What is single and double-entry system?

What is the meaning of single and double-entry system

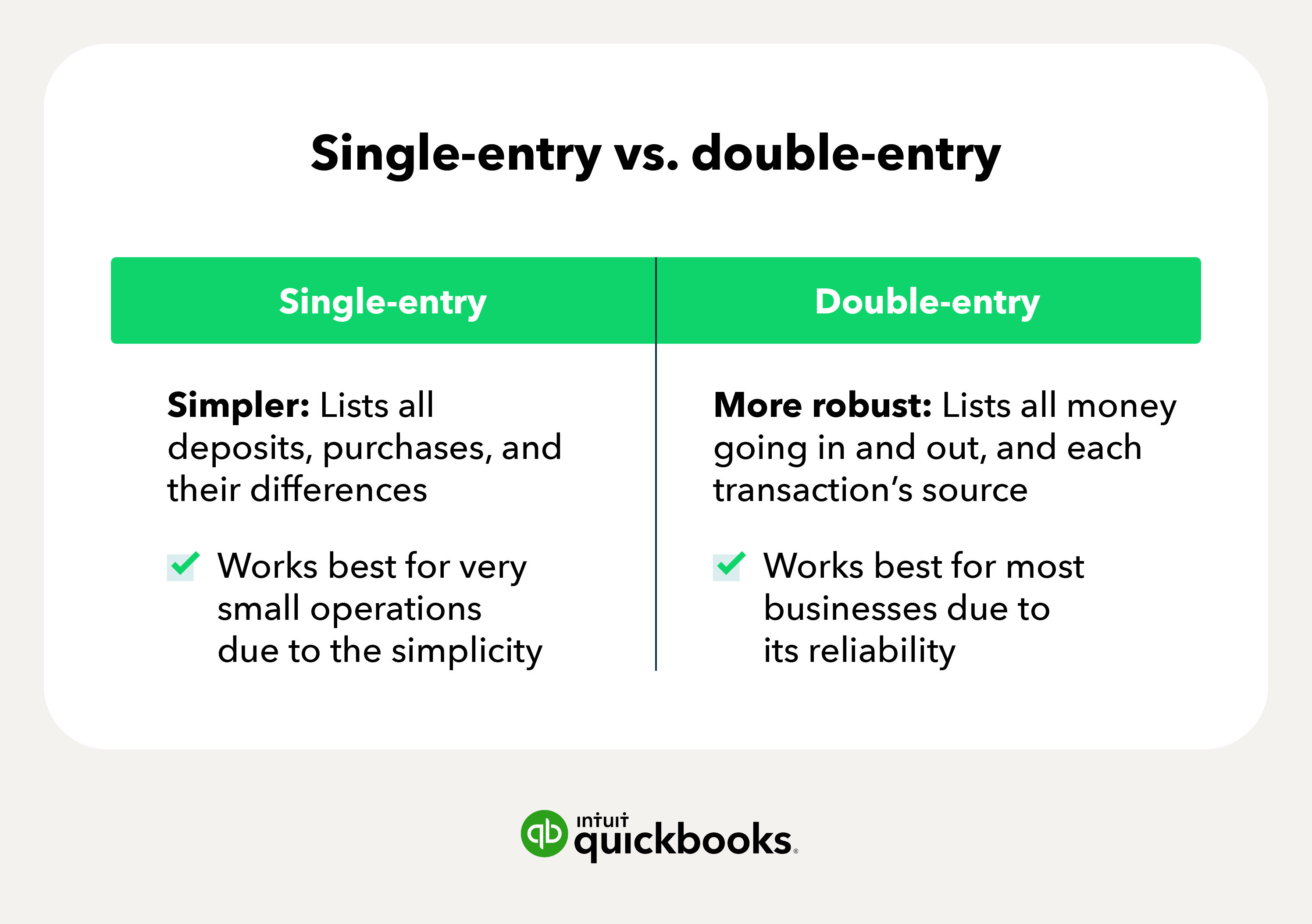

Recording method: Single-entry bookkeeping gives a one-sided picture of transactions recorded in the cash register. In double entry, changes due to one transaction are reflected in at least two accounts.

What is single entry system with example

A single entry system of bookkeeping is where the transactions of the business affect only one account, i.e. only one account's value will decrease or increase based on the transaction amount. Under this system, a cash book is prepared that shows the payment and receipts of the cash transactions.

What is the difference between single account system and double account system

A single Entry System is a bookkeeping system in which only one part of a transaction is recorded, such as debit or credit. A double entry system is a method of recording transactions in which both sides of a transaction are recorded. This sort of bookkeeping is not for tax purposes.

What is the double-entry system

The double-entry system is a method of bookkeeping that records financial transactions in two accounts. For every debit entry made to one account, there must be an equal and opposite credit entry made to another account.

What is an example of single entry and double entry

For example, if a business owner takes out a loan, this is recorded as income in the single-entry system. This transaction would also be recorded as a credit to Loan payable (which is a liability) and a debit to Cash in a double-entry system, so you'd better understand your cumulative bank debt.

What is an easy example of a double-entry system

In a double-entry accounting system, transactions are composed of debits and credits. The debits and credits must be equal in order for the system to remain balanced. For example, if a business pays its electricity bill for $1,200, then it will record an increase to “utilities expense” and a decrease to “cash”.

What is an example of single-entry and double entry

For example, if a business owner takes out a loan, this is recorded as income in the single-entry system. This transaction would also be recorded as a credit to Loan payable (which is a liability) and a debit to Cash in a double-entry system, so you'd better understand your cumulative bank debt.

What are simple examples for double-entry system

In a double-entry accounting system, transactions are composed of debits and credits. The debits and credits must be equal in order for the system to remain balanced. For example, if a business pays its electricity bill for $1,200, then it will record an increase to “utilities expense” and a decrease to “cash”.

What are the 2 types of accounting systems

Types of Accounting SoftwareSingle-entry systems.Double-entry systems.Manual accounting systems.Computerized accounting systems.

What is single account system

A single entry system of accounting is a form of bookkeeping in which each of a company's financial transactions are recorded as a single entry in a log. This process does not require formal training and is usually used by new small businesses because of its simplicity and cost effectiveness.

What are the two types of entry system

Options Explained. There are two types of accounting systems: The first is a Single Entry System where a small business records every transaction as a line item in a ledger. The other is a Double Entry System, where every transaction is recorded both as a debit and credit in separate accounts.

What are examples of double-entry system

In a double-entry accounting system, transactions are composed of debits and credits. The debits and credits must be equal in order for the system to remain balanced. For example, if a business pays its electricity bill for $1,200, then it will record an increase to “utilities expense” and a decrease to “cash”.

What are the three types of single entry system

Single-entry accounting systems are of three types. These include; pure single-entry, where only personal accounts are considered; simple single-entry, wherein personal and cash accounts are created; and quasi-single-entry, wherein cash, personal, and subsidiary accounts are maintained.

Is QuickBooks a double-entry system

QuickBooks Online uses double-entry accounting, which means each transaction or event changes two or more accounts in the ledger. Each of these changes involves a debit and a credit applied to one or more accounts.

Where is the double-entry system used

Double-entry accounting is the most common type of accounting used by businesses. It's based on the concept that every financial transaction has two sides: a debit side and a credit side. The ledgers must have every transaction in a business with at least one debit entry and one credit entry.

What is double-entry system and its benefits

In contrast to a single entry, this is a scientific method of tracking business transactions. It assists in the rechecking and cross-checking of accounting documents. Both sides of a transaction are registered as debit and credit in this system, so we keep separate accounts for the purchase and payment.

What are the 3 accounting systems

The 3 types of accounting include cost, managerial, and financial accounting. Although 3 methods of accounting are both vital to the healthy functioning of a business, they have different meanings and accomplish different goals.

What are the two accounting standards

Two popular accounting standards are used by a majority of countries globally. They are: GAAP or Generally Accepted Accounting Procedures. IFRS or the International Financial Reporting Standards.

Who uses single entry system

A single entry system of accounting is a form of bookkeeping in which each of a company's financial transactions are recorded as a single entry in a log. This process does not require formal training and is usually used by new small businesses because of its simplicity and cost effectiveness.

What is single entry accounting simple

Single-entry accounting is a method of tracking business assets, liabilities, income, and expenses which records each transaction a single time. Also referred to as single-entry bookkeeping. Compare with double-entry accounting, which logs every transaction so that the assets are liabilities/equity.