What is buying on credit 1920s?

What is buying on credit US history

Buying on Credit

Interest is a fee for borrowing money. The problem is that farmers were not the only people buying things on credit. Millions of Americans used credit to buy all sorts of things, like radios, refrigerators, washing machines, and cars. The banks even used credit to buy stocks in the stock market.

Cached

What is installment buying or buying on credit 1920s

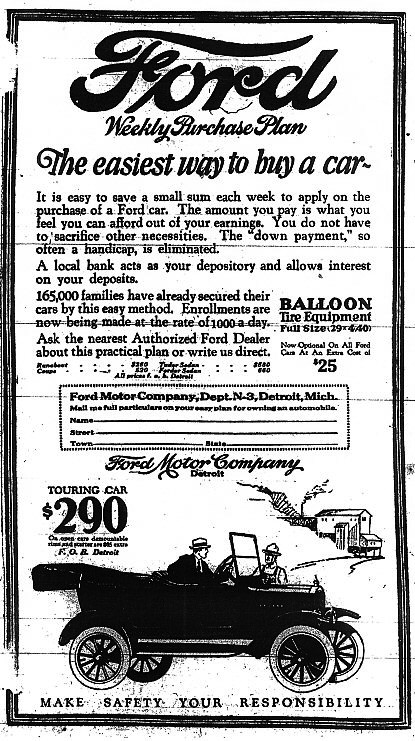

During the 1920s many Americans bought high-cost items, such as refrigerators and cars, on the installment plan, under which they would make a small down payment and pay the rest in monthly installments. Some buyers reached a point where paying off their debts forced them to reduce other purchases.

Cached

How did buying things on credit lead to problems in the 1920s

Consumerism was a culture that dominated the 1920s. It resulted in people buying things they didn't need and taking on debt they couldn't afford, which ultimately led to the stock market crash.

Cached

How did consumer credit work in the 1920s

From the 1920s to the early 1950s, we can see our modern-day consumer credit landscape take shape. Installment credit was used for car purchases and large household goods, such as refrigerators and radios. Everything else was paid for using revolving credit.

Cached

What does credit mean in 1920

Until the 1920s, Americans had to save their money to buy expensive goods. However, stores developed a way for people to make expensive purchases without having to save their money first. This was called consumer credit.

What is buying on credit 1920s quizlet

During the 1920s, buying stock on credit was called. buying on margin.

What does credit mean in the 1920s

Until the 1920s, Americans had to save their money to buy expensive goods. However, stores developed a way for people to make expensive purchases without having to save their money first. This was called consumer credit.

How did buying on credit affect the Great Depression

Buying on credit or using installment plans had been normalized in the 1920s, but the market crash in October 1929 resulted in a sharp drop in the number of consumers purchasing on credit by 1930, while households focused on paying off their existing debts.

Was buying on credit in the 1920s during the Great Depression

Buying on credit or using installment plans had been normalized in the 1920s, but the market crash in October 1929 resulted in a sharp drop in the number of consumers purchasing on credit by 1930, while households focused on paying off their existing debts.

What is buying on credit quizlet

credit extended to a consumer allowing the consumer to buy goods or services from a particular company and to pay for them later.

What was the effect of buying on credit during the 1920s quizlet

During the 1920's, many Americans were living beyond their means, buying things on credit that they could not afford. Businesses were mass-producing goods to keep up with demand, but when consumers' credit began running out, businesses had an over-production problem. This led to mass lay-offs of workers.

What is buying on credit also known as

A hire purchase (legally called a credit sale) is when you buy something and pay for it later. This means you: usually pay in instalments.

What effect did the use of credit on the economy in the 1920s

What effect did the overuse of credit have on the economy in the 1920s It made the economy weaker. How did the overproduction of goods in the 1920s affect consumer prices, and in turn, the economy Consumer demand decreased, prices decreased, and the economy slowed.

What is the difference between cash buying and credit buying

Despite the names, a cash transaction doesn't have to involve actual paper currency, and credit transactions can be paid using any method. So the main difference between cash and credit transaction is all about timing: A cash transaction will be paid immediately. A credit transaction will be paid at a later date.

What is the difference between cash and cash credit

The key difference between cash and credit is that one is your money (cash) and one is the bank's (or someone else's) money (credit).

What is the advantage of buying on credit

Convenience. Using credit cards when you travel or shop is more convenient than carrying cash. It also provides a handy record of transactions. Using a credit card also may give you some bargaining power if there is a dispute or disagreement involving a purchase.

What is the difference between cash and credit buying

The only difference between cash and credit transactions is the timing of the payment. A cash transaction is a transaction where payment is settled immediately and that transaction is recorded in your nominal ledger. The payment for a credit transaction is settled at a later date.

What does cash on credit mean

It is a short-term loan with a repayment period of up to 12 months. The interest rate is charged only on the amount withdrawn and not on the total sanctioned limit. You can withdraw money as many times as required from within the sanctioned limit. It is only offered if you provide collateral or security.

What does it mean to buy on credit

Using credit means you borrow money to buy something. You borrow money (with your credit card or loan). You buy the thing you want. You pay back that loan later – with interest.

Why was buying on credit bad

Buying on credit can also make your purchases more expensive, considering the interest you may pay on them. Getting into too much debt can not only hurt your credit score but also strain relationships with family and friends.