What is Self credit?

How does self credit work

Self offers credit builder loans. The funds are secured in a Certificate of Deposit at a partner bank and returned, minus fees and interest, at the end of the loan term. Monthly costs range from $25 to $150. Monthly payments are reported to all three credit bureaus.

Cached

How much will credit score increase with self

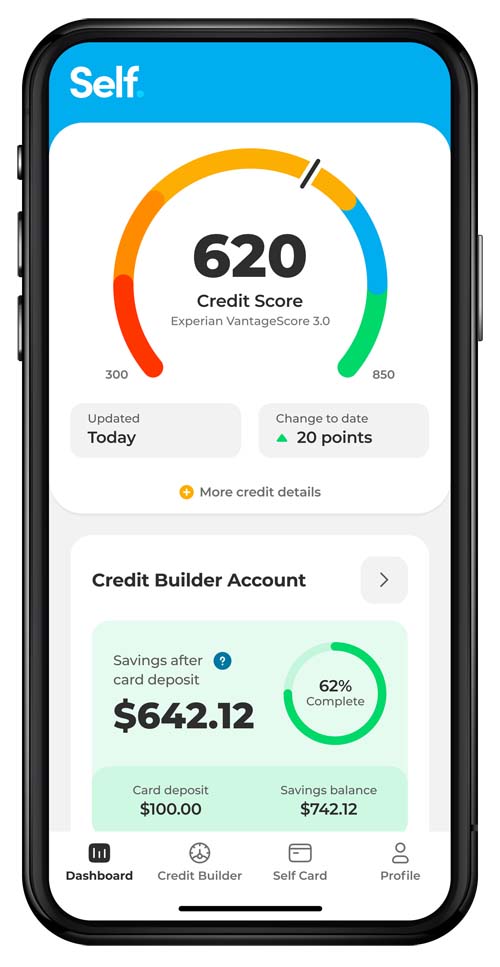

Self, an Austin, Texas-based startup founded in 2014, is an online lender that offers credit-builder loans to help customers with little or no credit build up their payment history. They claim the average Self customer raises their credit score by 49 points.

Cached

How much does self credit card give you

What is the credit limit on the Self Visa card The minimum credit limit is $100. As you make payments on your Credit Builder Account each month, you can choose to increase your credit limit up to a maximum limit of $3,000.

Do you get your money back from self

If you close the account with a balance, the balance is subtracted from your deposit refund. If you don't pay your credit card balance at all, Self can recoup their money using the deposit. It normally takes Self 10-14 business days to refund your deposit after you close the account.

What happens if you pay off self lender early

You'll get the money you paid back, minus the interest you already paid on the loan and the nonrefundable administrative fee you paid to open the account.

Is self a good way to rebuild credit

Self is a fully legitimate credit-building company that has helped many people with low or little to no credit. However, that doesn't mean that its offerings don't come with some downsides.

Is self the best way to build credit

Self reports on-time payments to the three major consumer credit bureaus, Equifax, Experian and TransUnion, which makes its credit-builder loan a good way to build credit — as long as you make payments on time and in full.

How high is self credit card limit

The starting credit limit for the Self Visa® Credit Card is $100 to $3,000. Since this is a secured card, you will need to fund that amount into a security deposit. Your exact starting credit limit will depend on how much of a security deposit you will put down when you first open your Self Visa® Credit Card.

Is the self credit card a real credit card

The Self Visa is a secured credit card, a card type that allows people with no credit or poor credit to build a credit profile. After meeting the Self Visa's lenient eligibility requirements, you're granted a loan that is placed into an interest-bearing Certificate of Deposit.

How long does it take to get money from self

The moment you make your last payment, the bank through which your CD is held will unlock your account. After 10 to 14 days, the full loan amount will then be disbursed to you, minus any applicable fees and interest. The funds can be sent to you either by check or via an ACH money transfer.

What happens after you pay off your self loan

Self and other similar lenders place the money in a secured account on your behalf, and you get the money (minus fees and interest rate payments) when the loan is paid off. The trade-off is that each payment you make will show up on your credit report and may improve your FICO score.

Can self lender hurt your credit

Self loan fees and penalties

Payments that are 30 days or more past the due date will be reported to the credit bureaus, likely damaging your score. If the account continues to be late, it will eventually be closed and the loan will be reported as "defaulted" on your credit reports.

Can I take money off my self credit card

No, you cannot get a cash advance with your Self Visa® Credit Card. This card can only be used for purchases. The fact that Self Visa® Credit Card cash advances are not an option might actually be a good thing as these transactions are very expensive.

How to get a 700 credit score in 2 years

Take the following steps to aim for a credit score of 700 or above.Lower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

How long does it take to build credit with self

Six months to establish credit

If you have no credit history or haven't had any lines of credit in the past six months, it will take at least six months before FICO will calculate a credit score for you. Once you have a credit score, though, you could still have what's called a thin credit file.

Can you get money off self credit card

No, you cannot get a cash advance with your Self Visa® Credit Card. This card can only be used for purchases. The fact that Self Visa® Credit Card cash advances are not an option might actually be a good thing as these transactions are very expensive.

How much should I spend on my credit card if my limit is $2000

What is a good credit utilization ratio According to the Consumer Financial Protection Bureau, experts recommend keeping your credit utilization below 30% of your available credit. So if your only line of credit is a credit card with a $2,000 limit, that would mean keeping your balance below $600.

Does self credit card require a deposit

No deposit required

Unlike most secured credit cards, the Self Secured Visa card doesn't require a security deposit upfront. The payments you save in Self's certificate of deposit* (CD) savings account act as your security deposit and credit limit.

Can you use self as a credit card

Unlike many traditional credit cards and secured cards, the Self Visa® Credit Card does not require a credit check or a hard inquiry on your credit to be approved. Instead, you must first open a credit builder loan, and Self will put your payments into a certificate of deposit at a partner bank.

Can I get cash off my self credit card

No, you cannot get a cash advance with your Self Visa® Credit Card. This card can only be used for purchases. The fact that Self Visa® Credit Card cash advances are not an option might actually be a good thing as these transactions are very expensive.