What is journal entry for credit purchase?

What is the journal entry of credit purchases

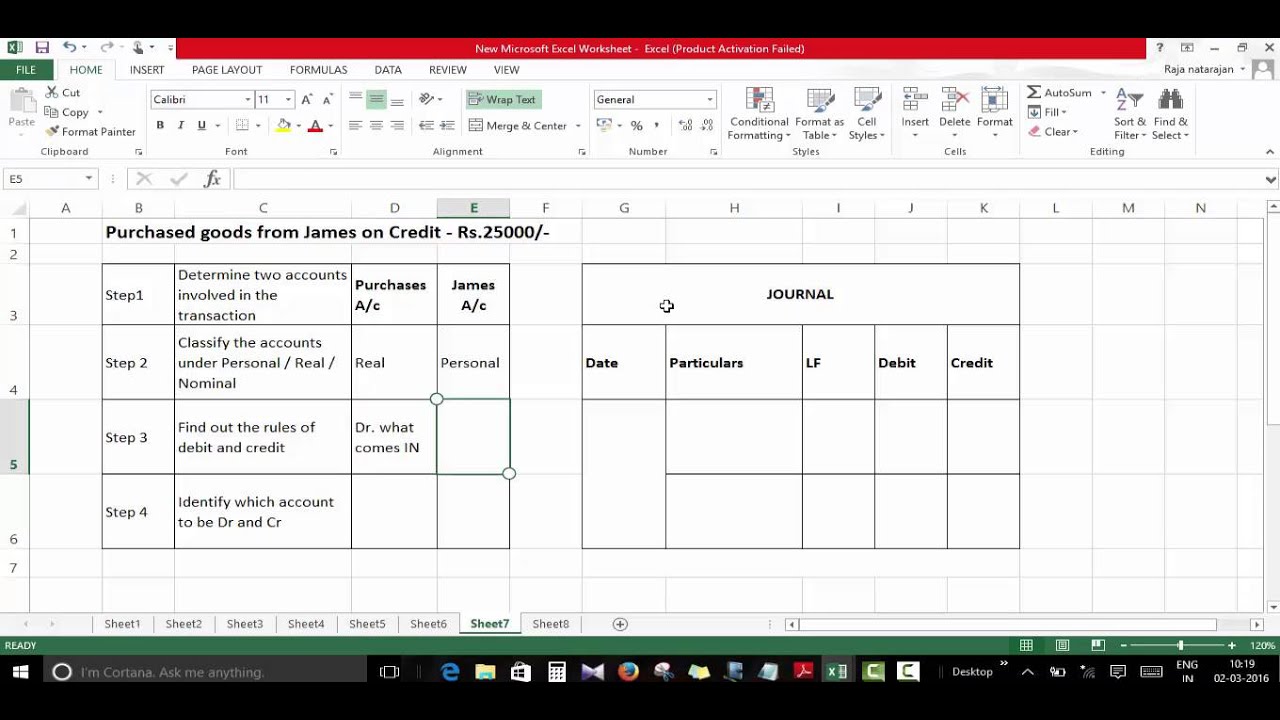

What is the Purchase Credit Journal Entry Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit. The purchases account will be debited.

Cached

How do you record credit purchases in accounting

A business records a purchase credit journal entry in its purchases journal at the time it purchases goods on credit from its vendors. When the business makes a purchase on credit, it debits the purchases account in its purchases journal, which will show up on the business's income statement.

Cached

How do you write a journal entry for credit

Debits are always entered on the left side of a journal entry. Credits: A credit is an accounting transaction that increases a liability account such as loans payable, or an equity account such as capital. A credit is always entered on the right side of a journal entry.

What is an example of a credit purchase

A credit purchase, or to purchase something “on credit,” is to purchase something you receive today that you will pay for later. For example, when you swipe a credit card, your financial institution pays for the goods or services up front, then collects the funds from you later.

How do I record a credit purchase in Quickbooks

Step 1: Enter a vendor creditSelect + New.Select Vendor credit or Receive vendor credit.In the Vendor dropdown, select your vendor.Depending on how you record purchases with this vendor, enter the Category details or Item details.Select Save and close.

What is a journal entry debit or credit

Journal entries consist of two sides: debits and credits.

Debits are dollar amounts that accountants post to the left side of the journal entry, and credits are dollar amounts that go on the right.

Is a credit purchase a liability or asset

When goods are purchased on credit, stock increases which is an asset and creditors increase, which is a liability.

What type of account is credit purchases

Credit Purchases in Accounting

Due to the credit purchase, an account receivable and an account payable are then created. The account payable is the current liability for the buyer, and they will pay the supplier at an agreed later date. The buyer should record it as a Credit Purchase.

Which journal is used to record purchases made on credit

Purchase Journal The purchases journal

Purchase Journal

The purchases journal is used to record all purchases on credit.

Which book is used to record credit purchases

Purchase Book

Purchase Book records all credit purchases of goods.

What are examples of debit and credit journal entries

Say you purchase $1,000 in inventory from a vendor with cash. To record the transaction, debit your Inventory account and credit your Cash account. Because they are both asset accounts, your Inventory account increases with the debit while your Cash account decreases with a credit.

Is purchases a debit or credit

debit

Purchases are an expense which would go on the debit side of the trial balance.

What is the double entry for credit purchases

Double entry is a system of Debit and Credit entries to describe the dual effect of a transaction. Every double entry must balance, with equal values on the Debit and Credit sides. A useful mnemonic to help you remember your double entry basics is DEAD CLIC.

Where is credit purchase of asset recorded

the Purchase book

All credit purchases are recorded in the Purchase book. Only credit purchases are recorded in the purchase book and not cash purchases. Goods are things that are produced for resale in a business. Any purchase of assets is not recorded in the Purchases book.

Is credit purchase an expense

Yes – I did answer your question! Purchases is an expense of the business – so it decreases the profit (and hence the equity) and if it is on credit then it increases the liability. Separately, if any of the purchases are unsold then we have inventory.

Are credit purchases recorded in the purchases journal

All credit purchases of goods are recorded in the purchase journal while cash purchases are recorded in cash book.

Which journal can be used for credit purchases within a business

Purchase Journal The purchases journal

Purchase Journal

The purchases journal is used to record all purchases on credit.

What is an example of credit entry in accounting

For example, if a business purchases a new computer for $1,200 on credit, it would record $1,200 as a debit in its account for equipment (an asset) and $1,200 as a credit in its accounts payable account (a liability).

What account is credit purchases

Credit Purchases in Accounting

Due to the credit purchase, an account receivable and an account payable are then created. The account payable is the current liability for the buyer, and they will pay the supplier at an agreed later date. The buyer should record it as a Credit Purchase.

What is credit purchase

A credit purchase, or to purchase something “on credit,” is to purchase something you receive today that you will pay for later. For example, when you swipe a credit card, your financial institution pays for the goods or services up front, then collects the funds from you later.