What is export credit insurance in simple terms?

What is an example of export credit

One example would be a bank supporting a domestic company's export and an export credit agency helping the international organization on the receiving end. Similarly to banks, export credits or insurance can be supplied for short-term (up to 2 years), medium-term (2 to 5 years), and long-term (over 5 years).

Cached

What is export credit short note

The Organisation for Economic Co-operation and Development (OECD) notes that 'export credit' is an insurance, guarantee or financing arrangement which enables a foreign buyer of exported goods and/or services to defer payment over a period of time.

What are the benefits of export insurance

Export credit insurance providers protect your sales from political risks, including import/export changes and foreign government intervention. Few companies can effectively compete without extending credit to their buyers.

Cached

What is the concept of credit insurance

Credit insurance is a type of insurance policy purchased by a borrower that pays off one or more existing debts in the event of a death, disability, or in rare cases, unemployment.

What is the purpose of export credit

An export credit agency offers trade finance and other services to facilitate domestic companies' international exports. Most countries have ECAs that provide loans, loan guarantees and insurance to help eliminate the uncertainty of exporting to other countries.

What is the role of export credit

ECGC is essentially an export promotion organisation, seeking to improve the competitiveness of the Indian exports by providing them with credit insurance covers. ECGC Ltd. also administers the National Export Insurance Account (NEIA) Trust which caters to project exports of strategic and national importance.

What is an advantage of export credit

Can take advantage of competitive prices in markets not otherwise available. Does not have to pay up front for the goods before they arrive. Can use credit terms to manage cash flow. Treats the export finance provider as the supplier, therefore is not taking on debt.

How many major advantages are in export credit insurance

Benefits of Export Credit Insurance

Credit Insurance helps you overcome unforeseen payment issues beyond your control in a foreign country. Receive Compensation in Case of Non-Payment Loss. Export Credit Insurance pays out up to 95% of unpaid invoices.

What is an example of credit insurance

For example, you may be offered insurance that will pay or reduce your monthly loan payment if you become disabled, or that will pay off or reduce your loan if you die. If it is credit property insurance, it usually pays the lesser amount between the value of the item or the balance of the loan.

Why do you need credit insurance

Credit insurance can cover and protect you from multiple different risks. This includes protection in case a customer is not paying or if a supplier is not delivering or has gone bust. Credit insurance also keeps watch on customers' credit to give warnings and help reduce exposure to potential bad debt.

What are the risks of export credit

Credit risk is the chance that your buyer will not pay you for what you have exported to them. It can happen for a number of reasons, including political instability, economic problems, or even fraud. The best way to protect yourself from credit risk is to do homework on your buyers before you agree to export to them.

What are the disadvantages of export credit

Disadvantages of Export Credit Insurance Policy

The Policy may not cover high-risk accounts – In most scenarios, the trade credit insurance policies may not be available for accounts with high credit risk. Besides, those that offer the coverage often charge very high fees.

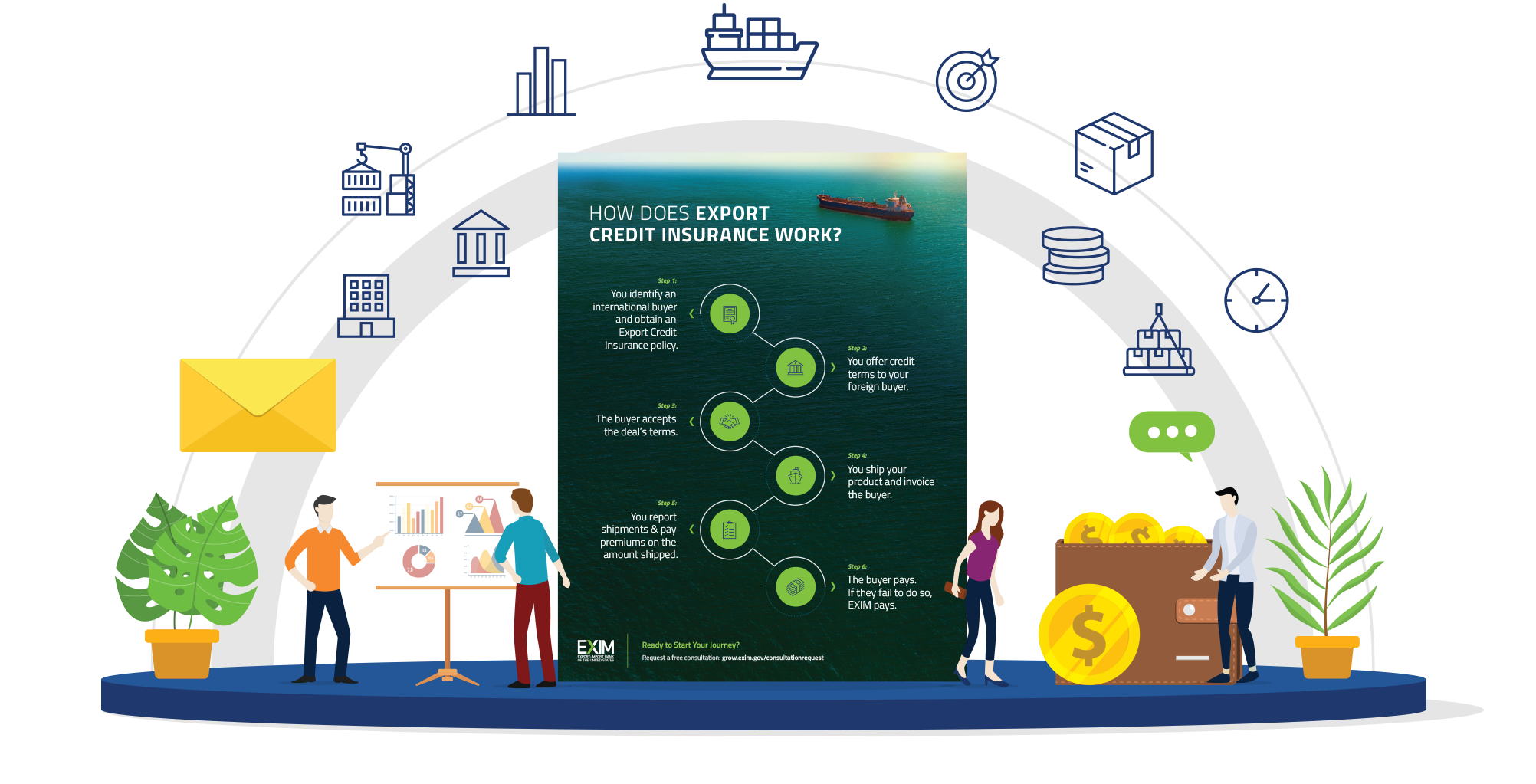

How does export credit work

An export credit agency offers trade finance and other services to facilitate domestic companies' international exports. Most countries have ECAs that provide loans, loan guarantees and insurance to help eliminate the uncertainty of exporting to other countries.

What is a disadvantage of export credit

Disadvantages of Export Credit Insurance Policy

The Policy may not cover high-risk accounts – In most scenarios, the trade credit insurance policies may not be available for accounts with high credit risk. Besides, those that offer the coverage often charge very high fees.

What is the most common type of credit insurance

Whole turnover credit insurance

This is the most common type of credit insurance policy and it covers all (or most) of a business through a comprehensive policy based on its turnover – protecting a business from non-payment from all current and future customers over a typical 12 month period.

What type of insurance is credit insurance

Credit insurance is optional insurance sold with a credit transaction, such as a mortgage or car loan, promising to pay all or a portion of the outstanding credit balance if the insured is unable to make their payments due to a covered event, such as loss of employment, illness, disability, or death.

When would a person use credit insurance

Credit insurance is optional insurance that make your auto payments to your lender in certain situations, such as if you die or become disabled. When you are applying for your auto loan, you may be asked if you want to buy credit insurance.

Do you need credit protection insurance

Generally, most borrowers don't need credit insurance if they have other life or health insurance policies in place. Lenders may offer you the option to buy credit insurance when applying for an auto loan, an unsecured personal loan or a credit card. A lender cannot require you to purchase credit insurance.

What are the three 3 main types of insurance

Health insurance. It allows the insured to cover up medical expenses while visiting a doctor and other major costs usually involved during surgeries.Life insurance.Rental or property insurance.

What are the 3 most important insurance

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.