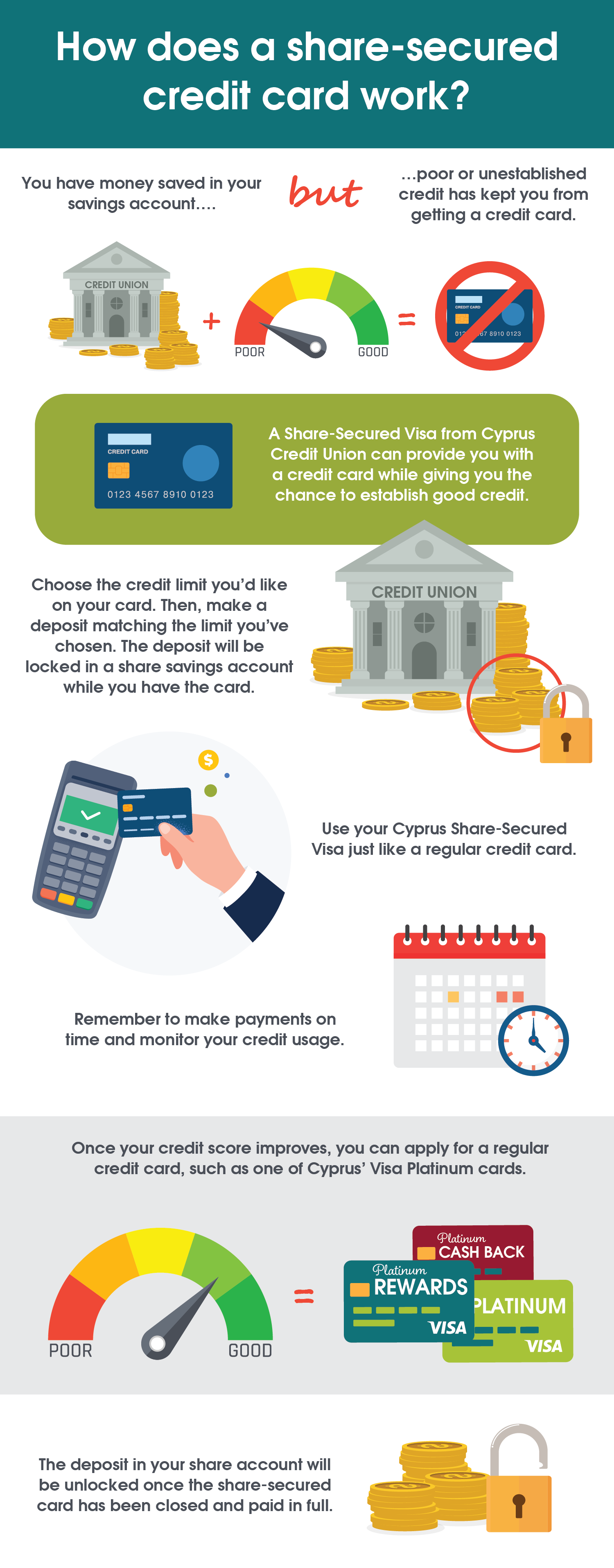

What is share secured credit card?

Do share secured loans build credit

Share-secured loans are a good option for those with poor or no credit scores. These loans can be a great way to build your credit score because they are easier to qualify for than other loans and they typically have low interest rates.

Cached

What are 2 downsides of getting a secured credit card

Secured credit cards may charge high application, processing or annual fees. Additionally, these types of cards typically have high interest rates because credit card issuers may expect high default rates from people with lower credit scores. Low credit limits.

Why would someone want a secured credit card

The biggest reason why someone would use a secured credit card is to rebuild bad credit. Secured cards are the best tool for the job because they offer nearly guaranteed approval and report account information to the major credit bureaus each month.

What does a secured credit card do

When a credit card is “secured,” it means money must be deposited with the credit card issuer in order to open an account. That money is known as a security deposit. And it's held by the credit card issuer while the account is open, similar to the security deposit given to a landlord to rent an apartment.

What is the point of a share secured loan

Share secured loans are essentially a way for you to borrow, using your own savings as the collateral. Instead of using all your savings to make a purchase, thus losing out on all future dividends and your emergency safety net, you're borrowing against that sum while your money stays in your account.

What is the downside of share lending

The main risks are that the borrower becomes insolvent and/or that the value of the collateral provided falls below the cost of replacing the securities that have been lent. If both of these were to occur, the lender would suffer a financial loss equal to the difference between the two.

Can I put $2000 on a secured credit card

Typically, secured credit cards let you select a credit limit ranging from $200 to $2,000; some cards offer set amounts (such as $250, $500 or $1,000) for you to choose from.

How fast does secured cards build credit score

If you have no credit history, getting your first credit score with a secured card may take up to six months. If you have poor credit, you can usually expect to see the effect of your new secured card on your credit score in a month or two.

How much should I spend on a $200 credit limit

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

Do secured cards build credit faster

While we can't say for sure how much your credit score might improve, we can tell you that using a secured card can boost your credit score relatively quickly — think “under six months” — especially if you focus on the five factors that make up your credit score: Payment history.

How does a $200 secured credit card work

With a secured credit card, the money you put down is a security deposit, which the card company holds in case you don't pay your bill. The money is not used to pay for purchases. If you provide a $200 deposit and then use the card to buy something for $50, you'll have to pay $50 when your bill comes.

What are the main disadvantages of a secured loan

Disadvantages of Secured LoansThe personal property named as security on the loan is at risk. If you encounter financial difficulties and cannot repay the loan, the lender could seize the property.Typically, the amount borrowed can only be used to purchase a specific asset, like a home or a car.

Is lending shares a good idea

While you could earn some extra income from lending the stocks you fully own, risks are involved, such as facing a loss on the reinvestment of the cash collateral from the borrower. Always do some thorough research before deciding to get involved with stock lending and know the risks first.

What are the pros and cons of shares

What are the pros and cons of buying sharesPro #1: Capital gains.Con #1: Capital losses.Pro #2: Hello dividends.Con #2: Goodbye dividends.Pro #3: Winning when you're losing.Con #3: Losing when you're losing.Pro #4: Lots of choice.Con #4: Too much choice.

How much to use on a $200 secured credit card

30%

To keep your scores healthy, a rule of thumb is to use no more than 30% of your credit card's limit at all times. On a card with a $200 limit, for example, that would mean keeping your balance below $60. The less of your limit you use, the better.

How does a $500 secured credit card work

This means, if your initial deposit is $500, your secured credit card will have a credit limit of at least $500. The financial institution backing your secured card account will place a hold on your refundable security deposit, meaning those funds won't be available for spending.

What happens after 6 months of having a secured credit card

If you've never used credit before, a secured credit card can help you establish a credit history. After using the card for about six months, you'll usually be assigned a FICO score.

How long does it take to build credit from 500 to 700

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How much of a $500 credit limit should I use

30%

The less of your available credit you use, the better it is for your credit score (assuming you are also paying on time). Most experts recommend using no more than 30% of available credit on any card.

How much will a secured credit card raise my score

Getting approved for a credit card does not raise your credit score automatically. For that to happen, you need to make all your payments on time and maintain a low credit utilization ratio. If you pay off the entire balance of a card that's maxed out, you may expect your credit score to increase by around 10 points.