What is an example of an accounts receivable?

What items are in accounts receivable

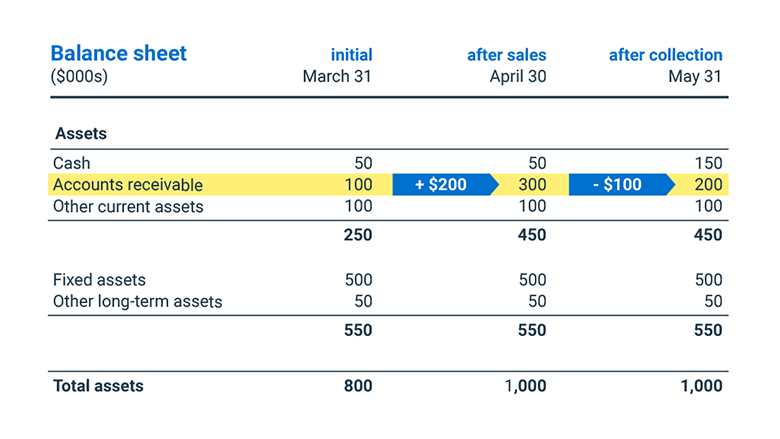

Accounts receivable are the funds that customers owe your company for products or services that have been invoiced. The total value of all accounts receivable is listed on the balance sheet as current assets and include invoices that clients owe for items or work performed for them on credit.

Cached

What is accounts receivable in simple words

Accounts receivable (AR) is an item in the general ledger (GL) that shows money owed to a business by customers who have purchased goods or services on credit. AR is the opposite of accounts payable, which are the bills a company needs to pay for the goods and services it buys from a vendor.

What is an example of an accounts receivable asset

Let's take the example of a utilities company that bills its customers after providing them with electricity. The amount owed by the customer to the utilities company is recorded as an accounts receivable on the balance sheet, making it an asset.

What type of expense is accounts receivable

Accounts receivable is the amount owed to a seller by a customer. As such, it is an asset, since it is convertible to cash on a future date. Accounts receivable is listed as a current asset on the balance sheet, since it is usually convertible into cash in less than one year.

What is another name for account receivable

The terms 'trade receivables' and 'accounts receivable' generally mean the same. Both represent the amount of money customers owe a business for the goods or services they've received.

What is the main purpose of accounts receivable

What is an Accounts Receivable The key role of an employee who works as an Accounts Receivable is to ensure their company receives payments for goods and services, and records these transactions accordingly.

What type of assets are receivables

Accounts receivable are considered a current asset because they usually convert into cash within one year. When a receivable takes longer than one year to convert, it will be recorded as a long-term asset. In addition to accounts receivable, there are other current assets found on the balance sheet.

Is accounts receivable an example of a real account

Here are a few examples of real accounts in accounting:Cash.Accounts receivable.Fixed assets.Accounts payable.Wages payable.Common stock.Retained earnings.

What is accounts receivable and its types

In the world of accounting, what is meant by accounts receivable or trade (account receivables) are current assets in a company due to sales transactions in the form of goods or services to a party In existing transactions, payments are made on credit or have not been paid off (accounts receivable).

Is accounts receivable a revenue or expense

Is accounts receivable revenue or an asset Accounts receivable is an asset because it represents money owed, not money held. It's represented on different financial statements than revenue. Until the company receives compensation for its good or service, accounts receivable acts as a placeholder for the funds.

What is the difference between accounts receivable and payable

So, what is the difference between accounts receivable and accounts payable Put simply, accounts payable and accounts receivable are two sides of the same coin. Whereas accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

What is accounts receivable and how does it work

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.

What are the 4 types of account receivable

Majorly, receivables can be divided into three types: trade receivable/accounts receivable (A/R), notes receivable, and other receivables.

What is another name for accounts receivable

They might call them an outstanding invoice, which means they are an invoice that has been sent to a client but remains unpaid. Some business owners might simply call them debts, receivables for short, or a line of credit.

Which of the following best describes accounts receivable

Which of the following best describes accounts receivable The amount of cash owed to a company by its customers from the sale of goods or services on account.

What are examples of accounts payable

Accounts payable are bills a company must pay. It's the money a business owes suppliers for provided goods and services. Some examples of accounts payable include cleaning services, staff uniforms, software subscriptions, and office supplies. Accounts payable does not include payroll.

Where does accounts receivable go on a balance sheet

assets section

An account receivable is recorded as a debit in the assets section of a balance sheet. It is typically a short-term asset—short-term because normally it's going to be realized within a year.”

How do you record accounts receivable

Account receivable is the amount the company owes from the customer for selling its goods or services. The journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account.

What is accounts payable and accounts receivable with example

If a company buys raw materials from a supplier, this results in an account payable for the company. Meanwhile, accounts receivables come from selling goods or services. When a customer pays for your service in installments, the amount owed will be listed as an account receivable until it is fully paid.

What is the main purpose of the accounts receivable

The accounts receivable (AR) team is responsible for all cash inflows. They manage invoicing, payment collections, cash application, deductions, and credit risk. The accounts receivable team, is therefore, critical to ensure that your sales revenue translates into cash in your bank account.