What is shown on a credit report?

What are 5 things found on a credit report

The information that is contained in your credit reports can be categorized into 4-5 groups: 1) Personal Information; 2) Credit History; 3) Credit Inquiries; 4) Public Records; and, sometimes, 5) a Personal Statement. These sections are explained in further detail below.

Cached

What things don’t show up on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

Does a credit report show everything you owe

Your credit report lists the amount owed on every account, along with its status and payment history, and contact information for the creditor handling the debt. Under federal law, you can obtain one free copy of your credit report every 12 months by visiting AnnualCreditReport.com.

What are 5 things not in your credit score

However, they do not consider: Your race, color, religion, national origin, sex and marital status. US law prohibits credit scoring from considering these facts, as well as any receipt of public assistance, or the exercise of any consumer right under the Consumer Credit Protection Act.

What are the most important things on your credit report

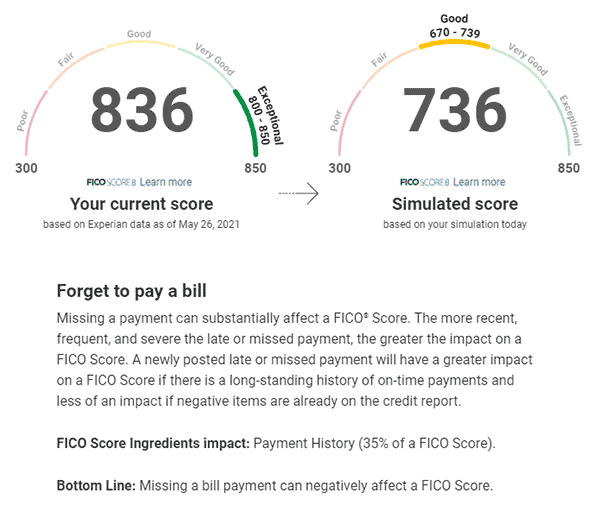

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score. That's more than any one of the other four main factors, which range from 10% to 30%.

What are 3 things you might find on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO® Scores to inform future lenders about your creditworthiness.

Will a credit report show bank accounts

Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

How do I find out all my debts

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228. You get one free report from each credit reporting company every year.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What are 3 things that hurt your credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

What are 5 things that make your credit score go up

How do you improve your credit scoreReview your credit reports.Pay on time.Keep your credit utilization rate low.Limit applying for new accounts.Keep old accounts open.

Does a credit report show bank accounts

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.

What is the most important thing in a credit report

Payment history — whether you pay on time or late — is the most important factor of your credit score making up a whopping 35% of your score.

Does debit show on credit report

Unlike credit cards, debit card activity isn't reported to the three credit bureaus (Experian™, Equifax® and TransUnion®) that monitor and provide access to your credit report.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

How do I find out what debt I owe

Credit reports show what money you've borrowed and paid back. It's a good idea to get copies of your credit reports to check you've got the right details for all your debts. You can get free copies of your credit reports from the 3 credit agencies – Experian, Equifax and TransUnion (formerly Callcredit).

What happens after 7 years of not paying debt

Although the unpaid debt will go on your credit report and cause a negative impact to your score, the good news is that it won't last forever. Debt after 7 years, unpaid credit card debt falls off of credit reports. The debt doesn't vanish completely, but it'll no longer impact your credit score.

What will destroy your credit score

Highlights: Even one late payment can cause credit scores to drop. Carrying high balances may also impact credit scores. Closing a credit card account may impact your debt to credit utilization ratio.

What brings your credit score down

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts (which may shorten your length of credit history overall), or applying for new credit accounts.

What 5 things are worst for your credit rating

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.