What is a soft credit card check?

Does a soft credit check affect anything

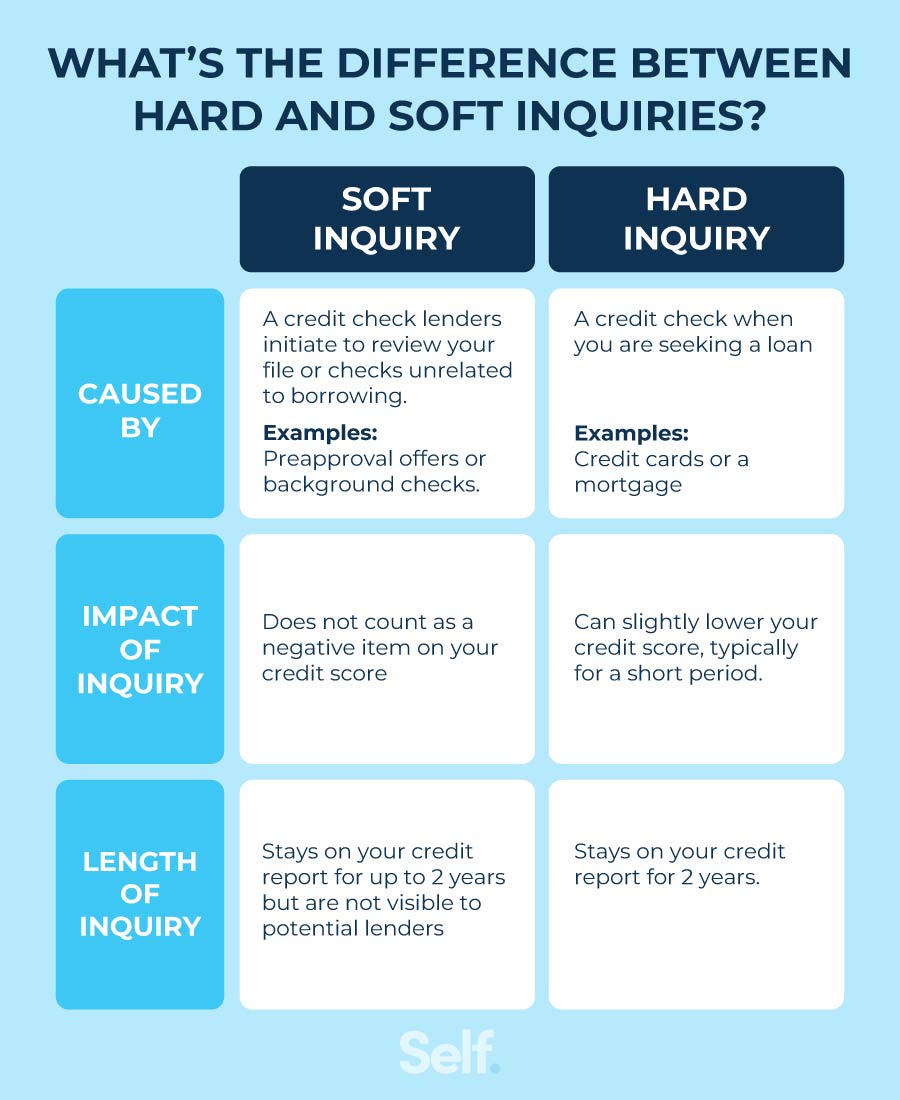

There are two types of credit score inquiries lenders and others (like yourself or your landlord) can make on your credit score: a "hard inquiry" and a "soft inquiry." The difference between the two is that a soft inquiry won't affect your score, but a hard inquiry can shave off some points.

Cached

Will I fail a soft credit check

Can I 'fail' a soft credit check Don't worry, you can't 'fail' a soft credit check. With a soft search, you're not actually applying for anything – so it won't result in a lender's decision.

What is the difference between soft and hard credit check

Credit pulls are when someone — even you — checks your credit. Lenders run hard checks when you officially apply for credit, which can cause your credit score to drop slightly. Soft checks, on the other hand, are for preapprovals or when you check your own credit, and they don't affect your credit score.

Cached

Can anyone pull a soft credit check

A soft inquiry, sometimes known as a soft credit check or soft credit pull, happens when you or someone you authorize (like a potential employer) checks your credit report. They can also happen when a company such as a credit card issuer or mortgage lender checks your credit to preapprove you for an offer.

Cached

How long does a soft credit check last

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

How many points does a soft credit check drop your score

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

How long does a soft credit check take

Hard inquiries are taken off of your credit reports after two years. But your credit scores may only be affected for a year, and sometimes it might only be for a few months. Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores.

How far back does a soft credit check go

Soft searches do not affect your credit score and aren't visible to potential lenders. They will only be visible to you and will remain on your credit report for around 12-24 months, depending on the type of soft search.

What banks do a soft credit check

Issuers Offering Pre-Approval With a Soft Pull for Credit Cards

| Credit Card Company | Online Pre-Approval Check | Soft Pull |

|---|---|---|

| Chase | Yes | Yes |

| Citibank | Yes | Yes |

| Discover | Yes | Yes |

| USAA | Yes (members only) | Yes |

Do soft credit checks show up on credit report

Hard and soft inquiries, sometimes referred to as credit checks, are requests to view your credit report by lenders, landlords, employers and companies that are authorized to do so. Both hard and soft inquiries will show up on your credit report.

What companies do soft credit check

Issuers Offering Pre-Approval With a Soft Pull for Credit Cards

| Credit Card Company | Online Pre-Approval Check | Soft Pull |

|---|---|---|

| Chase | Yes | Yes |

| Citibank | Yes | Yes |

| Discover | Yes | Yes |

| USAA | Yes (members only) | Yes |

What shows up on a soft pull

A soft pull credit check shows the same information that you can find on a hard pull. It will show a customer's lines of credit and loans. It will outline their payment history. It will also show any accounts that have been sent to a collection agency or if they have a tax lien.

How many points is a soft credit check

A soft inquiry does not affect your credit score in any way. When a lender performs a soft inquiry on your credit file, the inquiry might appear on your credit report but it won't impact your credit score.

Can banks see soft credit checks

If a lender checks your credit report, soft credit inquiries won't show up at all. Soft inquiries are only visible on consumer disclosures—credit reports that you request personally. The following types of credit checks are examples of soft inquiries.

How do I stop a soft credit check

One way is to go directly to the creditor by sending them a certified letter in the mail. In your letter, be sure to point out which inquiry (or inquiries) were not authorized, and then request that those inquiries be removed. You could also contact the 3 big credit bureaus where the unauthorized inquiry has shown up.

Do soft credit checks show on credit report

Hard and soft inquiries, sometimes referred to as credit checks, are requests to view your credit report by lenders, landlords, employers and companies that are authorized to do so. Both hard and soft inquiries will show up on your credit report.

How long does a soft credit check stay on your record

12-24 months

Soft inquiries will only stay on your credit reports for 12-24 months. And remember: Soft inquiries won't affect your credit scores. Lenders may be concerned if you have too many hard inquiries on your credit report within a short period of time. However, there are some exceptions to this.

Do multiple inquiries count as one

If you're shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time. The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days.

How many soft inquiries is too many

Soft inquiries don't drop your credit score, so there isn't a number that could be considered too much.

How bad is 3 hard inquiries

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.