What is an H 3 model disclosure?

What is the notice to home loan applicant disclosure

Notice to the Home Loan Applicant

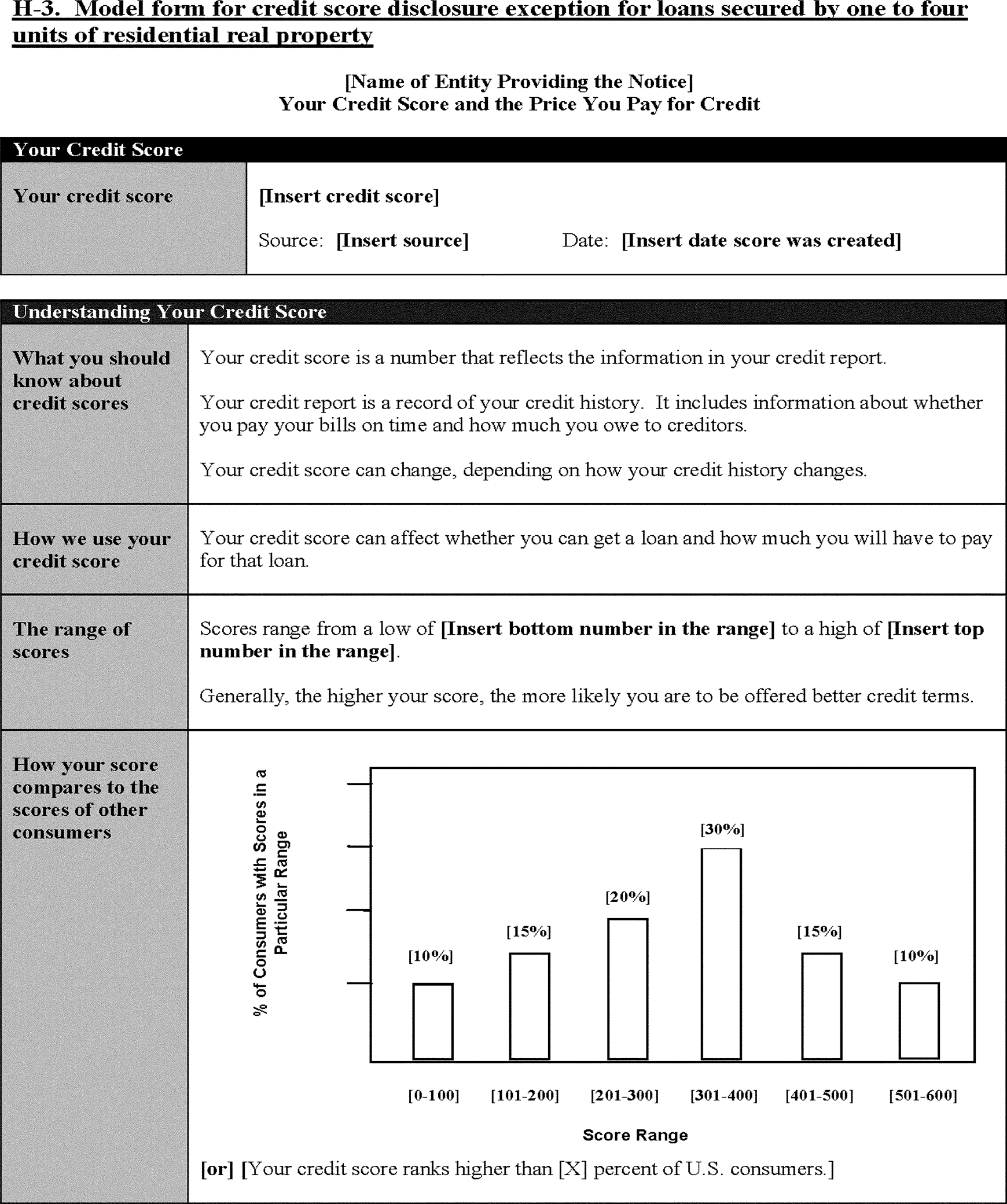

In connection with your application for a home loan, the lender must disclose to you the score that a consumer reporting agency distributed to users and the lender used in connection with your home loan, and the key factors affecting your credit scores.

CachedSimilar

Why did I get a credit score disclosure

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

Under what conditions must you send an applicant a credit score disclosure

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

Cached

What is the lowest credit score for a FHA loan

580

To qualify for an FHA-insured loan, you need a minimum credit score of 580 for a loan with a 3.5% down payment, and a minimum score of 500 with 10% down. However, many FHA lenders require credit scores of at least 620.

Does a loan disclosure mean loan is approved

Does a closing disclosure mean your loan is approved No, a closing disclosure does not always mean your loan is approved. You may find incorrect information or something you want to change. Your lender also has the opportunity to back out if they find something new that makes them change their mind.

What happens after loan disclosures are signed

After all the paperwork is signed, your lender will fund the loan. You'll receive a final settlement statement after the transaction is complete. If the closing disclosure overestimated any costs, you'll receive a refund for the difference.

What does disclosure mean in credit report

WalletHub, Financial Company

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.

Do they pull credit after closing disclosure

Credit is pulled at least once at the beginning of the approval process, and then again just prior to closing. Sometimes it's pulled in the middle if necessary, so it's important that you be conscious of your credit and the things that may impact your scores and approvability throughout the entire process.

When must the credit score disclosure be provided

The notice described in paragraph (f)(1)(iii) of this section must be provided to the consumer as soon as reasonably practicable after the person has requested the credit score, but in any event not later than consummation of a transaction in the case of closed-end credit or when the first transaction is made under an …

What are the disclosure requirements

Disclosure requirements allow media and public to examine campaign funding. These requirements allow interested parties, such as the media and the public, to examine records otherwise hidden from them. The result is closer scrutiny of facts and figures and of the relationships between political actors.

What credit score is needed to buy a house with no money down

What credit score do I need to buy a house with no money down No-down-payment lenders usually set 620 as the lowest credit score to buy a house. You can boost your credit score by keeping your revolving charge card balances to a minimum and paying all your bills on time.

Can I buy a house with a 580 credit score

Most lenders offer FHA loans starting at a 580 credit score. If your score is 580 or higher, you can put only 3.5% down. Those with lower credit scores (500-579) may still qualify for an FHA loan. But they'd need to put at least 10% down and it's more difficult to find a willing lender.

What are signs that your loan will be approved

Common Approval ConditionsIncome and bank statements verifying your monthly income.Additional paperwork to meet specific loan requirements.Verification of homeowners insurance.Gift letters for home buyers using gift funds for their down payment.A letter of explanation for a recent large withdrawal.

Can you be denied after closing disclosure

Can a mortgage be denied after the closing disclosure is issued Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

Can a loan be denied after closing disclosure is signed

Can a mortgage be denied after the closing disclosure is issued Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

What are the three levels of disclosure

LEVEL 1: GREETINGS: “Hi, how are you, fine.” “TGIF!” Everyone keeps walking.LEVEL 2: SMALL TALK: an exchange or two about traffic, the weather, or your local sports team.LEVEL 3: UNIVERSALLY ACCEPTABLE QUESTIONS:

What are the 4 types of disclosure

There are 4 types of PVG disclosure:Scheme Record.Existing Scheme Record.Scheme Record Update (also known as a Short Scheme Record)Scheme Membership Statement.

Does closing disclosure mean clear to close

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

Does closing disclosure mean underwriting is done

After you've cleared underwriting and conditional approvals, your loan officer will send you a Closing Disclosure. This five-page document outlines the terms and conditions of your mortgage agreement, providing a comprehensive overview of all of the costs and fees you'll pay when you provide your signature.

What is a disclosure on a credit report

WalletHub, Financial Company

A consumer disclosure is the long version of your credit report that contains all credit inquiries and suppressed information not found in your standard credit report, as well as the normal credit report records of balances, payment history, personal information, etc.