What is a FICO score of 9?

What is a good FICO 9 score

670 to 739

What Is a Good Credit Score

| FICO Score Ratings | |

|---|---|

| Very Good | 740 to 799 |

| Good | 670 to 739 |

| Fair | 580 to 669 |

| Very Poor | 300 to 579 |

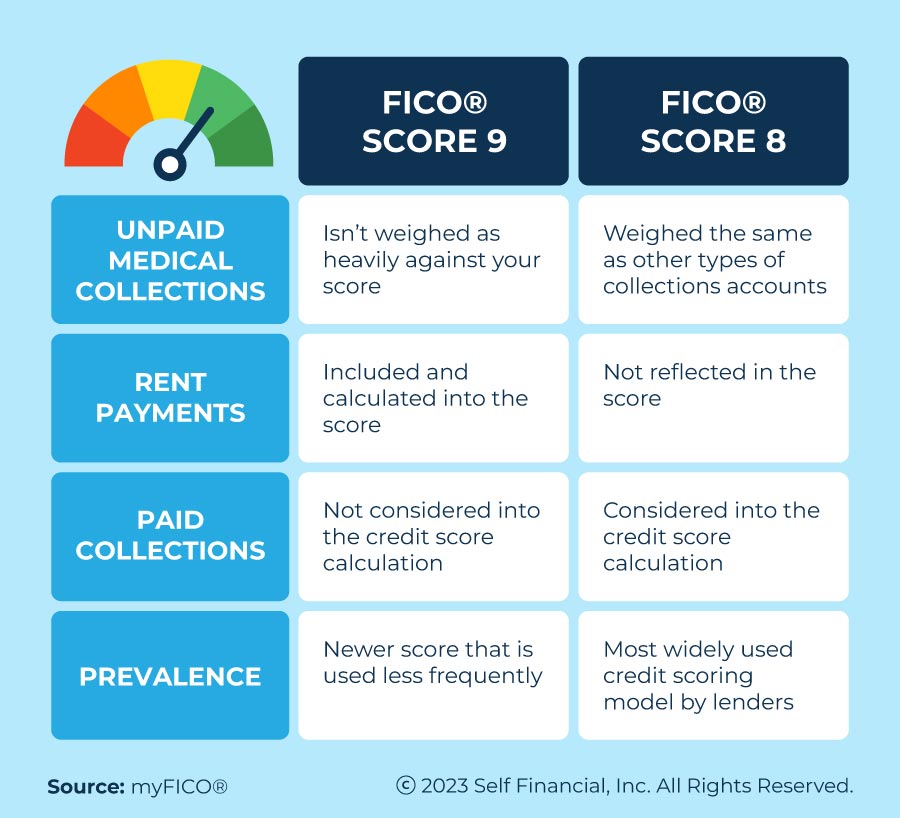

What’s the difference between FICO score 8 and FICO score 9

FICO 9 is similar to FICO 8 but differs when it comes to collections and rent payments. FICO 9 counts medical collections less harshly than other accounts in collections, so a surgery bill in collections will have less of an impact on your credit score than a credit card bill in collections.

Is FICO 9 common

FICO Score 9 is the second-latest version of the well-known credit scoring model, but it still isn't being used as widely as its predecessor, the FICO 8. All credit scores come from data in your credit reports, weighed according to proprietary formulas that calculate a score, typically on a 300-850 scale.

Cached

What does TransUnion FICO score 9 mean

Collections: FICO® Score 9 introduces a more sophisticated way to assess consumer collection information. FICO® Score 9 differentiates unpaid medical from unpaid non-medical collection agency accounts to support a more effective assessment of the true credit risk they represent.

Is FICO score 9 better than 8

Though the FICO® Score 9 is an updated version of FICO® Score 8, the FICO® Score 8 is still the most widely used base score by lenders, meaning that, while you may have a better credit score from the FICO® Score 9 model, lenders are more likely to still use the previous version.

Do mortgage lenders use FICO score 9

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

Do banks use FICO 8 or 9

While most lenders use the FICO Score 8, mortgage lenders use the following scores: Experian: FICO Score 2, or Fair Isaac Risk Model v2. Equifax: FICO Score 5, or Equifax Beacon 5. TransUnion: FICO Score 4, or TransUnion FICO Risk Score 04.

Do most lenders use FICO 9

Not All Lenders Embraced FICO 9

As mentioned, FICO 10 is the newest iteration, but most lenders are still on FICO 8. More specifically: The mortgage industry relies primarily on FICO scores 2, 4, and 5. Auto lenders use FICO Scores 2, 4, 5, 8, and 9.

What is FICO score 9 vs 10

For instance, with FICO Score 9, rent payments (when available) have been factored into the score while medical debt is weighted less than with previous versions. FICO Score 10 will weigh personal loans more heavily, penalizing borrowers who consolidate debt with personal loans and then choose to rack up more debt.

What is an acceptable FICO score for a mortgage

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

Is 8 a bad FICO score

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase.

Can a FICO score be an 8

The FICO Bankcard Score 8 is a FICO® Score that's created specifically for credit card issuers to help them understand the likelihood that a borrower will be 90 or more days late on a credit card payment in the next 24 months.

Who uses FICO score 9

The mortgage industry relies primarily on FICO scores 2, 4, and 5. Auto lenders use FICO Scores 2, 4, 5, 8, and 9. Credit card issuers use FICO Scores 2, 4, 5, 8, and 9.