What is a good APR for a car with a 700 credit score?

What is the APR for a 700 credit score car loan

3% to 6%

A credit score of 700 gets you an interest rate of 3% to 6% on car loans for new cars and about 5% to 9% for second-hand cars.

Cached

What is a good APR for a 700 credit score

4.58%

Good Credit Score For Mortgages

| FICO Score | Mortgage APR | Monthly Payment |

|---|---|---|

| 700 – 759 (Good) | 4.58% | $1,279 |

| 680 – 699 (Average) | 4.76% | $1,305 |

| 660 – 679 (Poor) | 4.95% | $1,338 |

| 640 – 659 (Bad) | 5.40% | $1,404 |

Is a 700 credit score good to buy a car

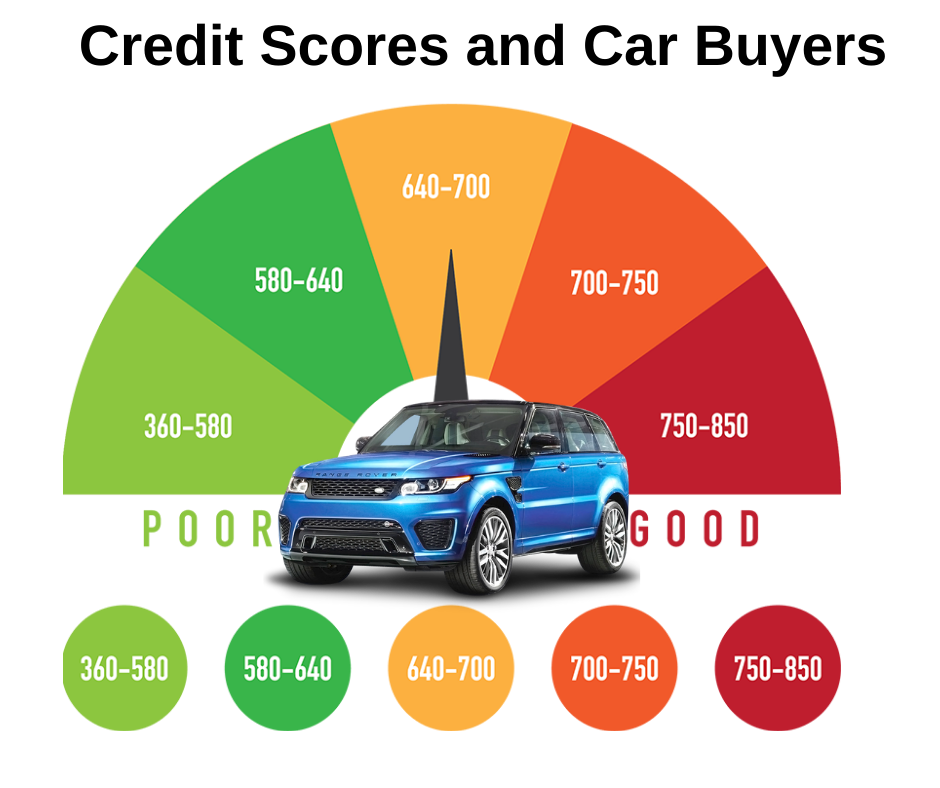

As you can see, a 700 credit score puts you in the “good” or “prime” category for financing, making 700 a good credit score to buy a car. While it's always a good idea to get your credit score in its best possible shape before buying a car, if you're already around the 700 range you will be good to go.

Cached

Is 7% APR high for a car

Car Loan APRs by Credit Score

Excellent (750 – 850): 2.96 percent for new, 3.68 percent for used. Good (700 – 749): 4.03 percent for new, 5.53 percent for used. Fair (650 – 699): 6.75 percent for new, 10.33 percent for used. Poor (450 – 649): 12.84 percent for new, 20.43 percent for used.

Cached

Is 7% APR good for a loan

A good interest rate on a personal loan is 5.99% to 9%. The average APR for a two-year personal loan from a bank is 9.87, according to the Federal Reserve, and the best personal loans have APRs as low as 5.99% for the most creditworthy borrowers.

Can you get 0% APR with 750 credit score

The exact credit score you might need to qualify for a 0% APR loan varies depending on your situation. Many lenders require a minimum score of at least 700. Others require excellent credit scores, such as 720, 750, or even 800.

What APR is too high for a car

The law says that the most a lender can charge for an auto loan are about 16% APR, but some lenders get away with 25% or more. Your annual percentage rate (APR) for a car loan depends on your credit score and whether you want a new or used car. A used car's APR will be higher than a new car's.

Why is my APR so high with good credit

Those with higher credit scores pose a lower default risk to issuers, and they tend to land better interest rates. Even if you have a higher interest rate and carry a balance, you can pay less interest on your credit card debt if you make payments whenever you can.

What credit score do I need to buy a 70k car

Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

Is 20% APR too high on a car

A 20% APR is not good for mortgages, student loans, or auto loans, as it's far higher than what most borrowers should expect to pay and what most lenders will even offer. A 20% APR is reasonable for personal loans and credit cards, however, particularly for people with below-average credit.

What is too high APR for a car

The law says that the most a lender can charge for an auto loan are about 16% APR, but some lenders get away with 25% or more. Your annual percentage rate (APR) for a car loan depends on your credit score and whether you want a new or used car. A used car's APR will be higher than a new car's.

Is 8% a bad APR

A good personal loan interest rate depends on your credit score: 740 and above: Below 8% (look for loans for excellent credit) 670 to 739: Around 14% (look for loans for good credit) 580 to 669: Around 18% (look for loans for fair credit)

Is 24.99% APR bad

Is 24.99% APR good A 24.99% APR is not particularly good for those with good or excellent credit. If you have average or below-average credit, however, it is a reasonable rate for credit cards. Still, you should aim for a lower rate if possible.

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

What APR should I expect with a 750 credit score for a car

750 is a good credit score that can get you car loans with equally as good rates. They aren't the best, but they are still in the top five. More specifically, you would be able to qualify for apr rates of anywhere from 3% to 6% for a new car loan and 5% to 9% for a used car loan.

Is 20% APR too high

A good APR is around 20%, which is the current average for credit cards. People with bad credit may only have options for higher APR credit cards around 30%. Some people with good credit may find cards with APR as low as 12%.

Is 12% APR too high

A low credit card APR for someone with excellent credit might be 12%, while a good APR for someone with so-so credit could be in the high teens. If “good” means best available, it will be around 12% for credit card debt and around 3.5% for a 30-year mortgage. But again, these numbers fluctuate, sometimes day by day.

What car can I afford with a 100k salary

How much car can I afford based on salary

| Annual salary (pre-tax) | Estimated monthly car payment should not exceed |

|---|---|

| $50,000 | $416 per month |

| $75,000 | $625 per month |

| $100,000 | $833 per month |

| $125,000 | $1,042 per month |

How much is a 30k car payment for 72 months

The total interest amount on a $30,000, 72-month loan at 5% is $4,787—a savings of more than $1,000 versus the same loan at 6%. So it pays to shop around to find the best rate possible.

Is an 18% APR bad

How good a credit card APR will be depends on how long it remains in effect. Low introductory APRs last for only a limited time before a high regular APR takes their place, for example. And an 18% regular rate won't cost you too much for a month or two, but carrying a balance for a long time will be expensive.