What is the 15 3 hack?

What is the 15 3 credit trick

With the 15/3 credit card payment method, you make two payments each statement period. You pay half of your credit card statement balance 15 days before the due date, and then make another payment three days before the due date on your statement.

When should I pay my credit card hack

The 15/3 credit hack gets its name from the practice of making your monthly payment in two installments: the first half 15 days before your due date and the second half three days before your due date. This hack, popular on various social media platforms, claims to be a shortcut to good credit.

Cached

Does paying twice a month increase credit score

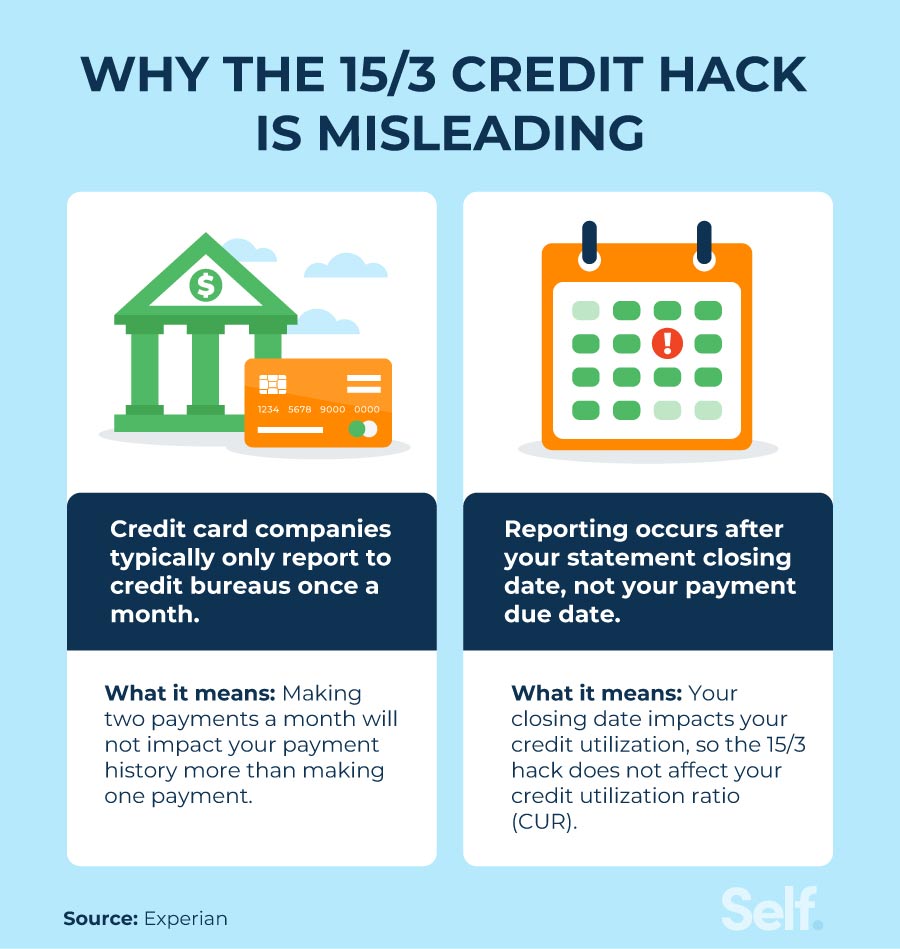

While making multiple payments each month won't affect your credit score (it will only show up as one payment per month), you will be able to better manage your credit utilization ratio.

How to trick your credit score

If your current credit score is less than ideal, here are ten hacks to increase your credit score fast.Dispute Errors on Your Credit Report.Pay Your Bills on Time.Reduce Your Credit Utilization Ratio.Request Credit Limit Increases.Avoid Opening New Lines of Credit.Pay Off Your Balance.

Cached

How to jump from 750 to 800 on credit score

How to Get an 800 Credit ScorePay Your Bills on Time, Every Time. Perhaps the best way to show lenders you're a responsible borrower is to pay your bills on time.Keep Your Credit Card Balances Low.Be Mindful of Your Credit History.Improve Your Credit Mix.Review Your Credit Reports.

How to go from 650 to 750 credit score

Here are some of the best ways.Pay on Time, Every Time.Reduce Your Credit Card Balances.Avoid Taking Out New Debt Frequently.Be Mindful of the Types of Credit You Use.Dispute Inaccurate Credit Report Information.Don't Close Old Credit Cards.

Does the 15 3 hack work

A desirable payment history involves no late payments—but only requires that you make the minimum payment on time each month. The number of payments made within a billing cycle has zero effect on payment history. The 15/3 hack does not help by multiplying the number of payments made.

How to pay off credit card trick

Make a payment three days before the statement closing date. Pay off whatever is left after the statement closing date but before the due date so you don't pay late fees or interest. This amount would be whatever you charged during the final three days of the billing cycle.

What the most points your credit score can increase in one month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

How many points can I raise my credit score in a month

In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days. Learn more: Lower your credit utilization rate. Ask for late payment forgiveness.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Does getting hacked affect your credit score

Identity theft occurs when someone gets or steals your personal information. The information can then be used to open credit accounts in your name or receive benefits, such as employment, insurance or housing. Identity theft may impact your credit reports and credit scores.

What happens when you make 2 credit card payments a month

When you make multiple payments in a month, you reduce the amount of credit you're using compared with your credit limits — a favorable factor in scores. Credit card information is usually reported to credit bureaus around your statement date.

Does 15 3 payment work

The 15/3 hack claims you can help your credit score dramatically by making half your credit card payment 15 days before your account statement due date and the other half-payment three days before. Problem is, it doesn't work.

How to get your credit score up 100 points in 30 days

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

How to get a 700 credit score in 30 days

Best Credit Cards for Bad Credit.Check Your Credit Reports and Credit Scores. The first step is to know what is being reported about you.Correct Mistakes in Your Credit Reports. Once you have your credit reports, read them carefully.Avoid Late Payments.Pay Down Debt.Add Positive Credit History.Keep Great Credit Habits.

How to get my credit score from 500 to 700

Average Recovery Time for Negative Marks on Your Credit ReportHow You Can Improve Your Credit Score From 500 to 700.Pay All of Your Bills on Time.Reduce Your Debt.Use a Secured Card Responsibly.Bring Your Utilization Below 30%

How long does it take to build credit from 600 to 700

Bringing Your Score Back Up

It usually takes about three months to bounce back after a credit card has been maxed out or you close an unused credit card account. If you make a single mortgage payment 30 to 90 days late, your score can start to recover after about 9 months.