What is Dun Bradstreet score?

What is a good score on Dun and Bradstreet

80 to 100

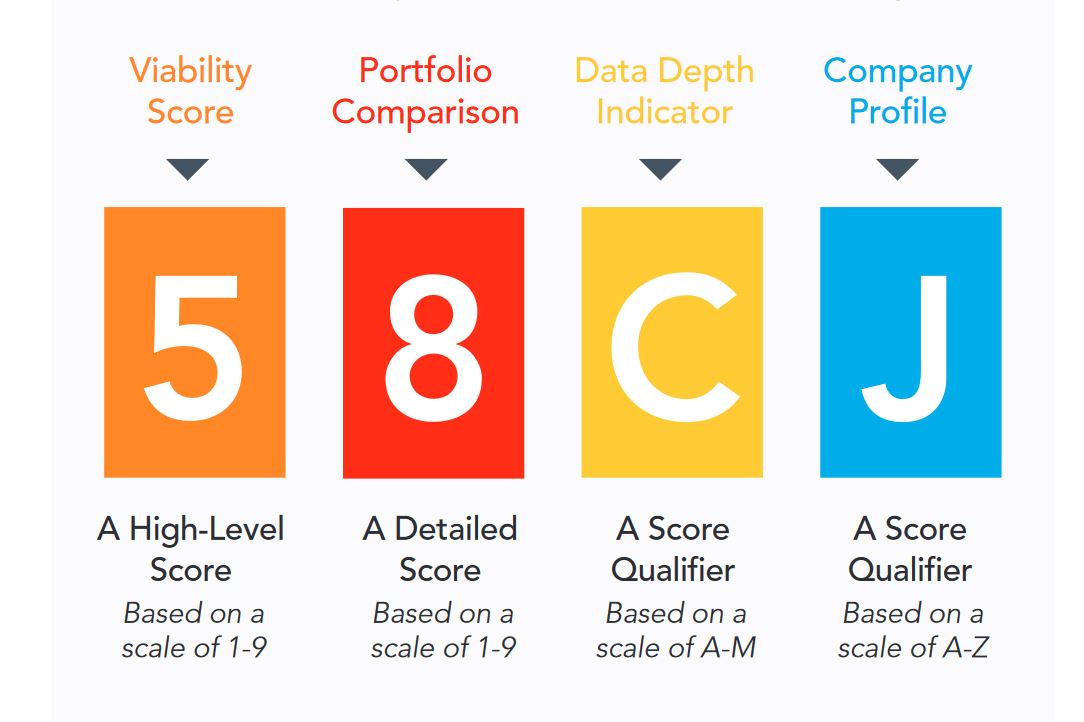

Types of D&B ratings

To be eligible for loans and decent credit ratings, this particular score should fall within the 80 to 100 range. Anything lower than that may indicate difficulty with making payments. Businesses within the 0 to 49 range are considered high risk and would dissuade investors or lenders.

Cached

What is a Dun & Bradstreet score of 76

Dun & Bradstreet

A score of 1–49 indicates a high risk of late payment, 50–79 indicates moderate risk, and 80–100 represents low risk. To view your credit file, you'll need the CreditBuilder™ Plus product.

What is a D&B business credit score

A D&B report is a business credit report used to assess the creditworthiness of a company. A D&B report typically has three main scores that assess this business credit, which includes the PAYDEX score, the commercial credit score, and the financial stress score.

Cached

How is D&B score calculated

How Is the D&B Failure Score Calculated Dun & Bradstreet aggregates company information from a variety of sources. These include public records, financial statements, and past payment experiences. The Failure Score also weighs a company's demographics against those of similar firms in the same industry.

How do I increase my DUNS score

On the Dun & Bradstreet PAYDEX score, paying on time can get you a score of 80, but paying early could get you to 100. Whatever you do, avoid paying late or allowing your accounts to become delinquent at all costs. Late payments could indicate that your business has financial problems and therefore damage your score.

Can you get a business loan with a DUNS number

Get Government Grants & Loans

In many cases, not having a DUNS number will make it difficult to apply for (and win) government contracts for your business. Similarly, applying and getting approved for Small Business Administration (SBA) loans is easier with a DUNS number.

What is the highest DUNS score

Dun & Bradstreet assigns scores on a scale of 1 to 100, with 100 being the best possible PAYDEX Score. Scores are divided into three Risk Categories, with 0 to 49 indicating a high risk of late payment, 50 to 79 indicating a moderate risk, and 80 to 100 indicating a low risk.

What is the lowest business credit score

Business credit scores range from zero to 100 and most small business lending companies require a minimum business credit score of 75.

What does B score mean

A+, A, A- indicates excellent performance. B+, B, B- indicates good performance. C+, C, C- indicates satisfactory performance. D+, D, D- indicates less than satisfactory performance.

Does my LLC credit affect my credit score

Does starting an LLC affect your credit score Starting an LLC will not directly affect your personal credit score unless you decide to personally guarantee or cosign a loan for your company.

What is the benefit of having a DUNS number

The greatest benefit of establishing a DUNS number for your small business is that anyone seeking to better understand your business' credit history and creditworthiness will likely look to Dun & Bradstreet to find this information. Businesses that contract with government agencies are required to have a DUNS number.

Can you use your DUNS number for credit

You can't apply for a business credit card with a DUNS number. DUNS stands for “Data Universal Numbering System.” It's a system developed by Dun & Bradstreet, one of the major business credit bureaus.

How do I qualify for a Dun and Bradstreet number

Obtaining a DUNS number is absolutely Free for all entities doing business with the Federal government. This includes grant and cooperative agreement applicants/prospective applicants and Federal contractors. Be certain that you identify yourself as a Federal grant applicant/prospective applicant.

What is a good credit score for business

Businesses are ranked on a scale between 101 to 992, with a lower score correlating to a higher risk of delinquency. A good Business Credit Risk Score is around 700 or higher.

What credit score does an LLC start with

You're aiming for a score of at least 75 in order to start getting favorable terms and taking advantage of having a strong business credit rating. The basic steps to start the process of establishing credit for your LLC are as follows: Get an EIN from the IRS. Register for a D-U-N-S number.

Can I get a business loan with a 550 credit score

Yes, it is possible to get a small business loan even if you have bad credit. This is because your credit score doesn't matter as much as the overall financial health of your business. Many lenders require a minimum credit score of 500, at least six months in business, and more than $30,000 in annual revenue.

Which rating is better BB or BBB

'BBB' National Ratings denote a moderate level of default risk relative to other issuers or obligations in the same country or monetary union. 'BB' National Ratings denote an elevated default risk relative to other issuers or obligations in the same country or monetary union.

Is it easier to get business credit with LLC

Getting Financing for Your LLC

One of the biggest benefits of establishing credit for your LLC is the ability to get access to more financing options. Some lenders simply won't lend to sole proprietorships; your business must be its own legal entity.

Does having an LLC help your credit

Starting an LLC gives your business the opportunity to pay vendors, utilities, credit cards, and loans on time, which will help to build your LLC's credit score. Separate your finances. Starting an LLC is an important step in separating your personal finances from your business finances.

Can you get business credit without DUNS

To get a business credit score from Dun & Bradstreet, one of the three major business credit bureaus, you first need a DUNS number.