What is an unacceptable check?

What are the signs of a bad check

Bad Checks: Signs to Look for

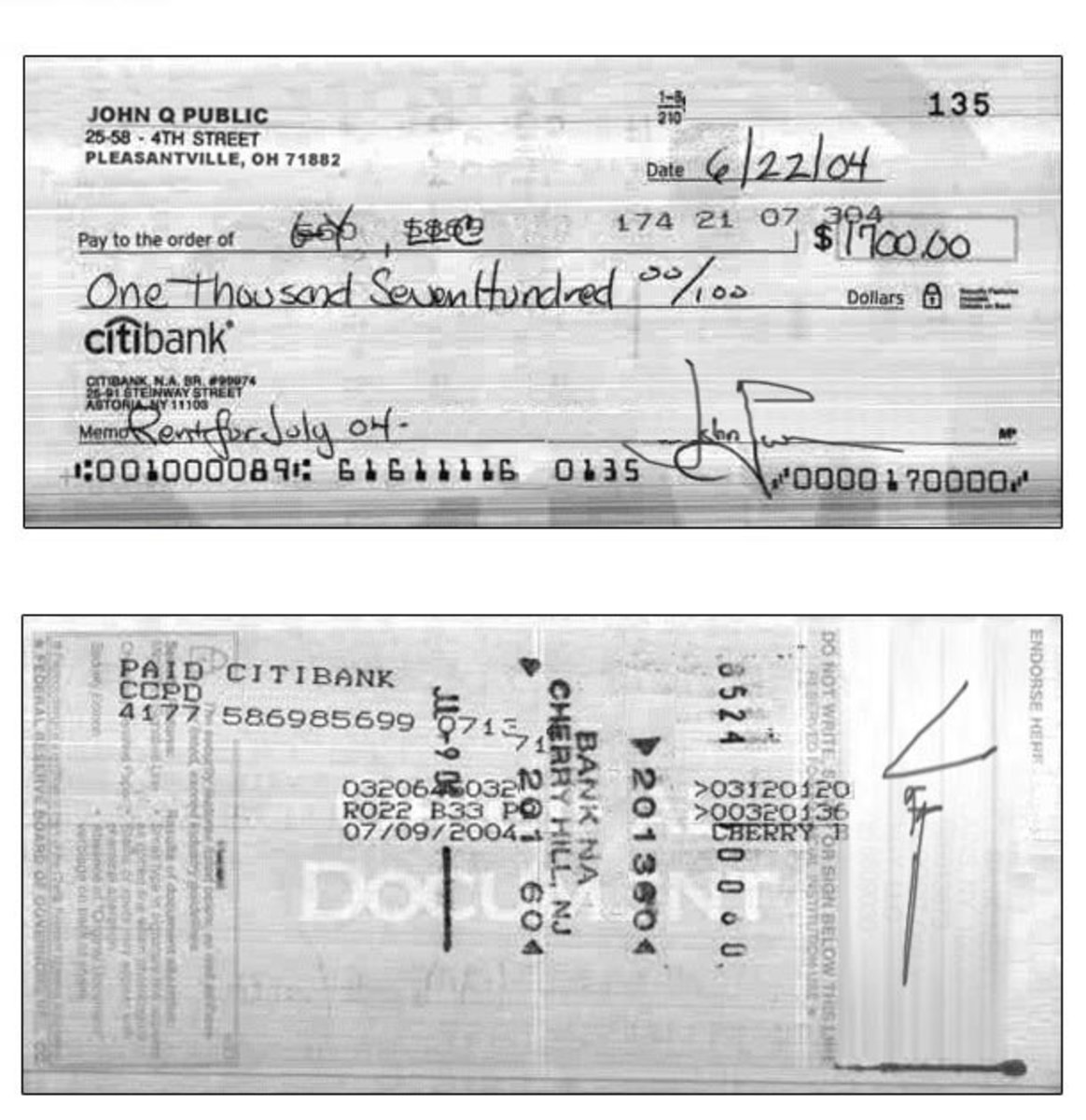

The check lacks perforations. The check number is either missing or does not change. The check number is low (like 101 up to 400) on personal checks or (like 1001 up to 1500) on busi- ness checks. (90% of bad checks are written on accounts less than one year old.)

What is a rejected check

A bounced check is slang for a check that cannot be processed because the account holder has non-sufficient funds (NSF) available for use. Banks return, or “bounce,” these checks, also known as rubber checks, rather than honor them, and banks charge the check writers NSF fees.

Will a check go through with insufficient funds

When you cash or deposit a check and there's not enough funds to cover it in the account it's drawn on, this is also considered non-sufficient funds (NSF). When a check is returned for NSF in this manner, the check is generally returned back to you. This allows you to redeposit the check at a later time, if available.

What is issuance of a bad check

The offense of "issuance of bad check" is a Class C misdemeanor. It is a crime for a person to issue or pass a check knowing that the person did not have sufficient funds on deposit with the bank to cover the check and any other check that was outstanding at the time the check was issued.

CachedSimilar

What are red flags on a check

Non-characteristic, sudden, abnormal deposit of checks, often electronically, followed by rapid withdrawal or transfer of funds. Examination of suspect checks reveals faded handwriting underneath darker handwriting, making the original writing appear overwritten.

Do banks verify checks before cashing

Because paper checks have no actual monetary value themselves, banks have to verify whether the transaction can actually be completed or not.

Why would a check be unacceptable

A bad check is a check the bank will not honor. There are three kinds of bad checks. Non-Sufficient Funds (NSF) checks: A check is NSF if there is not enough money in the account to pay it or the account is closed. Stop Payment checks: The person who wrote the check told the bank to stop payment.

Why would a check fail to deposit

No Payee Indicated – If the Paid to the Order of line (your name) is blank on the check, you will not be able to deposit the check. Before attempting to deposit a check, be sure that all crucial areas of information are written down – such as payee, check amount and payer's signature.

Will banks verify funds on a check

Yes, you can verify a check for free. To do this, you will need to speak with the bank that issued the check via phone or in person. Unfortunately, there is no free way to verify a check online.

What is a non sufficient fund check

Not sufficient funds (NSF) is a condition where a bank does not honor a check, because the checking account on which it was drawn does not contain sufficient funds.

What can cause a check to be returned

The check payment may have been rejected for a variety of reasons including: incorrect bank routing and account information on check payment, insufficient funds to cover check payment amount, or using accounts that are not authorized for check payments.

Why would a check fail

Insufficient funds: The issuer of the check said the account doesn't have enough funds. Stop payment: There's a stop payment blocking the check from being honored.

What are the common cheque frauds

Cheque FraudCounterfeit: when fake cheques are used that are not written or authorized by legitimate account holders.Forgery: when stolen cheques are signed by someone other than the account holders.

Why do banks flag checks

Bank holds are not illegal and in fact, it's fairly common for banks to hold checks as part of their funds availability policies. Fund availability simply means when you'll be able to use or withdraw the money you've deposited.

How does the bank verify if a check is good

The number on the check might be a part of the scam, so it's essential to call the official direct line to confirm the check's validity. The bank might need the check number, issuance date, and amount to confirm if the check is real. Complete an ABA routing number lookup.

How do I verify if a check is good

6 Ways to Spot a Fake CheckFeel the edges Legitimate checks will usually have at least one rough or perforated edge.Look at the logo. A hallmark of any legitimate check is the logo of the bank where the account is held.Verify the bank address.Check the check number.Rub the MICR line.Examine the paper.

What 6 reasons can a bank give for not accepting a check

Review some of the top reasons why a bank won't cash your check.You Don't Have Proper ID. Banks have to protect themselves against check fraud.The Check Is Made to a Business Name.The Bank Branch Can't Handle a Large Transaction Without Prior Notice.The Check is Too Old.Hold Payment Request on a Post-Dated Check.

Why is my check not being accepted

Insufficient funds: The issuer of the check said the account doesn't have enough funds. Stop payment: There's a stop payment blocking the check from being honored.

What does a bank do to verify a check

Banks can verify checks by checking the funds of the account it was sent from. It's worth noting that a bank will not verify your check before it processes it, meaning you may face fees for trying to cash a bad check. The bank checks if there are funds in the account, and if not, the check bounces.

What does a bank need to verify a check

Verifying a cashier's check is just like verifying any other check. You will need to contact the issuing bank and provide them with the check number, the amount the check was issued for, and the name of the account holder (the person who issued you the check).