What is Credit Karma deposit limit?

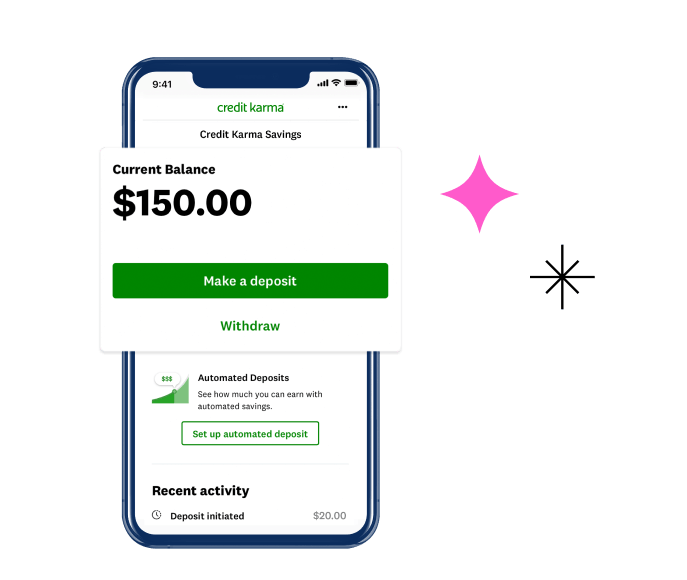

Can you deposit money into Credit Karma

You can make deposits into your Credit Karma Money Spend account using the following methods: Transfer from your Credit Karma Money Save account. Transfer from your linked external account. Deposit a check using the Credit Karma Mobile app.

Cached

How long does it take for Credit Karma to deposit money

Funds are generally available on the first business day after the day the deposit is received. Once your direct deposit is received, the funds will be available to you no later than the next business day but will often be available as soon as it is received.

Why won t Credit Karma let me withdraw money

Your Credit Karma Visa® Debit Card only provides direct access to funds in your Credit Karma Money Spend account. You will not be able to withdraw cash at an ATM or spend directly from your Credit Karma Money Save account.

Can I withdraw cash from Credit Karma

You can use your Credit Karma Visa® Debit Card to withdraw cash at any ATM that supports Visa. Fees may apply for ATM transactions outside of the Allpoint network.

How much cash can I deposit

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Can I deposit $4000 at ATM

Say, for example, your bank's ATMs only accepts a maximum of 40 bills — the cash deposit limit then ranges anywhere between $40 and $4,000, depending on the bills you insert into the machine.

Is Credit Karma transfer instant

Transfers between your accounts are immediate. From your Money home screen, scroll down to the Quick actions section and select the “Transfer money” option. Select “Internal transfer” to set up a transfer between your Spend and Save accounts. Enter the amount you would like to transfer.

Does Credit Karma direct deposit hit early

Early direct deposit is exactly what it sounds like. With Credit Karma Money Spend you can get access to your paycheck up to two days early. With Early Payday, there's no more waiting for payday while your money sits in some mysterious electronic limbo. Your money is posted as soon as the money is received.

What is the withdrawal limit for Credit Karma

You may not exceed $10,000.00 in daily transaction activity nor $50,000.00 in monthly transaction activity.

How do I withdraw large amounts on Credit Karma

Transfer to another accountGo to the Money tab in the Credit Karma app.Tap Spend account.Tap Transfer.Select Withdraw.Enter the amount you'd like to transfer.Select the account you want to transfer From and the account you want to transfer To.Confirm Withdraw amount.Confirm the transaction details, then tap Confirm.

What is the withdrawal limit

This is by far the most common use of the term “withdrawal limit.” Your bank's ATM withdrawal limit is the maximum amount of physical cash you can take out of an ATM in one 24-hour period. For example, many banks have a $500 limit, which means you can't take out more than $500 in cash during a single 24-hour period.

Is depositing $1000 cash suspicious

Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says. The federal law extends to businesses that receive funds to purchase more expensive items, such as cars, homes or other big amenities.

Can you deposit $5000 in cash

How much cash can you deposit You can deposit as much as you need to, but your financial institution may be required to report your deposit to the federal government.

Can I deposit 7000 at an ATM

Also check whether any limits apply to cash deposits. In most cases, there is no cap on the dollar amount you can deposit through an ATM. However, there may be a maximum number of items you can deposit. Wells Fargo, for instance, limits the number of bills and checks you can deposit to 30 per transaction.

Can I deposit a $10000 check at an ATM

Your Bank Account May Have Limits

Verify with your bank that you can deposit $10,000 or more into your account. “Depending on your bank and the specific amount you have, you may be charged fees or penalties for making large deposits,” Solomon said.

Why does Credit Karma take so long to deposit

Funds transferred into your Credit Karma Money accounts are not available for immediate withdrawal. The process typically takes 2-3 days. This additional time aims to prevent returned transfers and overdrafts on your external bank account.

How do I withdraw money from Credit Karma instantly

Access your Credit Karma Money Save account.Select Withdraw.Enter the desired amount under Withdrawal amount.Select Withdraw after making your selections.On the confirmation screen, make sure all the information is correct and choose Confirm to complete your withdrawal request.

Can I load money on my Credit Karma card at Walmart

Although Credit Karma Money members cannot deposit cash directly into their Spend or Save accounts, we can accept merchant deposits from retailers that offer this service, such as participating Walmart locations.

What bank does Credit Karma use

MVB Bank, Inc.

We partner with MVB Bank, Inc., Member FDIC, to provide banking services supporting Credit Karma Money™ Spend and Credit Karma Money™ Save12 accounts. When you open a Credit Karma Money™ Spend account, your funds will be deposited into an account at MVB Bank, Inc. and its deposit network.

Can I load money on my credit karma card at Walmart

Although Credit Karma Money members cannot deposit cash directly into their Spend or Save accounts, we can accept merchant deposits from retailers that offer this service, such as participating Walmart locations.