What is Argos normal credit?

How long do you have to pay normal credit on Argos

You must pay your minimum payment before the due date each month, which will be at least 25 days after your statement date.

What is normal credit

The average credit score in the United States as of February 2023 is 698 based on the VantageScore 3.0 credit score model.

Is Argos card a personal credit card

Find out which cards you are eligible for

However, this isn't a credit card in the traditional sense of the term: being a “store card”, it's exclusively for your Argos shopping. It'll also work at Sainsbury's (it's part of the same financial group), but that's about it, as it's not on the Mastercard or Visa networks.

What is Argos default card

It's part of the Argos debt collection process. It means that you failed to make your minimum monthly repayments which then sees your account enter into 'default'. If you're struggling with your finances, in my experience, it's best to keep in touch with the provider.

What happens if you don’t pay Argos

If you don't pay in full, you'll be charged interest on any balance remaining at the end of the plan. This interest will be backdated to the date of purchase.

How long does it take to get approved for an Argos card

Apply today, shop later

Apply today and if your application is accepted we'll send out your card in the post within 10 days. As soon as it arrives, you can shop online and in-store.

Is 500 credit bad

1. Poor (300-579): A 500 credit score falls within this range, indicating a higher likelihood of defaulting on loans and struggling with making timely payments. Individuals with scores in this range will have limited access to credit and may be required to pay higher interest rates and fees.

Is 300 credit bad

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 300 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

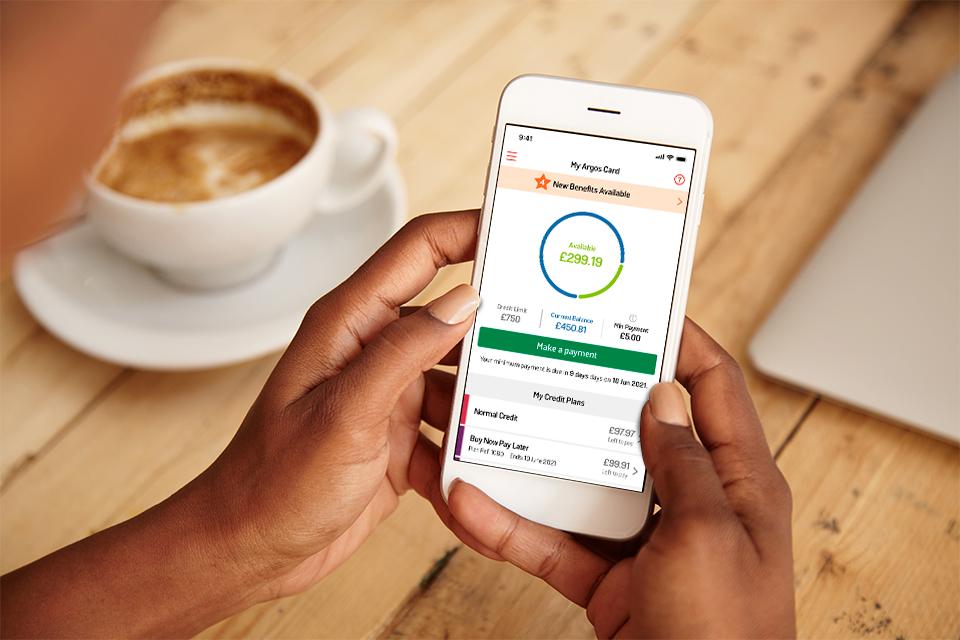

What is the highest limit on an Argos card

Some of the features of the Argos credit card include: Build your credit limit – get a credit limit starting from £150 to £1,000, and on every 4th statement you could get a credit limit increase up to a maximum if £3,000.

Can I use my Argos card for anything

Mostly, yes – you can use your Argos Card to buy groceries, Tu Clothing, Homewares, Electronics – basically anything that's stocked in Sainsbury's and Sainsbury's Local stores.

Can I use my Argos card to withdraw cash

Can I use my card to withdraw money from a cash machine and is there any charge Yes, but remember that you will be charged interest from the date the withdrawal appears on your account, as well as an additional withdrawal fee (3% or £3, whichever is greater).

Can Argos take me to court

Can Argos Catalogue take me to court If you owe money to Argos Catalogue and you do not pay, you can be sued. If Argos Catalogue sues you and wins, the court will enter a judgment (also called an order) against you that says you must pay back the debt.

How do I pay off Argos debt

You can select particular plans and amounts to pay off or let us allocate your payments to minimise any interest charged. BY PHONE: To pay by debit card over the phone, call 0345 640 0700. Just follow the instructions to make a payment using our automated payment service.

How do I know if my Argos Card has been approved

Apply today, shop later

Apply today and if your application is accepted we'll send out your card in the post within 10 days. As soon as it arrives, you can shop online and in-store.

Can you get money from Argos Card

Yes, you can withdraw cash.

How long does it take to go from 500 to 700 credit score

How Long Does It Take to Fix Credit The good news is that when your score is low, each positive change you make is likely to have a significant impact. For instance, going from a poor credit score of around 500 to a fair credit score (in the 580-669 range) takes around 12 to 18 months of responsible credit use.

How to go from 500 to 650 credit score

To increase your credit score from 500, ensure that you repay your existing debts on time. If you are already doing it, you may go a step further and take out new type of loans. Having a healthy mix of credit also helps to boost your credit score. And remember, not to utilize more than 30% of the available credit.

What is a 500 credit score considered

A 500 credit score is considered poor and can significantly limit your access to credit and financial opportunities. However, by taking proactive steps to improve your credit score, you can increase your chances of securing better interest rates, loan terms, and credit limits.

How to go from 300 to 600 credit score

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.Additional Topics on Improving Your Credit.

What is the average card limit

What is considered a “normal” credit limit among most Americans The average American had access to $30,233 in credit across all of their credit cards in 2023, according to Experian. But the average credit card balance was $5,221 — well below the average credit limit.