What is a gateway fee credit card processing?

What is a gateway in credit card processing

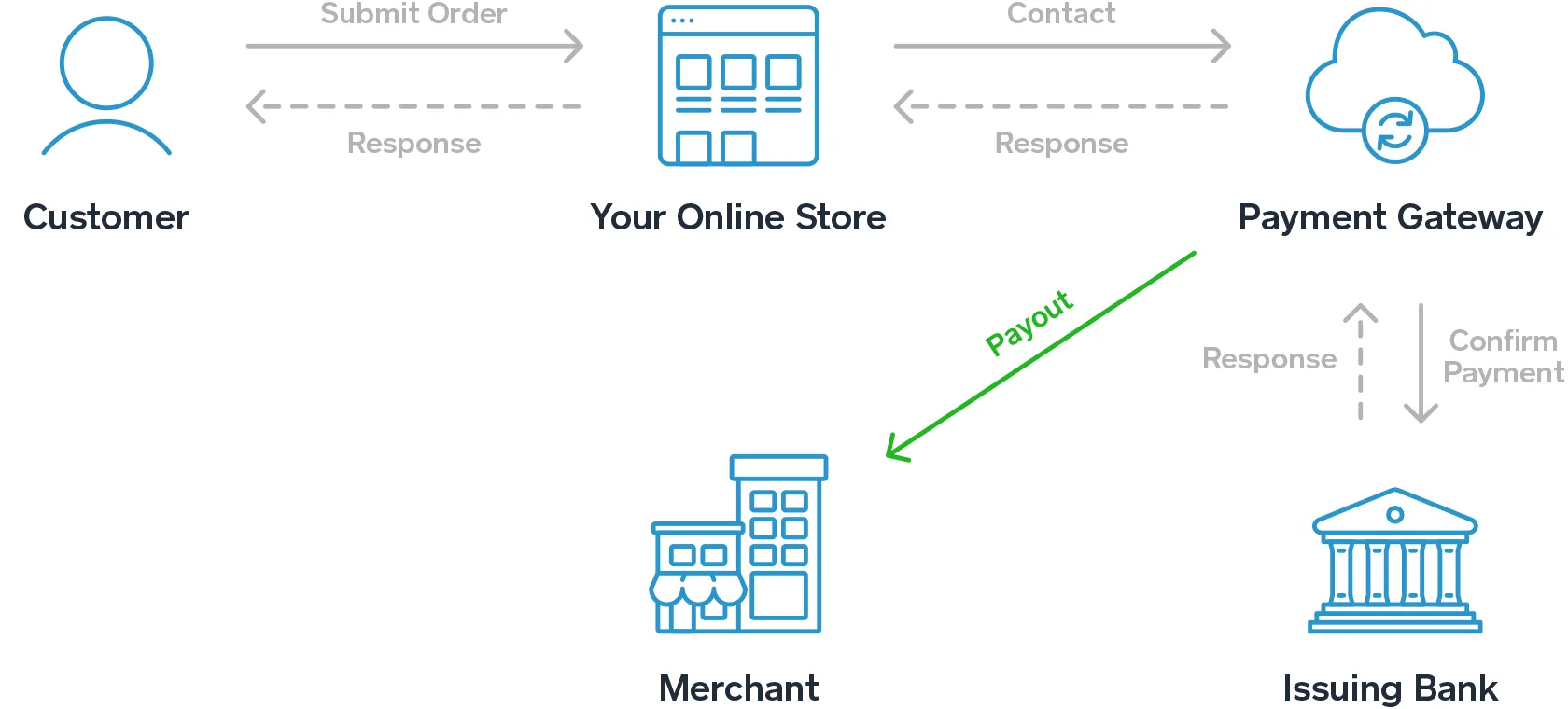

A credit card processing gateway is a connection point within the payment journey. A gateway connects your shopping cart, point of sale system or virtual terminal to the next point in the payment authorization process.

Cached

How do I avoid payment gateway fees

While some processing fees are unavoidable, there are steps you can keep them low.Accept Cards in Person When Possible.Require a Minimum Amount for Credit Card Sales.Minimize Chargebacks with a Credit Card Authorization Form.Use an Address Verification Service (AVS)Find a Better Payment Processor.

What is gateway payment services

A payment gateway is a technology used by merchants to accept debit or credit card purchases from customers. The term includes not only the physical card-reading devices found in brick-and-mortar retail stores but also the payment processing portals found in online stores.

Cached

What is the difference between credit card processor and gateway

The difference is a payment processor facilitates the transaction and a payment gateway is a tool that communicates the approval or decline of transactions between you and your customers.

Cached

What is an example of a payment gateway

Payment Gateway Examples

PayPal: PayPal is one of the most popular redirect payment gateways that is equipped with a robust anti-fraud team. With currency and cart compatibility, merchants also choose PayPal for its versatility. Apple Pay: Apple Pay payments are processed through a compatible credit card.

What is an example of a gateway

A gateway in a network converts information from one protocol to another and then transfers it over the web. For example, if a computer on the Internet sends an email to another, the gateway converts the message from one protocol to another and sends it back.

What are the disadvantages of payment gateway

What are the Limitations of Payment Gateways They are not mobile-friendly, not merchant-friendly, and don't facilitate recurring payments. They impose a fee when a chargeback occurs – a dispute for a certain online transaction raised by the purchaser who apprises the bank that has issued the card.

Is it mandatory to have a payment gateway

A payment processor sends transaction data between your merchant acquiring bank and a customer's issuing bank. It's required for all transactions, online or in person.

What is an example of a gateway payment

After your customer clicks on the payment link, they are taken to your payment processor's page to enter their card details and make the payment, after which they are redirected to your website. An example of this type of payment gateway is PayPal.

Which of the following is an example of a gateway in a credit card transaction

Examples of Payment Gateways

There are multiple options to choose from when you are looking for third-party payment gateways but the most common ones are PayPal, Stripe, Amazon Pay, 2Checkout, Apple Pay, Square and Authorize.net.

Do I need a payment gateway or processor

payment processor: Which do you need All businesses that accept credit cards, debit cards, prepaid cards or gift cards either online or in person need a payment processor. Only e-commerce businesses need a payment gateway.

Do I need payment processor and gateway

Do I need a payment gateway and payment processor You'll need both a payment gateway and a payment processor if you run an e-commerce business that accepts online payments. It's also important if you want to accept point-of-sale or mobile device payments.

What is an example of a payment gateway and payment processor

PayPal can be both a payment processor and payment gateway. If you want to use your own payment processor, you can just use PayPal's payment gateway Payflow. If you'd like both payment processing and payment gateway services, you can use the PayPal Commerce Platform.

What are the 2 types of a gateway

There are two main types of gateways: unidirectional gateways and bidirectional gateways.

What is a gateway and why is it used

A computer that sits between different networks or applications. The gateway converts information, data or other communications from one protocol or format to another. A router may perform some of the functions of a gateway. An Internet gateway can transfer communications between an enterprise network and the Internet.

Is it necessary to have a payment gateway

Payment gateways allow merchants to accept credit card payments by connecting payment processors (the service charging the card) and merchant account providers (the service providing your payment systems).

What is the difference between payment processing and payment gateway

A payment gateway is a place on a merchant's website where customers securely enter credit card information. A payment gateway also verifies that a customer's card is legitimate. A payment processor transmits card data from a merchant's point-of-sale system to card networks and banks involved in the transaction.

Who provides payment gateway

Answer: Fondy, PayPal, Authorize.Net, Stripe, 2Checkout, and Adyen are the top 5 best online payment gateway providers. They offer numerous beneficial features that can help in increasing sales by easing up the checkout process and offering your customers several payment options, in various currencies.

Is PayPal a gateway or processor

Is PayPal a payment gateway or a payment processor PayPal is what is known as a payment aggregator, and it has its own payment gateway, Payflow. You can learn more in our PayPal review. Payment aggregators do not require your business to set up a merchant account, unlike traditional payment processors.

What is the difference between a merchant service and a payment gateway

In fact, the two serve totally different functions: a payment gateway facilitates online transactions and allows you to process them, while a merchant account is a holding account where those payments first land before being deposited into your regular bank account.