What is a journal entry credit?

What is a journal entry debit or credit

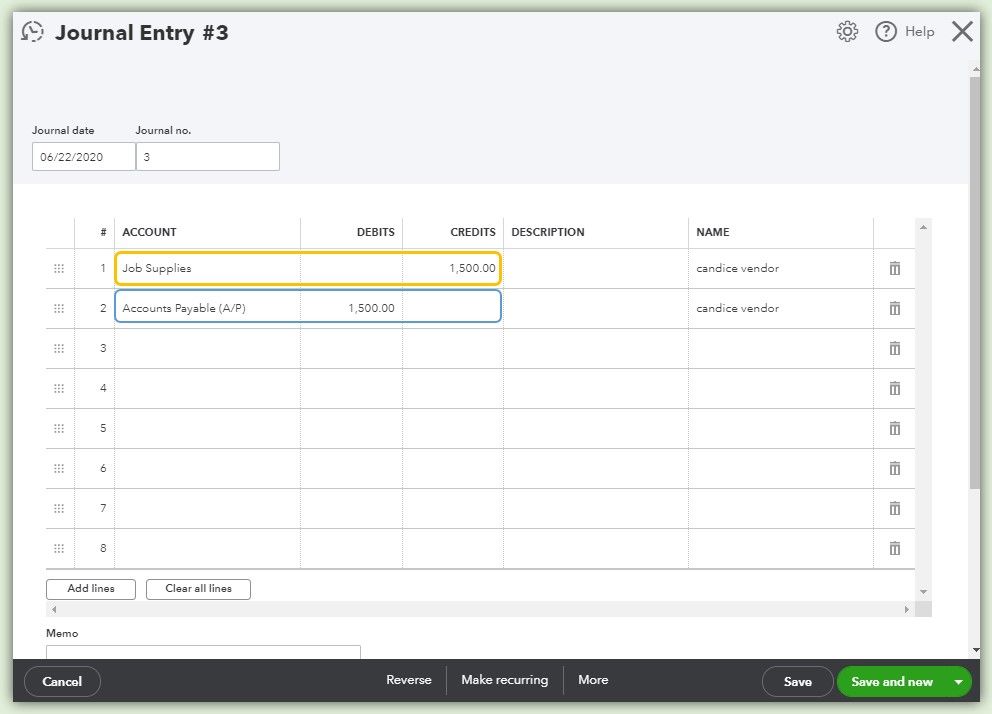

Journal entries consist of two sides: debits and credits.

Debits are dollar amounts that accountants post to the left side of the journal entry, and credits are dollar amounts that go on the right.

How do you write a journal entry for credit

Debits are always entered on the left side of a journal entry. Credits: A credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as capital. A credit is always entered on the right side of a journal entry.

Cached

What goes on credit side in journal entry

On the other hand, a credit (CR) is an entry made on the right side of an account. It either increases equity, liability, or revenue accounts or decreases an asset or expense account (aka the opposite of a debit).

Cached

What is an example of a journal entry

For example, if the owner of Razor Bakery buys sugar worth Rs 50, she is deducting Rs 50 from her cash balance, but adding Rs 50 worth of sugar to her sugar balance. A journal entry records both sides of this transaction in the form of a debit and credit value.

Is a debit or credit negative on a journal entry

Another way to understand debits and credits in business accounting is to look at them mathematically. A simple way to distinguish between the two is to know that a debit entry always adds a positive number to the ledger, and a credit entry always adds a negative number.

What is difference between credit and debit

What's the difference When you use a debit card, the funds for the amount of your purchase are taken from your checking account almost instantly. When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to pay.

Can cash be credit in journal entry

Whenever cash is received, the Cash account is debited (and another account is credited). Whenever cash is paid out, the Cash account is credited (and another account is debited).

What are the 5 types of journal entries

They are:Opening entries. These entries carry over the ending balance from the previous accounting period as the beginning balance for the current accounting period.Transfer entries.Closing entries.Adjusting entries.Compound entries.Reversing entries.

Does CR mean I owe money

If there is “CR” next to the amount, it means your credit card had a credit balance on the statement date, so you don't need to make any payment for this period.

What is difference between debit and credit

What's the difference When you use a debit card, the funds for the amount of your purchase are taken from your checking account almost instantly. When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to pay.

What is journal entry in simple terms

A journal entry is a record of a business transaction in your business books. In double-entry bookkeeping, you make at least two journal entries for every transaction. Because a transaction can create a lot of changes in a business, a bookkeeper tracks them all with journal entries.

Is a credit a positive or negative

On a balance sheet, positive values for assets and expenses are debited, and negative balances are credited. Financial Industry Regulatory Authority.

Is a credit balance positive or negative

A credit balance applies to the following situations: A positive balance in a bank account. The total amount owed on a credit card.

Is credit positive or negative

The UGAFMS (PeopleSoft) system identifies positive amounts as DEBITS and negative amounts as CREDITS. Each account has a debit and credit side, but as you can see, not every account adds on the debit side or subtracts on the credit side.

What is debit vs credit in accounting for dummies

Debits and credits indicate where value is flowing into and out of a business. They must be equal to keep a company's books in balance. Debits increase the value of asset, expense and loss accounts. Credits increase the value of liability, equity, revenue and gain accounts.

Is a credit to cash positive or negative

What is a credit A credit entry increases liability, revenue or equity accounts — or it decreases an asset or expense account. Thus, a credit indicates money leaving an account. You can record all credits on the right side, as a negative number to reflect outgoing money.

Would cash be a debit or credit

debit

In business transactions involving cash, receiving cash would be recorded as a debit entry because it increases the amount of available funds for the company. On the other hand, paying out cash would be recorded as a credit entry because it reduces the amount of available funds.

What are the three rules of journal entry

Golden Rules of Accounting1) Rule One. "Debit what comes in – credit what goes out." This legislation applies to existing accounts.2) Rule Two. "Credit the giver and Debit the Receiver." It is a rule for personal accounts.3) Rule Three. "Credit all income and debit all expenses."

What are the 3 basic types of entries

There are three types: transaction entry, adjusting entry, and closing entry. An accounting entry is a formal recording of transactions where debit and credit transactions are recorded into the general ledger.

What does CR mean on my balance

credit balance

What does the "Dr/Cr" mean on my invoice/statement A "Dr" balance means a debit balance which is an amount due for payment, whilst a "Cr" balance means a credit balance which indicates that no payment is due.