What is DR and CR in journal entry?

What is the DR and CR rule for journal entry

Rules for Debit and Credit

First: Debit what comes in, Credit what goes out. Second: Debit all expenses and losses, Credit all incomes and gains.

What is a debit and credit in a journal entry

Debits are recorded on the left side of an accounting journal entry. A credit increases the balance of a liability, equity, gain or revenue account and decreases the balance of an asset, loss or expense account. Credits are recorded on the right side of a journal entry. Increase asset, expense and loss accounts.

Cached

What is CR and DR in accounting

An increase in liabilities or shareholders' equity is a credit to the account, notated as "CR." A decrease in liabilities is a debit, notated as "DR." Using the double-entry method, bookkeepers enter each debit and credit in two places on a company's balance sheet.

Cached

What is DR in journal entries

A debit (DR) is an entry made on the left side of an account. It either increases an asset or expense account or decreases equity, liability, or revenue accounts (you'll learn more about these accounts later).

Cached

Does Dr mean I owe money

Overdrawn balance is marked with the letters dr (meaning debit). An overdraft facility fee will apply per annum or per overdraft sanction (whichever is the more frequent). Credit Transfer – This is a manual lodgement to your account from a branch or bank other than the account holding branch.

What are the 5 rules of debit and credit

+ + Rules of Debits and Credits: Assets are increased by debits and decreased by credits. Liabilities are increased by credits and decreased by debits. Equity accounts are increased by credits and decreased by debits. Revenues are increased by credits and decreased by debits.

What is a debit and credit for dummies

You may be asking: what's the difference between a debit and a credit In double-entry accounting, debits record incoming money, whereas credits record outgoing money. For every debit in one account, another account must have a corresponding credit of equal value.

Does debit mean you owe money

Debits are the opposite of credits. Debits represent money being paid out of a particular account; credits represent money being paid in.

Does CR mean I owe money

If there is “CR” next to the amount, it means your credit card had a credit balance on the statement date, so you don't need to make any payment for this period.

Is debit money in or out

Simply put, debit is money that goes into an account, while credit is money that goes out of an account.

What are the three golden rules of debit and credit

Before we analyse further, we should know the three renowned brilliant principles of bookkeeping: Firstly: Debit what comes in and credit what goes out. Secondly: Debit all expenses and credit all incomes and gains. Thirdly: Debit the Receiver, Credit the giver.

What are the 3 golden rules of accounting

Take a look at the three main rules of accounting: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit expenses and losses, credit income and gains.

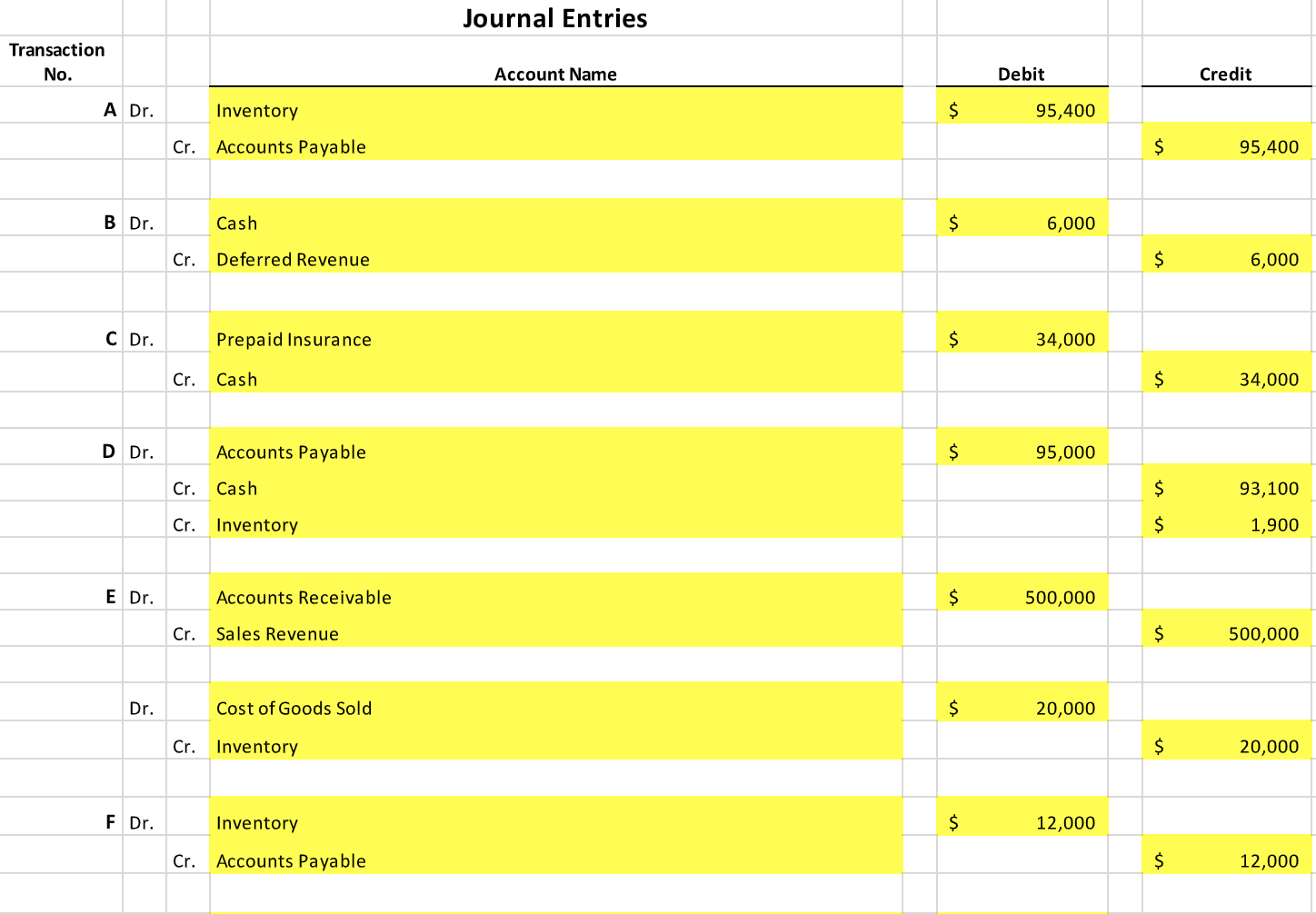

What is an example of a debit and credit

Debits and Credits in Common Accounting TransactionsSale for cash: Debit the cash account | Credit the revenue account.Sale on credit: Debit the accounts receivable account | Credit the revenue account.Receive cash in payment of an account receivable: Debit the cash account | Credit the accounts receivable account.

Is a debit balance positive or negative

A debit balance is a negative cash balance in a checking account with a bank.

Does debit mean gain or loss

A debit increases the balance and a credit decreases the balance. Gain accounts. A debit decreases the balance and a credit increases the balance.

Is a debit to cash positive or negative

A debit balance is a negative cash balance in a checking account with a bank.

Does debit mean cash

When cash is received, the cash account is debited. When cash is paid out, the cash account is credited.

What is the correct rule of debits and credits

Revenues are increased by credits and decreased by debits. Expenses are increased by debits and decreased by credits. Debits must always equal credits after recording a transaction.

What are the 5 rules of Debit and Credit

Difference between Debit and Credit:

| Credit | Debit |

|---|---|

| Credit the giver | Debit the receiver |

| Nominal Account | |

| Credit all incomes and gains | Debit all expenses and losses |

| Real Account |

What are the rules of debits and credits

+ + Rules of Debits and Credits: Assets are increased by debits and decreased by credits. Liabilities are increased by credits and decreased by debits. Equity accounts are increased by credits and decreased by debits. Revenues are increased by credits and decreased by debits.