What is considered major derogatory credit?

How do I remove a major derogatory tax mark

How to rebuild your score after a derogatory markTry to make payments on time.Try to keep credit card balances below 30% of the credit limit.Look into using tools like a credit-builder or share-backed loan, becoming an authorized user on the credit card of someone with good credit, or getting credit with a co-signer.

Cached

What are major derogatory tradelines

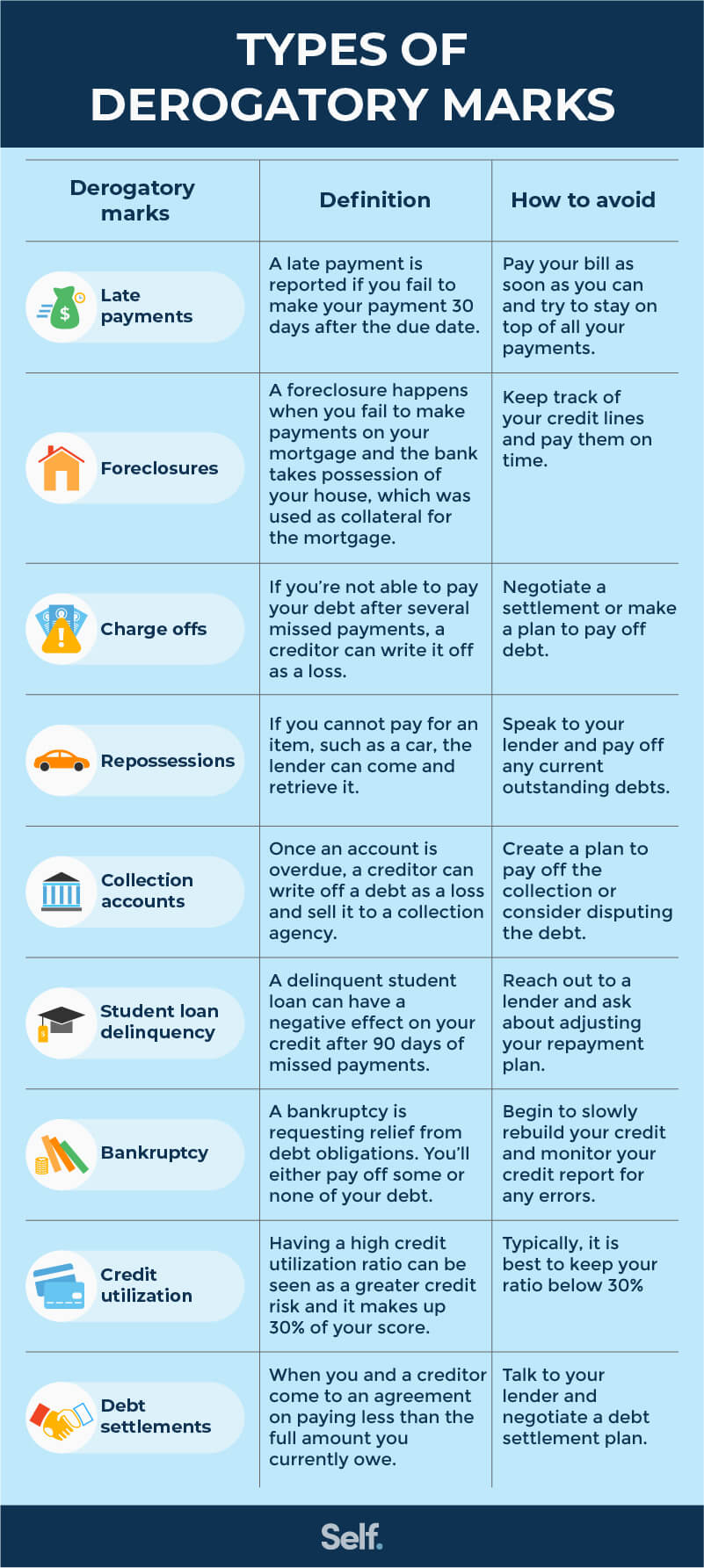

Major Derogatory Entries90, 120, 150-day late payments, etc.Charge-offs.Collections.Foreclosures.Settlements.Short sales.Repossessions.Public records (bankruptcies)

What are examples of derogatory credit

Here are examples of some of the common derogatory marks and what can cause them:Late payments typically appear on credit reports when an account is 30 days or more past due.Charge-offs happen when a creditor considers a debt a loss and closes an account, which generally occurs if an account is 180 days past due.

Cached

How long does it take for derogatory marks to fall off

seven years

The Fair Credit Reporting Act dictates how long each type of derogatory remark stays on your credit report, and the general rule is that most derogatory marks stay there for seven years.

Cached

What is a major derogatory account

A major derogatory credit item is typically defined as an account that is 90 days past due or more. If you have a major derogatory on your credit report, that is a huge red flag to lenders, and it may hinder you from being able to qualify for credit.

Can you buy a house with derogatory credit

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.

Will a derogatory mark go away if you pay it

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Should I pay off my derogatory accounts

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Should I pay off derogatory marks

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Can you buy a house with derogatory marks

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.

Will paying a derogatory mark go away

Making a payment doesn't automatically remove the negative mark from your report, but it does prevent you from being sued over the debt. Pay the full settled amount to prevent your account from going to collections or being charged off. Ask your lender if they will remove the item if you pay your debt in full.

Can a derogatory mark be removed

There are multiple reasons why you may have received a derogatory remark on your credit score. This could be because you've missed payments, filed for bankruptcy, haven't paid your debt or even because of an error. Depending on the type of remark, you can file a dispute or request a removal.

Can you have good credit with derogatory marks

Even if the derogatory mark is legitimate, you can start improving your credit. Make payments on any accounts that are past-due, and then consistently make the minimum payment on time. Keep your account balances low and only apply for new credit that you need.

Can derogatory marks be removed

There are multiple reasons why you may have received a derogatory remark on your credit score. This could be because you've missed payments, filed for bankruptcy, haven't paid your debt or even because of an error. Depending on the type of remark, you can file a dispute or request a removal.

Can you buy a house with a derogatory mark

Homebuyers can buy a house and qualify for a mortgage with derogatory credit. Borrowers do not need perfect credit to qualify for a home mortgage. You can have derogatory credit tradelines and qualify for FHA, VA, USDA, Conventional, Jumbo, and non-QM loans.

Will paying off derogatory accounts raise credit score

Contrary to what many consumers think, paying off an account that's gone to collections will not improve your credit score. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Law's editorial disclosure for more information.

Should I pay off a 5 year old collection

The best way is to pay

Most people would probably agree that paying off the old debt is the honorable and ethical thing to do. Plus, a past-due debt could come back to bite you even if the statute of limitations runs out and you no longer technically owe the bill.

Should I pay a closed derogatory account

It can be beneficial to pay off derogatory credit items that remain on your credit report. Your credit score may not go up right away after paying off a negative item. However, most lenders won't approve a mortgage application if you have unpaid derogatory items on your credit report.

How long before a debt becomes uncollectible

four years

The statute of limitations on debt in California is four years, as stated in the state's Code of Civil Procedure § 337, with the clock starting to tick as soon as you miss a payment.

Can a 7 year old debt still be collected

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt.