What is best credit card if you have great credit?

What is the best credit card for good credit rating

Best Cards for Good Credit of June 2023Hilton Honors American Express Card: Best feature: Hilton hotel rewards.Discover it® Balance Transfer: Best feature: 0% Introductory APR.Discover it® Cash Back: Best feature: Cash back on everyday purchases.Chase Freedom Unlimited®: Best feature: Flexible cash back rewards.

Which credit card usually gives the highest credit limit

Highest “Overall” Credit Limit: $500,000

The winners of the nosebleed award for the highest credit limit among cards for mere mortals are these twins: Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, with annual fees in the mid-triple digits and high-double digits, respectively.

What credit cards can I get with 850 credit score

Popular Credit Cards for an 850 Credit ScoreNo Annual Fee & Great Rewards: Chase Freedom Unlimited®Travel Rewards: Capital One Venture X Rewards Credit Card.Rates & FeesCash Back: Wells Fargo Active Cash® Card.Rates & Fees Initial Bonus: Citi Premier® Card.Rates & FeesLow Intro APR: Wells Fargo Reflect® Card.

What is considered an excellent credit card

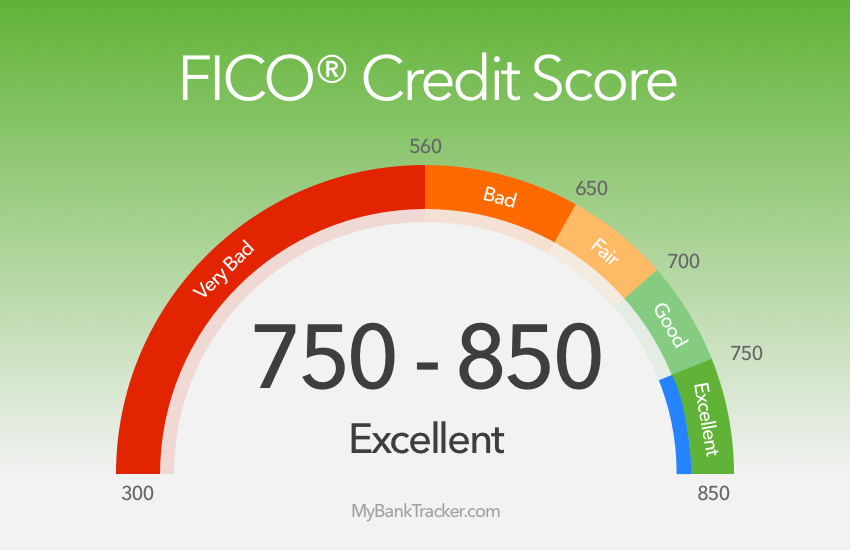

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What credit limit can I get with a 700 credit score

What credit score is needed to get a high-limit credit card

| VantageScore 3.0 credit score range | Average credit card limit |

|---|---|

| 300–640 | $3,481.02 |

| 640–700 | $4,735.10 |

| 700–750 | $5,968.01 |

| 750+ | $8,954.33 |

Feb 15, 2023

Is 850 credit score rare

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

How many people have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2023.

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

How rare is a 750 credit score

Your credit score helps lenders decide if you qualify for products like credit cards and loans, and your interest rate. You are one of the 46% of Americans who had a score of 750 or above in 2023, according to credit scoring company FICO. Here's how your 750 credit score can affect your financial life.

How big of a loan can I get with a 750 credit score

$50,000 – $100,000

You can borrow $50,000 – $100,000+ with a 750 credit score. The exact amount of money you will get depends on other factors besides your credit score, such as your income, your employment status, the type of loan you get, and even the lender.

How much is a 850 credit score worth in money

The average mortgage loan amount for consumers with Exceptional credit scores is $208,617. People with FICO® Scores of 850 have an average auto-loan debt of $17,030.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

How much credit can I get with a 800 credit score

Having younger accounts has a noticeable impact on other credit factors. Notably, consumers with a credit score of 800 or higher and a credit history of less than 10 years have an average credit limit of $50,798 — lower than the credit limit for all consumers.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

Why is it so hard to get a credit score of 850

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Can I get a 50K loan with a 650 credit score

For a loan of 50K, lenders usually want the borrower to have a minimum credit score of 650 but will sometimes consider a credit score of 600 or a bit lower. For a loan of 50K or more, a poor credit score is anything below 600 and you might find it difficult to get an unsecured personal loan.

Can I get a $50,000 personal loan with 700 credit score

You will likely need a minimum credit score of 660 for a $50,000 personal loan. Most lenders that offer personal loans of $50,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.