What is proof of income for students?

What is proof of income for student loans

Most banks, credit unions and online lenders require employment and income verification via contact information and pay stubs. Pay stubs, or pay records, show how much you have made, the taxes that were taken out and the hours you have worked during that pay period.

What are examples of proof of income documents

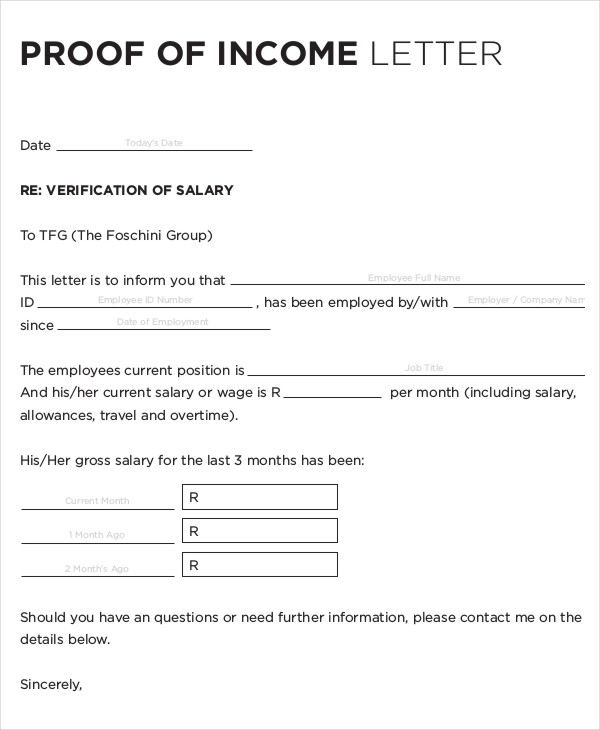

Pay stubs, earnings statement or W- 2 form identifying employee and showing amount earned period of time covered by employment. Signed and dated form or letter from employer specifying amount to be earned per pay period and length of pay period.

How do I get proof of income from

How to Provide Proof of IncomeAnnual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

What should a student put for annual income for a credit card

Bottom Line. Students can list actual income from a job, regular bank deposits from family members or leftover financial aid as their income on a credit card application. Make sure to be honest about income on an application.

Cached

Can you get a student loan without proof of income

Getting a student loan without a job may be possible when you have a cosigner. A cosigner is someone who may be willing to make your payments. Private lenders will accept this payment arrangement.

How do I verify income for student loan forgiveness

To confirm your eligibility with the Education Department, you'll need to show either a standard 1040 tax return or a tax return transcript. If you didn't file taxes in either of those years, you'll want a verification letter from the IRS that you were a nonfiler.

What is the easiest proof of income

Pay stub

A pay stub is usually the easiest way to show proof of income. That's because it shows the income you earned during a specific pay period as well as your year-to-date (YTD) income.

Is a bank statement a proof of income

Bank statements are among the most common documents used for income verification. Bank statements show the movement of funds into and out of an account and provide insight into the borrower's income, spending, and debt repayment history. Retired and self-employed borrowers often use bank statements as proof of income.

How can I prove income without paystubs

These are the most common ways to show proof of income without pay stubs; however, you can also use these methods:Provide W2s or wage and tax statements.Show your tax returns.Produce a letter from and signed by your clients.Provide an employment contract.Show proof of disability payments or social security benefits.

Can I get a credit card as a student with no income

It is technically possible to get a credit card on your own, but issuers will require you to have an independent income, which most college students do not have. If you're under 21 and don't have your own income, you will need a parent or another trusted adult to co-sign for you on a credit card application.

What counts as annual income for students

Here's What Counts as Income on a Student Credit Card Application: Wages from full-time or part-time jobs (including work-study) Investment dividends. Residual amount from scholarships and other financial aid (not student loans) after paying tuition and other college expenses.

Can I get a student loan if I have no job

With federal loans, you are eligible for deferment while you are unemployed or unable to find full-time employment for up to three years. During deferment, you are not responsible for paying interest on the following loans: Direct Subsidized Loans.

Can a student get a loan without parents

You can get a private student loan without a parent, as well, but there's a pretty big catch. Private student loans generally require a creditworthy cosigner, but the cosigner does not need to be your parents. Someone else with a good or excellent credit score can cosign the loan.

Do I have to report my income to student loans

Each year you must “recertify” your income and family size. This means that you must provide your loan servicer with updated income and family size information so that your servicer can recalculate your payment. You must do this even if there has been no change in your income or family size.

How do I know if my loan is eligible for student loan forgiveness

You may be eligible for discharge of your federal student loans based on borrower defense to repayment if you took out the loans to attend a school and the school did something or failed to do something related to your loan or to the educational services that the loan was intended to pay for.

How can I get proof of income without a job

Unemployment Statement. An unemployment statement can be a convenient way for renters who are out of a job to show proof of income. All renters need to do is provide the statement sent by the state unemployment office.

How can I get proof of income without pay stubs

These are the most common ways to show proof of income without pay stubs; however, you can also use these methods:Provide W2s or wage and tax statements.Show your tax returns.Produce a letter from and signed by your clients.Provide an employment contract.Show proof of disability payments or social security benefits.

What can I use as proof of income other than bank statement

Paystubs and Other Documents to Prove Income

Pay stub: Your pay stub is the most popular way to prove income paid by your employer. Employment Verification Letter: An employment verification letter verifies income or salary and dates of employment.

What happens if you can’t prove income

Instead of pay stubs or bank statements, you can submit any compensation or subsidy records you have. These documents come in many forms, including social security statements, workman's compensation letters, unemployment statements, and more.

How can a college student build credit with no income

Here are some things you can do to start the process.Become an authorized user.Open a student credit card.Open a secured credit card.Get a cosigner.Don't apply for too many cards at once.Maintain a solid payment history.Spend responsibly.Keep an eye on your account.