What is bank or credit record?

What is an example of a bank credit

Examples of Bank Credit

The most common form of bank credit is a credit card. A credit card approval comes with a specific credit limit and annual percentage rate (APR) based on the borrower's credit history. The borrower is allowed to use the card to make purchases.

What is a bank credit history

If you have a credit card or a loan from a bank, you have a credit history. Companies collect information about your loans and credit cards. Companies also collect information about how you pay your bills. They put this information in one place: your credit report.

What is a credit record and why is it important

A credit report is a detailed account of your credit history. They're an important measure of your financial reliability. Your credit report might be used in a variety of situations, from getting a credit card to buying a house – or even applying for a job.

Can my bank show me my credit score

Most banks and credit unions will give their customers complimentary access to their credit scores as well. Reviewing your score can help you stay on top of finances and get better terms on a future mortgage or auto loan.

What are 3 examples of types of credit

Types of CreditTrade Credit.Trade Credit.Bank Credit.Revolving Credit.Open Credit.Installment Credit.Mutual Credit.Service Credit.

What is another name for bank credit

synonyms for banker's credit

On this page you'll find 6 synonyms, antonyms, and words related to banker's credit, such as: circular note, credit memorandum, credit slip, l/c, and lettre de creance.

How do I check my bank credit history

Banks and other lenders check the CIBIL Score of the applicants before approving their loan or credit card application. Consumers can visit the official website of CIBIL to check their CIBIL Score and Report.

What is proof of credit history

This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records.

Does everyone have a credit record

Your credit record, or credit score, is a record of your financial history that includes details of money you've borrowed and repayments you've made. Here's what else it shows. Everyone has a credit score, and financial providers use them to know if someone presents a risk when they apply to borrow money.

What is a good credit record

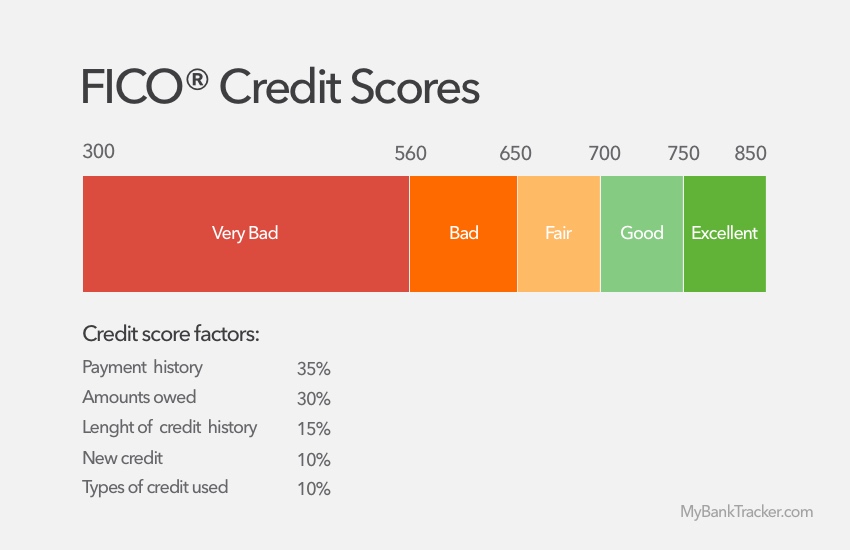

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

How do I find out my credit score for free

To get the free credit report authorized by law, go to AnnualCreditReport.com or call (877) 322-8228.

How much does it cost to check your credit score

You are entitled to get a free credit report annually from each of the nationwide credit reporting companies. It's a good idea to review your credit reports for free every 12 months. Most or all of the information that goes into a credit score comes from your credit report.

What are the 4 main types of credit

Four Common Forms of CreditRevolving Credit. This form of credit allows you to borrow money up to a certain amount.Charge Cards. This form of credit is often mistaken to be the same as a revolving credit card.Installment Credit.Non-Installment or Service Credit.

What is the most common credit type

The two most widely used types of credit scores are FICO Score and VantageScore.

What is another word for credit report

Credit File. Another term for your credit report. The term credit file is usually used to indicate the full record of your credit history maintained by a credit bureau.

What are the types of credit by banks

List of Top 8 Types of CreditTrade Credit.Trade Credit.Bank Credit.Revolving Credit.Open Credit.Installment Credit.Mutual Credit.Service Credit.

Can anyone see my credit history

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

Can you see bank accounts on a credit report

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

How do I find my credit record

How to check your credit reportCheck your Experian credit report through their partner website, MoneySavingExpert's Credit Club.Check your Equifax credit report through their partner website, ClearScore.Check your TransUnion credit report through their partner website, Credit Karma.

How do I get my credit history

You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com. Phone: Call (877) 322-8228. Mail: Download and complete the Annual Credit Report Request form .