipient to receive immediate cash payment from a bank or other financial institution. For that reason, money orders are a popular way to make small to medium-size payments in circumstances where cash or personal checks aren't practical.

Which is safer a cashier’s check or money order

A cashier's check is a type of official check that banks issue and sign. Money orders are available in several places, including the U.S. Postal Service, convenience stores, drug stores, grocery stores, and check-cashing companies. It is generally easier to buy money orders, but cashier's checks are more secure.

Do money orders get reported to the IRS

When a customer uses currency of more than $10,000 to purchase a monetary instrument, the financial institution issuing the cashier's check, bank draft, traveler's check or money order is required to report the transaction by filing the FinCEN Currency Transaction Report (CTR).