What is maximum for PayPal Pay Later?

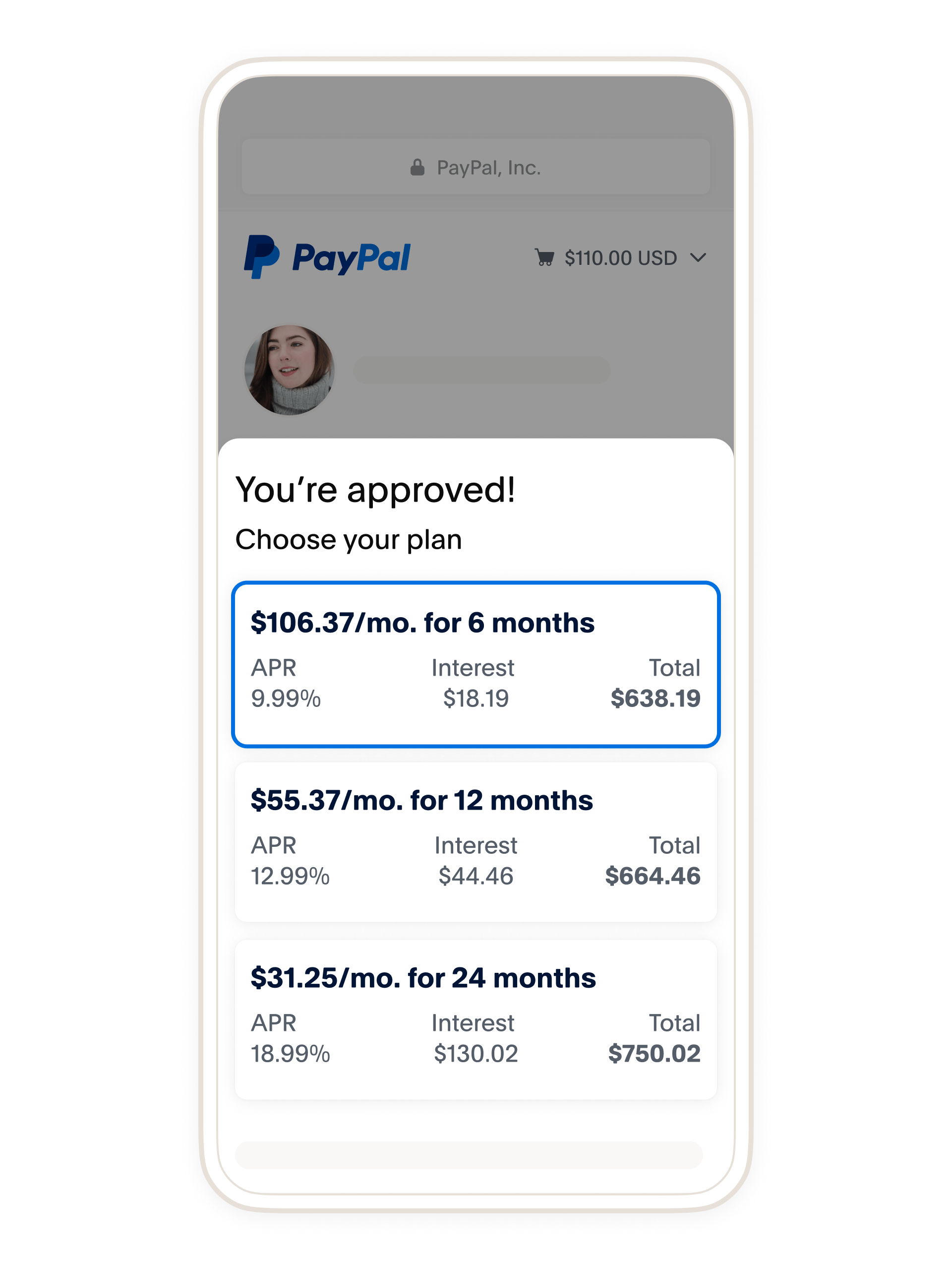

Is Pay Later good on PayPal

PayPal's Pay in 4 feature is an excellent option if you want to make a large purchase more affordable by paying it over time. It only works if the merchant accepts PayPal, but millions of online stores do. You'll enjoy interest-free payments every two weeks, and you can pay it off early if you choose.

Cached

Does PayPal have a limit

FAQs On Paypal's Limits

Yes, but not with a regular account. While the PayPal transfer limit for normal users is $4,000, verified users can send or accept a maximum of $10,000 in a single payment. Additionally, users with a linked bank account can send a maximum of $25,000 per transaction.

Why can’t I pay in 4 on PayPal

You'll need to spend $30 or more (up to $1500) to pay using PayPal Pay in 4. When applying to use PayPal Pay in 4, a soft credit check may be required to assess your credit worthiness, so your application to use PayPal Pay in 4 may be rejected. Your credit score will not be impacted by the soft credit check.

Does PayPal later affect credit score

When your PayPal Pay Monthly loan is approved and used, it may be reported to the credit reporting agencies within 30-60 days of the loan date. Your payment history and loan status, including if payments are missed or delinquent, may be reported.

What credit score is needed for PayPal bill me later

Getting Approved for “Bill Me Later” Programs

Unfortunately, if you have poor credit, Bill Me Later isn't going to be for you. Paypal Credit, for example, requires a credit score of at least 650. Related: What Is a Bad Credit Score

How do I know my PayPal limit

Here's how to check what your limits are for your PayPal Business Debit Mastercard:Hover over your profile and select Account Settings.Click Money, banks, and cards.Click Manage under “PayPal Business Debit Mastercard.”Click Change if you want to update your daily purchase and ATM withdrawal limits.

How do I increase my PayPal limit

How do I increase my credit limit We review your credit limit monthly and may invite you to increase your limit once you've been a PayPal Credit customer for at least 6 months. You can always request a credit limit decrease or opt out of receiving offers to increase your credit limit.

How many Pay in 4 does PayPal allow

four equal payments

PayPal Pay in 4 is PayPal's buy now, pay later (BNPL) service for online shoppers. If you use this option at checkout, you can split your purchase into four equal payments with no interest or fees.

How much does PayPal Pay in 4 allow

PayPal Pay in 4 enables you to make four equal payments over the course of your purchases from approved online merchants. The entire payback period is six weeks, with the first payment due up front and the subsequent payments due every two weeks. Consider the scenario where you were spending $400 on a purchase.

How do I get approved for PayPal Pay in 4

To be eligible for PayPal Pay in 4, you must purchase an eligible item that costs between $30 and $1,500 from a participating online merchant that accepts PayPal. You also must be at least 18 years old and live in an eligible state.

Does PayPal Pay in 4 automatic payments

PayPal Pay in 4 is a buy-now, pay-later service that allows online shoppers to split their purchases into four payments with the option to pay off early. The payments are typically made in four equal installments over a six-week period, and are set up as automatic payments.

Does everyone get approved for PayPal Credit

The PayPal Cashback Credit Card requires at least good credit (a credit score of 700+) to get approved.

How do I avoid a limit on PayPal

How to Avoid a PayPal Limitation1 Use unique information.2 Use a payment method that matches your identity.3 Connect to PayPal directly.4 Keep your buyers happy.5 Wait before transferring funds to other users.6 Don't change your account information too much.7 Don't use E-trade as your bank.

How long does it take to increase PayPal limit

When the required steps have been completed, the review of the account usually takes 3 business days. We'll contact you via email once the review is completed. We may automatically lift some limitations when you complete the steps.

How many PayPal Pay in 3 plans can you have

Can I have multiple PayPal Pay in 3 plans at the same time Yes. You can track how much you owe on each plan through your PayPal account. It will also show any plans you have completed in the past 12 months.

Does PayPal Pay in 4 hurt my credit score

You can select PayPal Pay in 4 at checkout and receive an instant decision about your approval. PayPal will run a soft credit check at the time, but this won't impact your credit score.

What is the limit on AfterPay

For Afterpay, the highest limit is $1,500 per transaction and customers can hold a maximum of $2,000 as outstanding balance, but these limits are variable and depend on a variety of factors such as payment history and frequency of on-time payments.

Do you need a credit score to use PayPal Pay in 4

PayPal will conduct a soft credit pull when you apply for a payment plan. This doesn't affect your credit score, and there is no minimum credit score requirement to use PayPal.

How long does it take PayPal to authorize Pay in 4

If you do not complete your Pay in 4 transaction, the pending authorization will be automatically voided by PayPal within 72 hours of the pre-authorization hold. Although PayPal has released the hold on your funds, this may take up to 1-5 business days to process through your financial institution.

Can I get PayPal Credit with a 600 credit score

You will need a credit score of at least 700 to get it.