What is included in credit terms?

What are common credit terms

Common Credit TermsInterest Rate. When you borrow money, like with a loan, you incur a fee that's known as an interest rate.Annual Percentage Rate (APR)Minimum Payment.Principal Balance.Billing Cycle.Credit Utilization.Payment Terms.Refinancing.

Cached

What are credit terms of credit

Credit terms are the terms and conditions applicable for the sales made on credit. Such terms could be anything from possible discounts or late fines in cases of defaults. Today, almost every materialistic item can be bought on credit, and there are many easy options to avail of the same.

What are the essential elements of credit terms

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

What is an example of credit terms in accounting

The terms which indicate when payment is due for sales made on account (or credit). For example, the credit terms might be 2/10, net 30. This means the amount is due in 30 days; however, if the amount is paid in 10 days a discount of 2% will be permitted.

What are the 5 credit related terms

This review process is based on a review of five key factors that predict the probability of a borrower defaulting on his debt. Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral.

What are 3 key terms on credit

The terms associated with a credit account. They include APR, credit limit, payment schedule, and fees (such as late-payment, over-limit, or annual fees.)

What are the 5 components of credit

The 5 Factors that Make Up Your Credit ScorePayment History. Weight: 35% Payment history defines how consistently you've made your payments on time.Amounts You Owe. Weight: 30%Length of Your Credit History. Weight: 15%New Credit You Apply For. Weight: 10%Types of Credit You Use. Weight: 10%

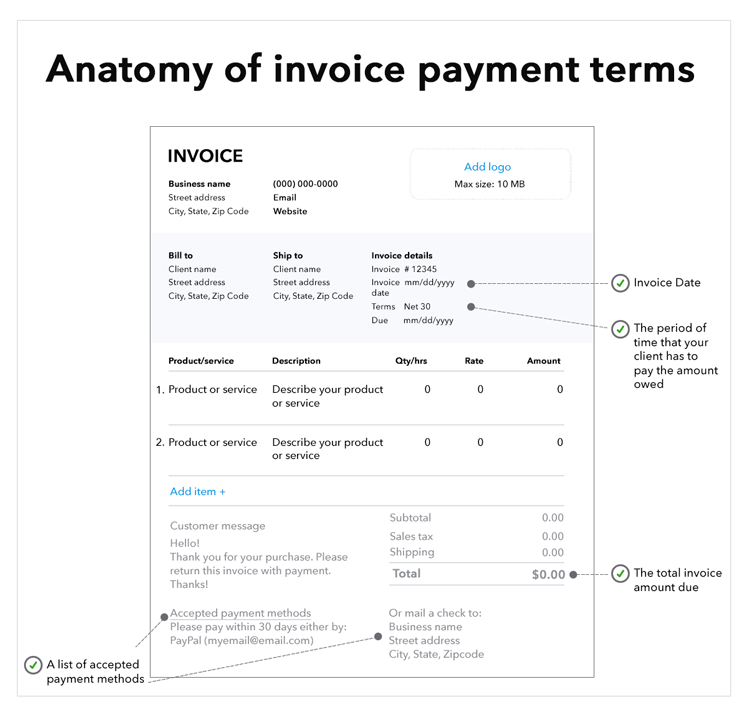

What is a credit term in accounting

What are Credit Terms Credit terms are the payment requirements stated on an invoice. It is fairly common for sellers to offer early payment terms to their customers in order to accelerate the flow of inbound cash.

What are the three main terms of credit

The three main types of credit are revolving credit, installment, and open credit.

What are the 8 types of credit

Trade Credit, Consumer Credit, Bank Credit, Revolving Credit, Open Credit, Installment Credit, Mutual Credit, and Service Credit are the types of Credit.

What are the 7 basic components of a credit score

We'll break down each of these factors below.Payment history: 35% of credit score.Amounts owed: 30% of credit score.Credit history length: 15% of credit score.Credit mix: 10% of credit score.New credit: 10% of credit score.Missed payments.Too many inquiries.Outstanding debt.

What are the four main terms of credit

Terms of credit have elaborate details like the rate of interest, principal amount, collateral details, and duration of repayment. All these terms are fixed before the credit is given to a borrower.

What are the five terms of credit

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral.

What are the 4 terms of credit

Terms of credit have elaborate details like the rate of interest, principal amount, collateral details, and duration of repayment. All these terms are fixed before the credit is given to a borrower.

What are the 5 Cs of credit

Lenders score your loan application by these 5 Cs—Capacity, Capital, Collateral, Conditions and Character. Learn what they are so you can improve your eligibility when you present yourself to lenders.

What are the 3 Cs of credit

Students classify those characteristics based on the three C's of credit (capacity, character, and collateral), assess the riskiness of lending to that individual based on these characteristics, and then decide whether or not to approve or deny the loan request.

What are 3 items not included in a credit score

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education.

What are the 5 C’s of credit

What are the 5 Cs of credit Lenders score your loan application by these 5 Cs—Capacity, Capital, Collateral, Conditions and Character. Learn what they are so you can improve your eligibility when you present yourself to lenders.

What are the 3 important terms of credit

Various terms of credit:Principal: The principal is the amount of money borrowed from a lender without including the interest.Interest: Interest is the cost that a borrower pays to a lender for using their money.Collateral: Collateral is any asset that a borrower pledges to a lender to secure a loan.

Which of the following is not a term of credit

Hence, the correct answer is that savings are not included in terms of credit.