What is limit of the amount of money you could insure in 2008?

What was the FDIC insurance limit in 2008

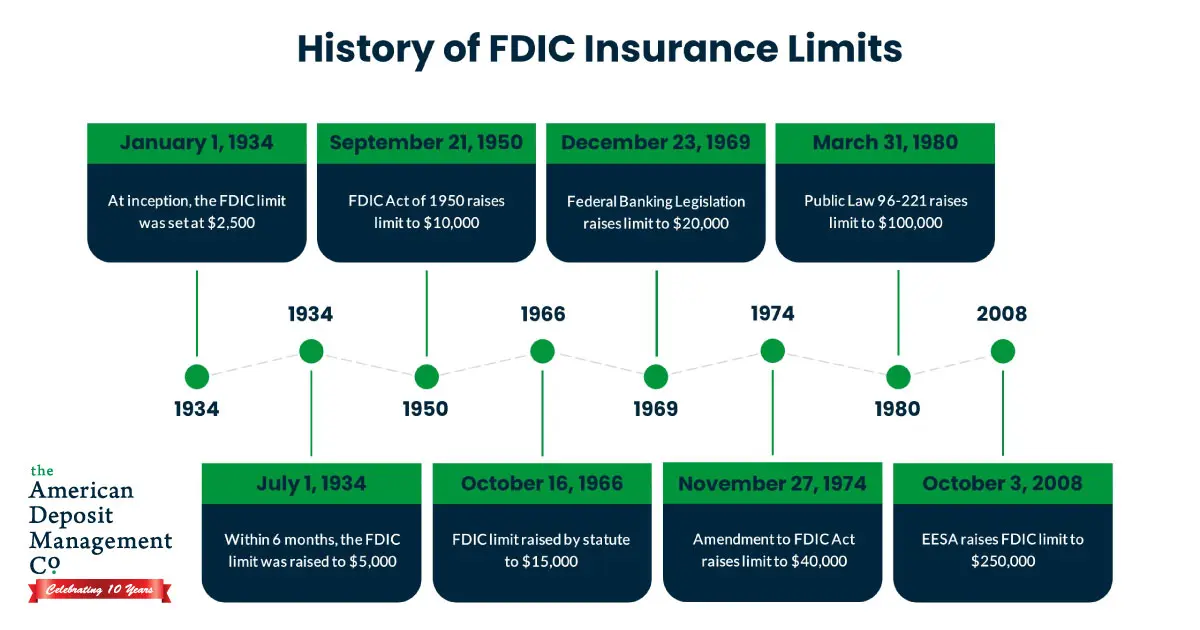

to $250,000

Emergency Economic Stabilization Act of 2008 Temporarily Increases Basic FDIC Insurance Coverage from $100,000 to $250,000 Per Depositor.

What is the maximum amount of money that is insured

$250,000

COVERAGE LIMITS

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC provides separate coverage for deposits held in different account ownership categories.

What happens if you have more than 250k in the bank

Bottom line. Any individual or entity that has more than $250,000 in deposits at an FDIC-insured bank should see to it that all monies are federally insured. It's not only diligent savers and high-net-worth individuals who might need extra FDIC coverage.

Does FDIC cover $500000 on a joint account

Each co-owner of a joint account is insured up to $250,000 for the combined amount of his or her interests in all joint accounts at the same IDI.

Does the FDIC insure $250000 in multiple accounts

The standard deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

How much money can you have in any one bank and be covered by FDIC insurance

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. And you don't have to purchase deposit insurance.

Can you insure large amounts of money

Single, individually owned accounts are insured up to $250,000 total at FDIC member banks. However, joint accounts — with two or more owners — are insured up to $500,000 total. So to double the insured amount in deposit accounts at a single bank, you can add another owner.

How do I insure a large amount of money

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

How do I insure 2 millions in the bank

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

What is the FDIC insurance limit for multiple accounts

The FDIC refers to these different categories as “ownership categories.” This means that a bank customer who has multiple accounts may qualify for more than $250,000 in insurance coverage if the customer's funds are deposited in different ownership categories and the requirements for each ownership category are met.

Does FDIC cover multiple accounts at one bank

If you open a bank account in your name with no beneficiaries, that's a single account. And if you have multiple accounts at the same bank under the same ownership category, the FDIC insures up to $250,000 across all those accounts.

Will FDIC banks insure your account upto $250000

A: Yes. The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

Who insures your money up to $250000

The FDIC

The FDIC insures deposits according to the ownership category in which the funds are insured and how the accounts are titled. The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category.

What to do if you have more than 250k in savings

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

What are 3 things not insured by FDIC

Investment products that are not deposits, such as mutual funds, annuities, life insurance policies and stocks and bonds, are not covered by FDIC deposit insurance.

What is the FDIC 250k limit per person

The standard deposit insurance coverage limit is $250,000 per depositor, per FDIC-insured bank, per ownership category. Deposits held in different ownership categories are separately insured, up to at least $250,000, even if held at the same bank.

How many Americans have $300,000 in savings

What's better, the 2023 Retirement Savings assessment shows 16 percent of Americans have $300,000 or more saved; 10 percent have $200,000 to $299,999; and 12 percent have $100,000 to $199,999. Twenty percent of survey respondents report having somewhere between $10,000 and $100,000 in their nest egg so far.

How can I avoid FDIC limits

Here are some of the best ways to insure excess deposits above the FDIC limits.Open New Accounts at Different Banks.Use CDARS to Insure Excess Bank Deposits.Consider Moving Some of Your Money to a Credit Union.Open a Cash Management Account.Weigh Other Options.

How do millionaires insure their money

Millionaires can insure their money by depositing funds in FDIC-insured accounts, NCUA-insured accounts, through IntraFi Network Deposits, or through cash management accounts. They may also allocate some of their cash to low-risk investments, such as Treasury securities or government bonds.

How many Americans have over $100,000 in savings

Most Americans are not saving enough for retirement. According to the survey, only 14% of Americans have $100,000 or more saved in their retirement accounts. In fact, about 78% of Americans have $50,000 or less saved for retirement.