What is an ideal credit score UK?

How many people have 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Does anyone have a 999 credit score

There's no universal number that indicates a good score because each credit agency uses a different scoring system. Experian, for example, uses a range from 0 to 999. A score of between 881 and 960 is good, between 961 and 999 your score is excellent.

Cached

What is the UK average credit score

However, you can increase your chances of acceptance with a credit card for bad credit, and when managed responsibly, it could help you build your credit score. The average UK credit score is 797 out of 999 (according to Experian), however scores can vary depending on the credit reference agency.

Is it possible to have a credit score of 900

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

Cached

Why is it so hard to get a credit score of 850

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What can a credit score of 666 get you

What Does a 666 Credit Score Get You

| Type of Credit | Do You Qualify |

|---|---|

| Unsecured Credit Card with No Annual Fee | YES |

| Unsecured Credit Card with Rewards | YES |

| Home Loan | YES |

| Auto Loan | YES |

Do Brits have credit scores

In the UK, things work differently. The UK credit score system centres around three main credit reference agencies (CRAs): Experian, Equifax and TransUnion. Each one collects information from creditors and factors these into an algorithm that calculates your credit score.

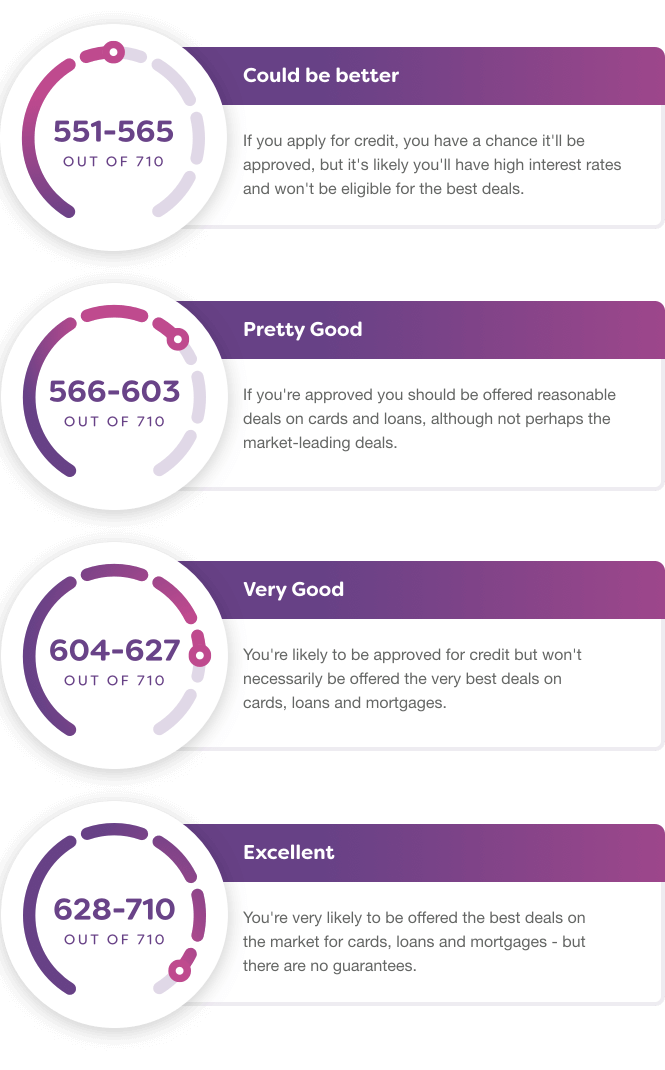

What is a poor credit score UK

In the UK, having bad credit can impact how many lenders are willing to give you a credit card, mortgage or bank loan. A bad credit score with Equifax is under 379. A 'Poor' credit score with Equifax is 280-379, and a 'Very Poor' credit score is under 279.

How much of the population has 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What percentage of the population has a credit score over 750

A 750 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders' better interest rates and product offers. 25% of all consumers have FICO® Scores in the Very Good range.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

How many people have an 825 credit score

21% of all consumers have FICO® Scores in the Exceptional range.

What is a 800 credit score worth

A FICO® Score of 800 is well above the average credit score of 714. It's nearly as good as credit scores can get, but you still may be able to improve it a bit. More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range (740-799).

Is UK credit score valid in USA

However, your UK credit history does not translate to the US, and vice versa. In both countries, these credit bureaus collect information about your credit history and credit behaviors, as well as personal information. However, that's pretty much where the similarities stop.

Is UK credit score the same as US credit score

Many countries, including Canada and the U.K., have credit scoring systems that are similar to the American system. Yet, there is no communication between the systems. So your credit score in the U.S. will not affect your credit score in the U.K.

Why is my credit score 0 UK

You've not used any credit in a long time

If it's been longer than that, and you don't have any other credit accounts on your report, you might not see a credit score. It's a good idea to start building your score again – you could take out a credit builder card .

Is 350 a good credit score UK

Your score falls within the range of scores, from 300 to 579, considered Very Poor.

How many Americans have over 700 credit score

The latest data reveals that 16.4% of Americans have a FICO score of between 700 and 749. With 23.1% of consumers with a credit score between 750 and 799 and 23.3% of Americans in the highest credit score percentile, a total of 62.8% of the US population have a credit score over 700.