What is a disadvantage of trading in a car?

What are the pros and cons of trading in your car

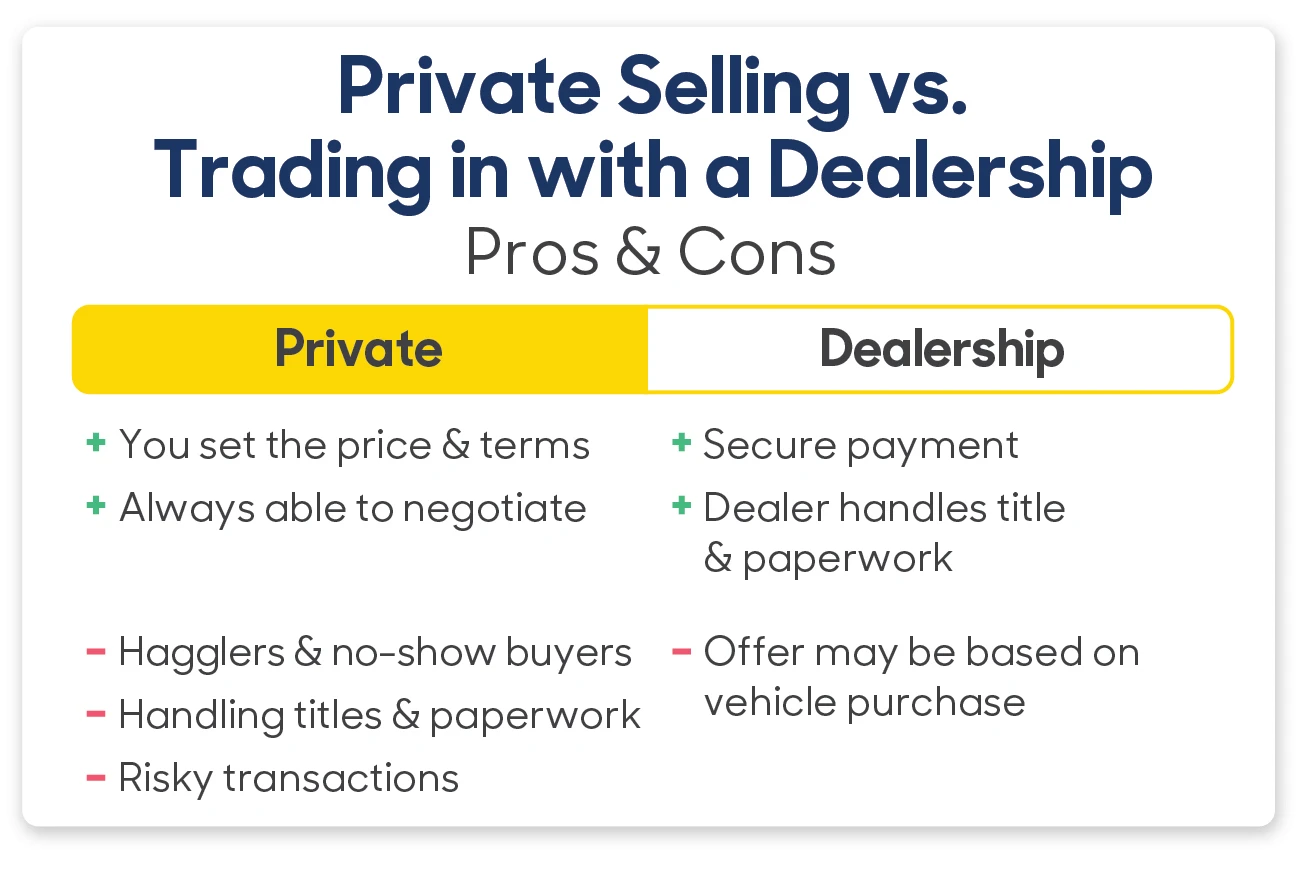

Trading in your car can come with several benefits — but you likely won't get as much money for the sale.Pro: Less hassle. A key benefit of trading in your vehicle is that it could end up requiring less work on your part.Pro: Reduced taxable sales price.Con: Lower offer.Pro: Higher sale value.Con: More work and time.

Cached

Is it ever a good idea to trade in your car

Generally speaking, you should only trade-in your car when the dealer pays you more for it than the amount left to pay on your loan. When your vehicle is worth more than you owe, you have positive equity. If you have negative equity, you'll still owe money on the loan even after you trade in the car.

Is it a bad idea to trade in a new car

It is best not to trade in your vehicle when you purchased it very recently. As soon as you drive a new vehicle off the lot, it loses around 10% of its value and up to 20% of its value within the first year. If you purchased a new, not used, vehicle within the last year and are thinking of trading it in, just don't.

Cached

Is it smart to trade in a car that isn’t paid off

While you can trade in a financed car at any time, it is most beneficial to wait until you have positive equity before doing so. It is also a good idea to wait at least a year or more before trading in, especially if you purchased your car brand new.

What are the disadvantages of trading

Cons:Easy losses. A lot of people think that trading is the simplest method of making money in the stock market, but it is also the easiest way of losing money.High tax liability. A tax liability is the sum of taxation that industry or an individual acquires based on current tax rules.Circuits.

Is it better to trade in a car or put money down

In almost every case, it's best to pay down or pay off your auto loan before selling it or trading it in. The main concern is whether you have positive or negative equity on your loan. With negative equity, you will want to pay off your auto loan before you trade in your car.

Does trading in a car hurt your credit

Trading in your car can hurt your credit score. Trading in your vehicle can cost you if you're not careful. Sometimes the dealership tells you they'll pay off the financing on your trade-in vehicle when you finance a new vehicle through them.

How long should you keep your car before trading it in

If the vehicle is new, you should ideally wait until at least year three of ownership to trade it in to a dealership, as this is when depreciation normally slows down. If it's used, it already went through the big drop in depreciation and you can usually trade it in after a year or so.

Is it better to trade in car or keep it

Is it better to sell your car or trade it in You'll get more money if you sell the car on your own, but you'll have to deal with strangers and the process could take a couple months. Trading in a car will net you less but will take much less time and effort.

Is it bad to trade in a car you still owe on

If you recently took out a loan, you might still be upside down, where you owe more than the car is worth. In this case, it's best to wait until the loan balance is lower before you trade in the car. Otherwise, you could take a major financial hit. You'll get penalized.

What is one negative of trade

Also known as a negative balance of trade, a country with a trade deficit has spent more money than it has made in international trade with the rest of the world. The balance of payments (BOP) records all free trade made between countries and will show when a country has a trade deficit or a trade surplus.

What is the hardest thing about trading

Therefore the hardest part of trading is learning the qualitative parts, those parts that can only be learned from experience or time in the markets.

How can I trade in my car without losing money

Trading in a car with positive equity

In addition to any equity applied to the car purchase, you can make a down payment with any saved or additional cash you have to reduce the overall balance of the loan. But you'll need to provide financing — cash or an auto loan — for the remaining purchase price of the car.

Is it OK to trade in a car you still owe money on

Yes, you can trade in a financed car, but the balance of your loan doesn't just disappear when you do so — it still has to be paid off. In most cases, the loan balance should be covered by the trade-in value of the vehicle, but that will depend on a variety of factors, including condition and age.

When’s the best time to trade in your car

Typically, the first two quarters of the calendar year offer higher values for trade-ins. That's because early in the year, buyer numbers are up, and dealers need more vehicles to meet demand. Additionally, since new models usually come out in the summer or fall, the further away from that time, the newer a car feels.

At what mileage is it best to trade in a car

30,000 To 40,000 miles

The depreciation of your vehicle will generally begin to accelerate faster after this milestone, so the closer your car is to this mileage, the better your trade-in will likely be.

Is it better to trade in a car or pay it off

When you take out an auto loan, the car is used as collateral until all the money has been repaid. In most cases, it's in your best interest to pay off your car loan before you trade in your car.

What are the dangers of trade

Businesses involved in international trade face a range of trade risks, including changes in exchange rates, political instability, regulatory changes, and natural disasters. Failure to manage these risks effectively can lead to reduced revenue, increased costs, damage to reputation, and uncertainty.

What is the problem with trade

Critics say trade drives down all blue-collar wages, making it more difficult for companies that compete with cheap imports to increase pay while the greater competition for remaining jobs can lower wages. There is a growing inequity in pay.

What are common mistakes when trading

Biggest trading mistakesNot researching the markets properly.Trading without a plan.Over-reliance on software.Failing to cut losses.Overexposure.Overdiversifying a portfolio.Not understanding leverage.Not using an appropriate risk-reward ratio.