What is routing number Navy Federal Virginia?

Are all Navy Federal routing numbers the same

Although Navy Federal Credit Union only uses one routing number for all of its transactions, many large financial institutions that have locations in different states have more than one routing number.

Cached

How do I find my Navy Federal routing number

Mobile banking made. Easy. Hi this is russ from av federal you define your account or routing. Numbers i can help with that open and sign into the mobile. App on your account screen select the

How many numbers are in Navy Federal routing number

They're made up of 9 digits, and sometimes called routing transit numbers, ABA routing numbers, or RTNs. The Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network also needs them to process electronic funds transfers – like direct deposits and bill payments.

Cached

What is the routing number of a bank

What is a Routing Number A routing number is a unique, nine-digit number that functions as an address for your bank. It is used for electronic transactions such as funds transfers, direct deposits, digital checks, and bill payments.

Are routing numbers different for each branch

Each routing number is unique to one financial institution and helps avoid confusion. Routing numbers ensure that checks intended for Citibank don't go to CIT Bank, for example.

Are routing numbers the same for each account at a bank

If you hold two accounts at the same bank, the routing numbers will, in most cases, be the same, but your account numbers will be different. Anyone can locate a bank's routing number, but your account number is unique to you, so it is important to guard it, just as you would your Social Security number or PIN code.

How do I find my routing and account number

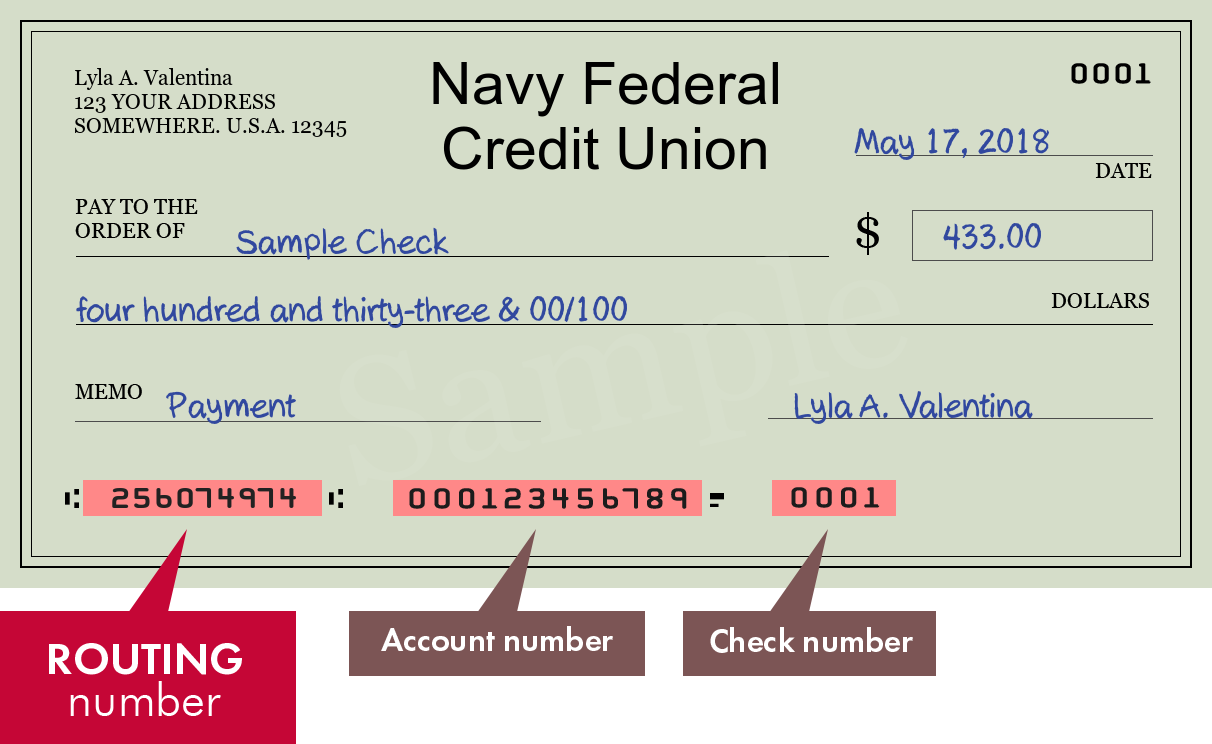

At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number.

How do I find my routing or account number

If you look along the bottom of your checks, you'll usually see three different numbers aligned in a row. From left to right, the first is the routing number for your bank. The second is your unique checking account number. The last is the number for the specific check you're holding.

Why are there 2 routing numbers

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

Are routing numbers the same for each bank branch

Each routing number is unique to one financial institution and helps avoid confusion. Routing numbers ensure that checks intended for Citibank don't go to CIT Bank, for example. A bank or credit union may have more than one routing number.

Is a bank routing number 8 or 9 digits

Routing numbers are always 9 digits long. Account numbers may be up to 17 digits long. Some banks list the routing number first on the check, while other banks list the account number first, and still more list the routing number, check number, then account number.

What is my routing account number

The routing number is the nine-digit number printed in the bottom left corner of each check. Your specific account number (usually 10 to 12 digits) is the second set of numbers printed on the bottom of your checks. The number furthest to the right is the check number.

Does it matter which routing number you use

If you're not sure which routing number you'll need for a particular transfer type, you should check with your bank beforehand. Careful. Using the wrong number can lead to delays in processing the transfer.

Which routing number should be used

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

How do I find my routing number without a check

Checks aren't the only place to find your routing and account numbers. Every major bank has a mobile banking app and website through which customers can access their unique bank accounts and the numbers associated with those accounts. You'll also find these numbers on your bank statements.

How do I find my bank account routing number without a check

How to find a routing number without a checkGo online: Your bank may post its routing number online via its website or mobile banking app.Bank statement: You might find the routing number on your monthly paper or electronic bank statement, although not all banks include it.Call the bank.Visit a branch.

Is your routing number and account number on your card

No, credit cards do not have routing numbers. Instead, credit cards have a 16-digit account number. When you use a credit card, a routing number is not necessary to complete the transaction. Instead, your credit card is attached to an account number that allows banks to keep track of their charges.

How do I find my routing and account number on my debit card

The 9-digit number on the bottom left is your routing number. After the routing number is your account number on the bottom center.

Which routing number should I use

ABA routing numbers are used for paper or check transfers. ACH routing numbers are used for electronic transfers. Transactions using ACH routing numbers “clear” faster (same or next day) than funds transferred on paper checks using ABA numbers.

Does it matter which routing number in use

If you're not sure which routing number you'll need for a particular transfer type, you should check with your bank beforehand. Careful. Using the wrong number can lead to delays in processing the transfer.