What is deferred interest on credit card?

Does deferred interest hurt your credit

If you don't pay off your balance during the deferred interest period, for example, then the deferred interest will be added to the balance you owe. That will increase your credit utilization ratio, which could hurt your credit scores.

Cached

How do you avoid paying deferred interest charges

How to avoid getting hit with deferred interest. Avoiding deferred interest is straightforward — you just have to follow through on the exact terms of the offer, including paying off your balance in full before the promotional period expires. Also make sure you make your minimum payments on time.

How do you pay deferred interest

Deferred interest is when interest payments are deferred on a loan during a specific period of time. You will not pay any interest as long as your entire balance on the loan is paid off before this period ends. If you do not pay off the loan balance before this period ends, then interest charges start accruing.

Cached

What are the pros and cons of deferred interest

Deferred interest mortgages can offer homebuyers the advantage of lower monthly payments for a set amount of time. However, these loans also carry risks because the monthly payments increase. So, if you can't afford the higher payments, you would risk defaulting on the loan and potentially losing your home.

Do you have to pay back deferred interest

Deferred interest means the issuer keeps track of the interest from day one, and if you don't pay off the entire balance by the end of the promotion, you'll be charged all of the accumulated interest at once (even if you only owe a penny of the original amount).

Is deferred payment good or bad

Deferments do not hurt your credit score. Unlike simply missing a payment or paying it late, a deferred payment counts as “paid according to agreement,” since you arranged it with your lender ahead of time. That's especially important if you're already in the kind of emergency that would call for a deferment.

Is deferred interest bad

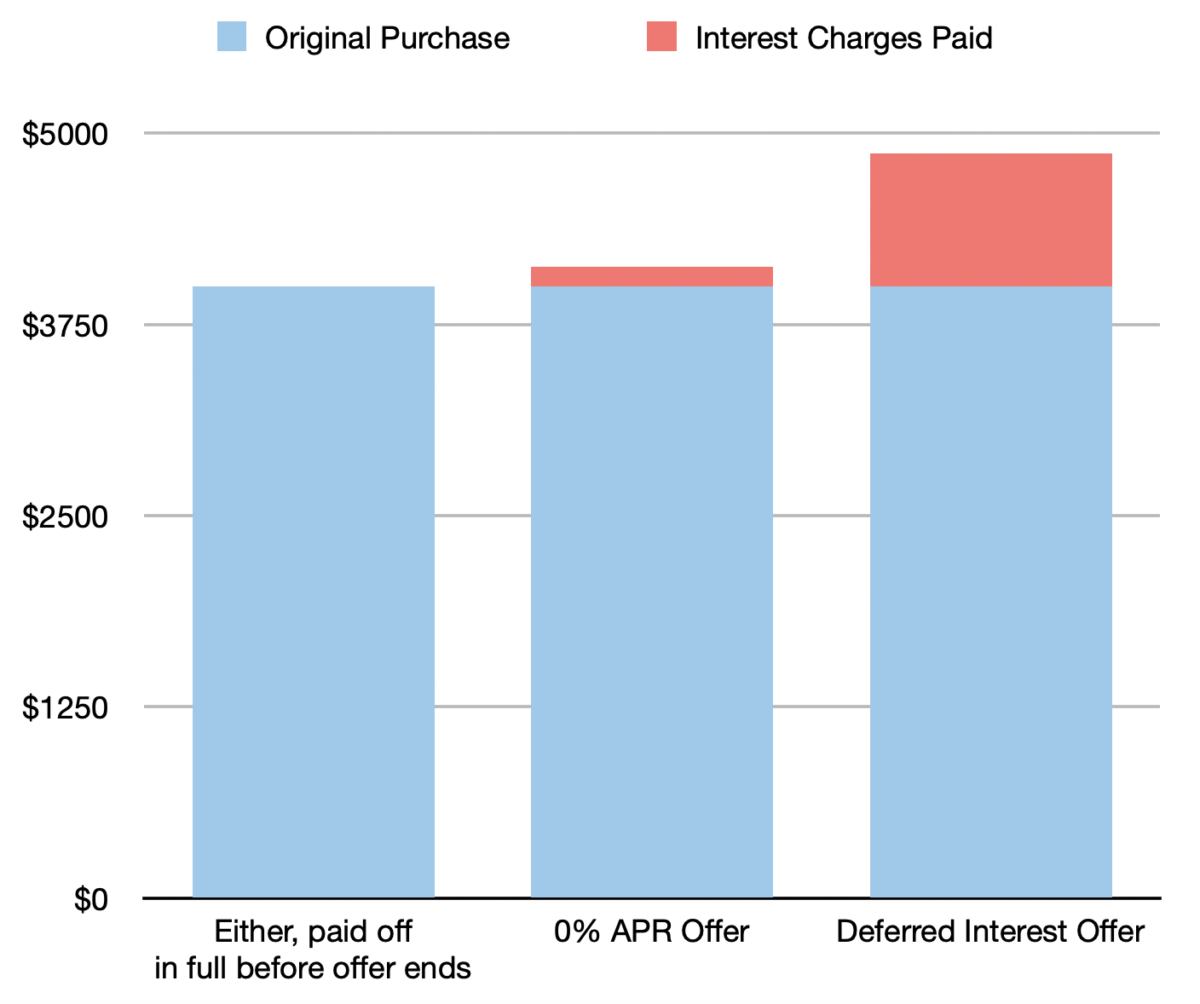

Is deferred interest worth it It's generally best to avoid deferred interest offers in favor of safer options. Remember, if you're late on a payment, or if you fall even one penny short of repaying your balance in full within the promotional period, you'll be on the hook for significant interest charges.

Why did I get charged interest on my credit card after I paid it off

This means that if you have been carrying a balance, you will be charged interest – sometimes called “residual interest” – from the time your bill was sent to you until the time your payment is received by your card issuer.

Is deferred interest taxable

You don't have to report deferred interest on your federal income tax return until you are filing your return for the year in which the first of these events occurs: You cash the HH bond. The HH bond stops earning interest. (This happens 20 years after issue.)

Is being deferred good or bad

A deferral means the college wants to review your application again with the regular decision pool of applicants. While it might feel like a rejection, a deferral is not a denial, nor does it mean there was something wrong with your application.

Is deferred interest good

Is deferred interest worth it It's generally best to avoid deferred interest offers in favor of safer options. Remember, if you're late on a payment, or if you fall even one penny short of repaying your balance in full within the promotional period, you'll be on the hook for significant interest charges.

How long does a deferred payment last

How Long Is a Student Loan Deferment If you qualify, student loan deferment allows you to stop making payments on your loan for up to three years.

Is deferred interest legal

While the Credit CARD Act does not explicitly ban deferred interest, these promotions technically violate two provisions of the Credit CARD Act. However, the Federal Reserve carved out an exception, asserting that Congress intended to preserve these plans.

What does 12 months deferred interest payment required

How interest is calculated: A deferred interest plan means that you won't have to pay any interest on the purchase if you pay it off within the specified time frame – in this case, 12 months.

Should I pay off my credit card in full or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

Do I get charged interest if I pay off my credit card every month

A credit card can be a great way to make purchases and earn rewards. And if you pay off your credit card's last statement balance in full every month, you may not have to worry about extra charges—like interest. But things can happen, and you may find yourself carrying a balance and accruing interest on that balance.

Does deferred interest mean no interest

Quick Answer. Deferred interest is a period of time during which you won't pay interest charges on a credit account. If you don't pay your balance in full before the period expires, you'll incur all the retroactive interest from the time you opened the account.

What triggers deferred tax

What causes a deferred tax liability Any temporary difference between the amount of money owed in taxes and the amount of money that is required to be paid in the current accounting cycle creates a deferred tax liability.

Why are so many people getting deferred

A student is deferred when there isn't enough information or context to put them through a full acceptance. The student might be a strong applicant but the school needs more. They might need to see your entire application and how it stands next to the rest of the applicants.

How do I get out of a deferral

Our counselors have some tips on what you can do if you're deferred.Revisit Your School List.Find Out What the College Needs From You.Compose a Letter of Continued Interest (LOCI) or Deferral Letter.Seek Additional Recommendation Letters.Consider Updating Your Application.Visit.Send Additional Grades and Test Scores.